ARTIGOS POPULARES

- Bitcoin price slips below $93,000 on Monday, retesting its key 50-day EMA.

- Investors move toward safe-haven assets while risky assets such as BTC dip amid escalating EU–US trade-war fears.

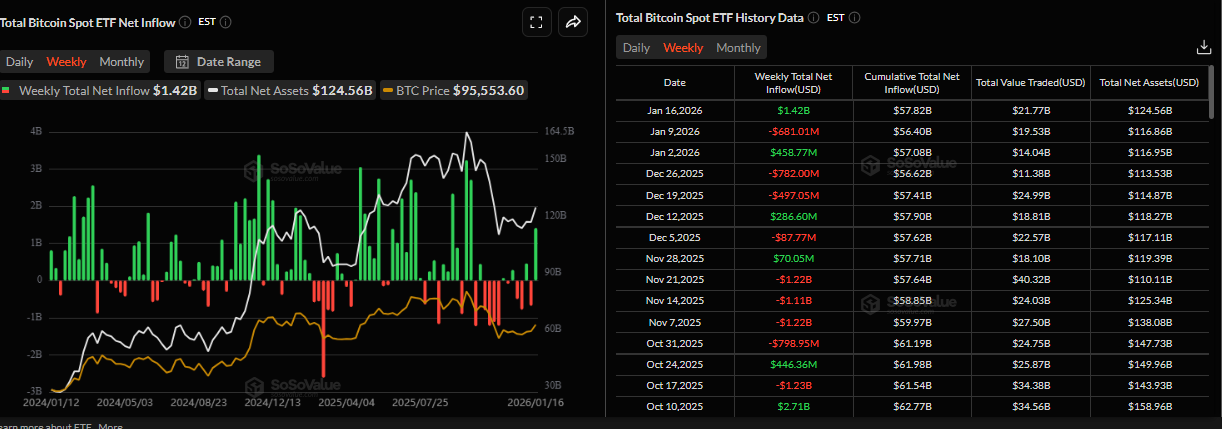

- US-listed spot ETFs recorded an inflow of $1.42 billion last week, the highest since early October.

Bitcoin (BTC) price extends losses, trading below $93,000 on Monday and retesting a key support. The growing trade war tension between the European Union (EU) and the United States (US) has triggered risk-off sentiment, with investors moving toward safe-haven assets while risky assets face a correction. Despite a short-term bearish outlook for the Crypto King, institutional demand remains strong, with spot Exchange Traded Funds (ETFs) recording inflows of over $1.4 billion last week.

Investor moves toward safe-haven assets

Bitcoin price starts the week on a negative note, sliding below $93,000 and printing its fifth consecutive red candle. This price correction is further fueled by rising trade-war tensions between the EU and the US.

On Sunday, a report noted that the EU capitals are considering imposing €93 billion ($101 billion) in tariffs on the US or restricting American companies' access to the bloc’s market.

This news came in response to US President Donald Trump’s threats to impose tariffs on eight European nations that have opposed his plan to take Greenland. Trump announced a 10% tariff on goods from countries including Denmark, Sweden, France, Germany, the Netherlands, Finland, the United Kingdom (UK), and Norway, starting on February 1, until the US is allowed to buy Greenland.

