Because of the longest government shutdown in US history, the September nonfarm payrolls report, originally scheduled for release on 3 October, did not arrive until 20 November.

Nonfarm payrolls increased by 119,000 in September, more than double economists’ consensus forecast of 50,000, while the August figure was sharply revised down to -4,000. This belated but surprisingly strong report has shredded the narrative that the US economy is heading for a hard landing.

That evening, Morgan Stanley promptly scrapped its call for a December rate cut, saying the extent of the summer slowdown in employment had been badly overstated and the economy is showing remarkable resilience. The bank now expects the Federal Reserve to wait until January 2026 before cutting rates again.

The data broadly confirms the Fed’s assessment in its October minutes: the labour market is cooling, but nowhere near collapse, making the odds of a December rate cut increasingly slim.

The unemployment rate rose to 4.4% while US Treasury yields tumbled. The move both doused some of the more aggressive rate-cut fantasies and, paradoxically, reignited dovish hopes because of the unexpected rise in joblessness. It is a classic “two-handed” report, providing ammunition for both hawks and doves.

Because of the shutdown, the October employment report has been scrapped altogether. Data for October and November will now be released together on 16 December, while the Fed’s December policy meeting will be held on 9–10 December. In other words, when officials next set policy, the only jobs data they will have in hand is this already-stale September report.

In its latest report, UBS raised its mid-2026 gold price target by US$300 to US$4,500 per ounce, arguing that even if the Fed stands pat in December, the probability of renewed easing in the first quarter of next year remains very high.

Market commentary:

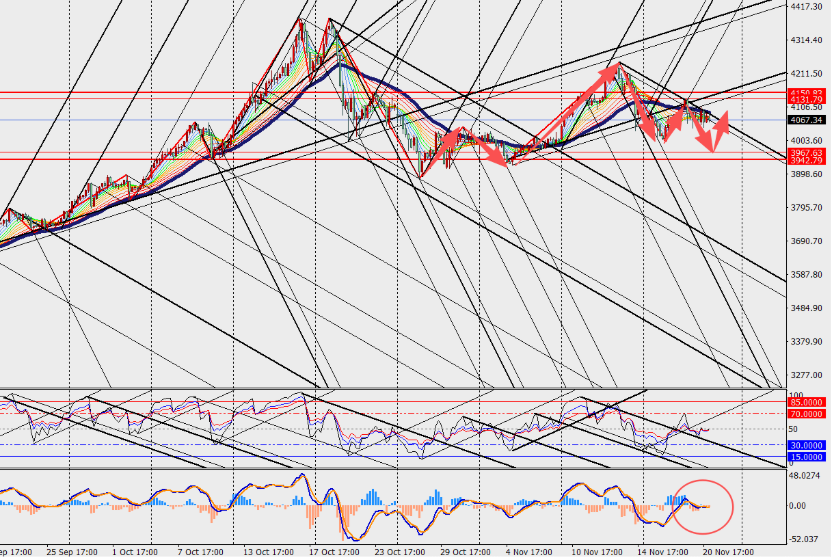

On the 4-hour chart, gold is meeting resistance and trading sideways, with MACD lines and histogram converging near the zero line.

Although since November gold has moved into a consolidation phase at elevated levels, none of the underlying supports have disappeared: the Fed’s rate-cutting cycle is not yet over, geopolitical risks remain, global central bank gold purchases are still strong, and holdings in gold ETFs continue to flow back into the market.