ARTIGOS POPULARES

Yen weakness has extended to an eight-year low, the much-discussed “Takaichi trade” is in full swing, and economists’ expectations for a BOJ rate hike are heating up. Together, these dynamics hint that FX and equity markets may be heading for a new phase.

Origins of the Weaker Yen and the “Takaichi Trade”

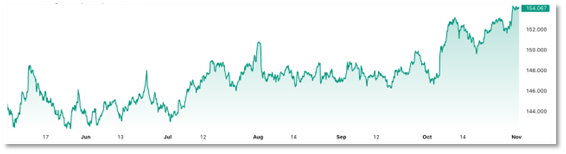

USD/JPY recently slipped below the 153 handle, hitting an eight-month low. The core drivers are the market’s expectations for policies under the new Prime Minister, Sanae Takaichi, combined with the BOJ’s wait-and-see stance.

Policy divergence between the U.S. and Japan: On October 30, the BOJ kept its policy rate unchanged at 0.5%. While the Fed has also cut rates, its stance still leaves the U.S.–Japan rate gap wide—and even widening. Interest rates anchor currency pricing: when returns abroad far exceed those in Japan, global capital naturally sells yen and buys dollars, pushing the yen lower.

Rise of the “Takaichi trade”: Investors broadly expect Prime Minister Sanae Takaichi to continue a policy mix centered on accommodative monetary policy and active fiscal expansion—dubbed “Takaichi-nomics.” In markets, this has spawned the so-called “Takaichi trade”: sell the yen and buy Japanese equities, further exacerbating yen weakness.

Meet Japan’s “Fireball,” Takaichi Sanae, its polarising new leader

Imported inflation and a BOJ dilemma: Persistent yen depreciation heightens Japan’s imported-inflation risk. Core CPI rose 2.9% YoY in September, above the BOJ’s 2% target and accelerating. Yet with real wages still falling and household purchasing power under pressure, the BOJ faces a tough balance between supporting growth and controlling inflation.

Authorities’ Response and Market Expectations

Japan’s authorities have shown high alert as the yen drops rapidly.

Official warnings of intervention: Finance Minister Satsuki Katayama said authorities are watching FX moves with “a strong sense of urgency.” After the warning, the yen briefly firmed. The 155 level is viewed as a key psychological line; if the yen slides there too quickly, the likelihood of direct government intervention rises sharply.

A Q4 window for hikes: Although the BOJ stood pat in October, it has indicated a willingness to raise rates if the economy and inflation evolve as projected. Surveys show most economists expect a policy hike in Q4. The December meeting is the key checkpoint, and many expect a move to 0.75%. However, if Prime Minister Takaichi takes a cautious view of policy normalization, a delay is possible.

What to Watch Next

Traders should monitor the following signals to confirm market direction:

Clear guidance from the BOJ: Watch Governor Kazuo Ueda’s comments around the December meeting, especially on whether a virtuous wage–inflation cycle has formed.

Inflation verification: Keep a close eye on Tokyo core CPI, which has stayed above the 2% target for more than three and a half years—this is the BOJ’s most critical input.

Substance of “Takaichi-nomics”: Assess the scale, details, and execution of the new cabinet’s fiscal stimulus. This will determine the strength and durability of the “Takaichi trade.”

Global spillovers: The Fed’s rate path and the global growth outlook will influence U.S.–Japan rate differentials and risk sentiment, indirectly steering the yen and Japanese stocks.

How a Yen Rate Hike Could Hit Markets

All told, a BOJ hike would mainly impact U.S. equities via liquidity and valuations—and the market is already flashing some warning signs.

Liquidity and valuation shock: Some analysts argue that the normalization of Japanese policy could end a key liquidity source that has supported elevated U.S. equity valuations in recent years. Strategists have observed a tight relationship between Nasdaq valuations and Japan’s real bond yields. That implies rising real yields in Japan could directly pressure U.S. tech valuations.

History’s cautionary tale: Xu Xiaoqing of Dunhe Asset calls this risk a “gray rhino”—high-probability, high-impact, and widely recognized. He warns the BOJ may be forced to hike rapidly at some point in 2025 to fight inflation, delivering a major hit to global liquidity. Historically, when the short-term U.S.–Japan rate spread narrows below 400 bps, U.S. equities tend to struggle and volatility increases.

A BOJ rate hike hangs over U.S. stocks like a Damoclean sword—tightening global liquidity and pulling capital back home, posing a material threat to U.S. equities, especially richly valued tech names.