ARTIGOS POPULARES

Ethereum price today: $3,230

- Ethereum Net Taker Volume has contracted from -$500 million to -$138 million, signalling a return of taker buyers.

- BitMine chairman Thomas Lee says ETH has bottomed as the company intensifies buying activity.

- ETH bounces near $3,100 after seeing a rejection around $3,470 and key EMAs.

Ethereum buyers are beginning to regain strength following signs of recovery in Net Taker Volume on the crypto exchange Binance.

The metric tracks the difference between buyers and sellers purchasing ETH using market orders. The volume has improved from a low of about -$500 million in October — which triggered heavy ETH distribution — to -$138 million.

While it remains negative, the contraction in selling shows that taker buyers are returning, opening the door for an upward price growth, according to CryptoQuant contributor Maartunn in a Thursday note.

-1765495534203-1765495534204.png)

Additionally, such a rise in the Net Taker Volume when prices are sitting lower has often coincided with a market bottom. Ethereum treasury BitMine chairman Thomas Lee shares a similar view.

BitMine doubles down on ETH acquisition

In an appearance on the Farokh radio podcast, Lee noted that "BitMine believes Ethereum's already bottomed." He added that the company has been "putting its money where its mouth is" lately.

"Compared to two weeks ago, the amount of Ethereum we're buying is more than double," said Lee. According to smart money tracker EmberCN, citing data from Arkham, BitMine purchased 33,504 ETH through FalconX on Wednesday. However, the company has yet to confirm the purchase.

BitMine's last update showed that the company acquired 138,452 ETH last week, pushing its holdings to 3.86 million ETH at the time. The company also reported cash holdings of $1 billion, giving it more firepower to accelerate accumulation.

BitMine aims to acquire 5% of ETH's circulating supply.

Ethereum Price Forecast: ETH struggles near $3,470 resistance and key EMAs

Ethereum has experienced $134.8 million in liquidations over the past 24 hours, led by $105.4 million in long liquidations, according to Coinglass data.

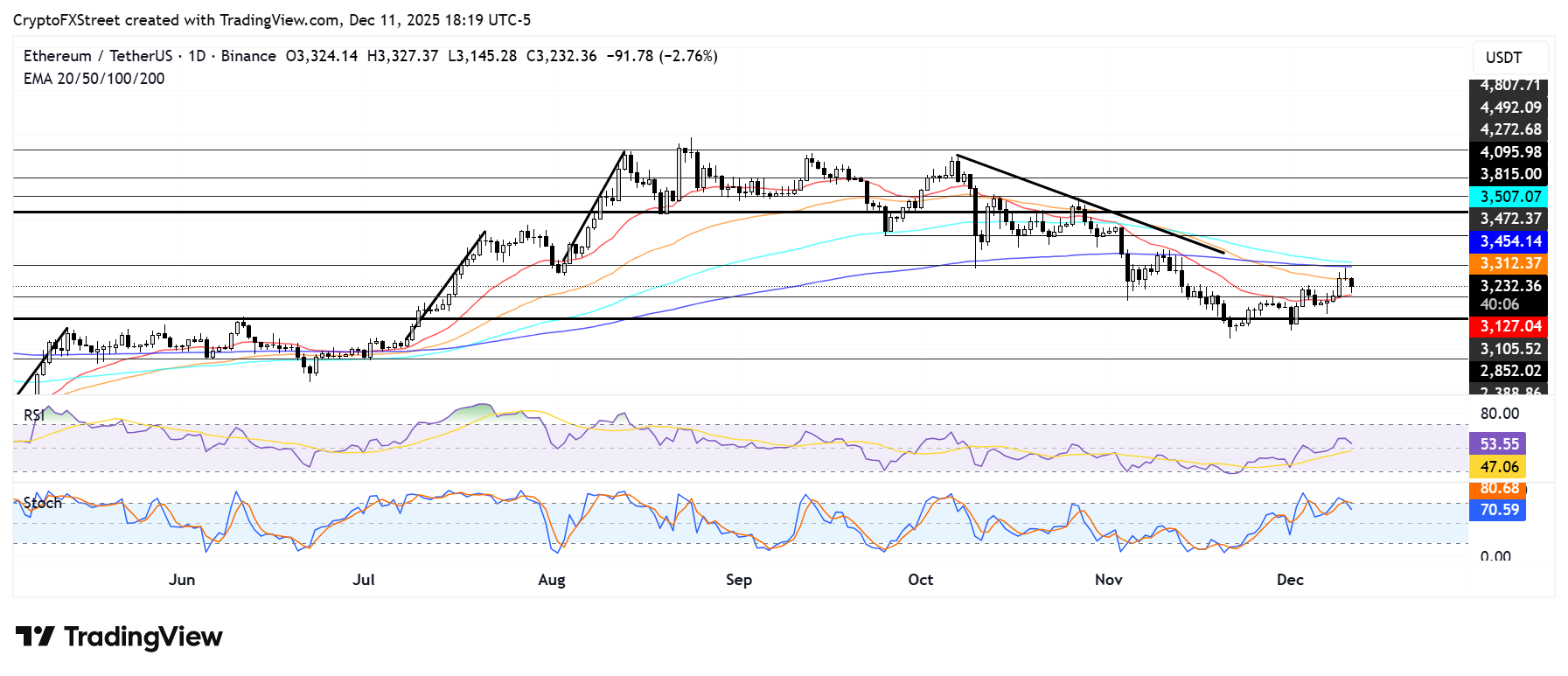

ETH has bounced near the $3,100 support after a rejection at the $3,470 resistance, which lies near the 200-day and 100-day Exponential Moving Averages (EMAs). The 50-day EMA has also proven a key hurdle, with ETH failing to close above it on several attempts over the past two days.

A decisive close above the EMAs and $3,470 could push ETH to test the $3,800 resistance, and if successful, the $4,100 key level. On the downside, the $3,100 and 20-day EMA could serve as support. Further down is the $2,850 support if ETH moves below $3,100

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels but trending downward, indicating a weakening bullish momentum.