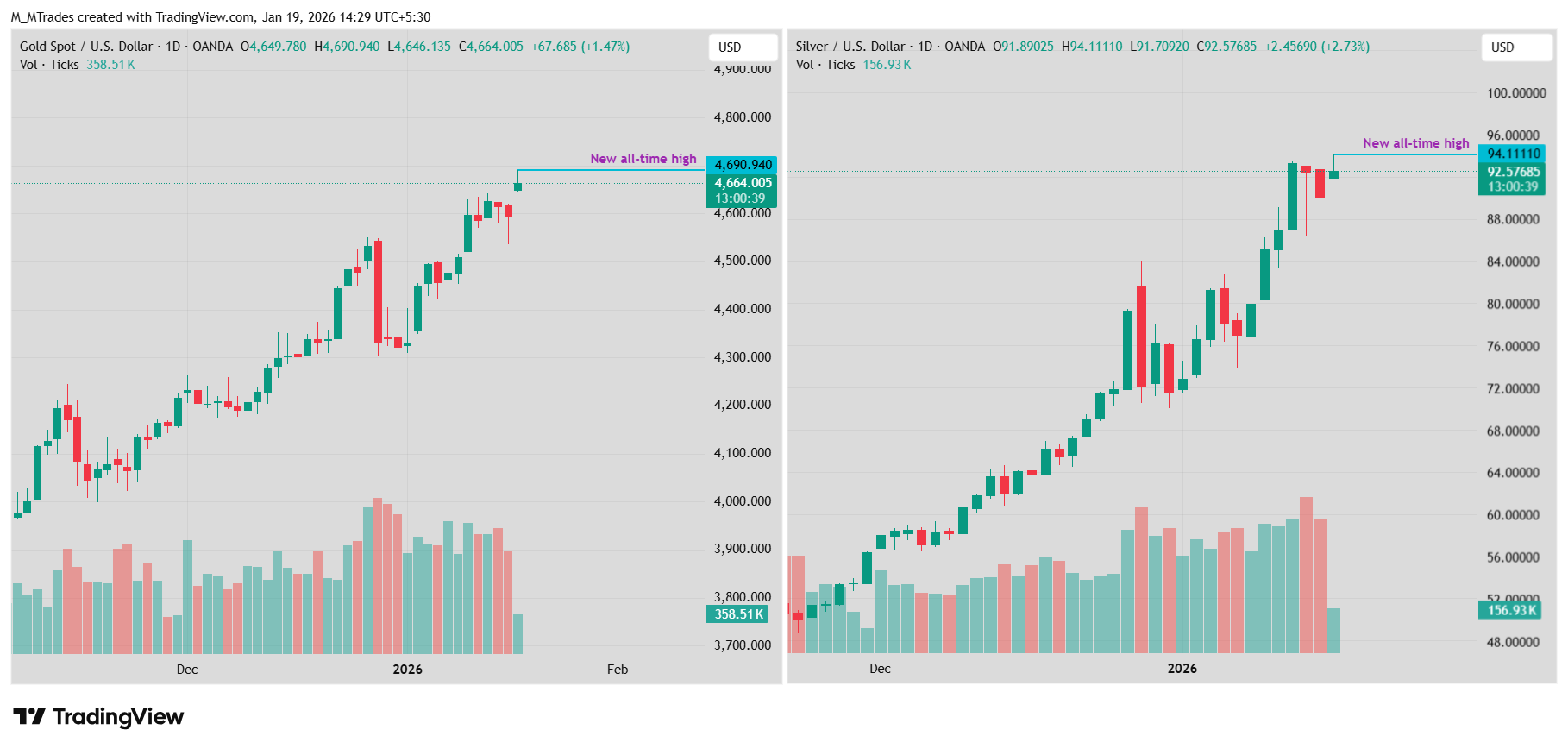

These growing trade tensions triggered risk-off sentiment among traders on Monday, prompting investors to move toward safe-haven assets such as Gold (XAU) and Silver (XAG), whose prices hit new all-time highs (ATHs) of $4,690.94 and $94.11, respectively, as shown in the chart below.

Meanwhile, the broader crypto market reacted negatively to this news, triggering billions in liquidations to start the week.

Institutional demand remains robust

Institutional demand remained strong last week. The SoSoValue chart below shows that spot Bitcoin Exchange Traded Funds (ETFs) recorded a net inflow of $1.42 billion last week, the highest weekly inflow since early October, when BTC reached a new all-time high of $126,199. If these inflows continue and intensify, BTC could rally toward the $100,000 psychological level.

Bitcoin Price Forecast: BTC could correct deeper if it closes below the 50-day EMA

Bitcoin price rallied to a nearly two-month high of $97,800 on Wednesday, after finding support around a previously broken upper consolidation zone at $90,000. However, BTC failed to sustain its upward momentum and declined by 3.17% over the next four days. As of Monday, BTC is trading down, retesting the 50-day Exponential Moving Average (EMA) at $92,404.

If BTC closes below the 50-day EMA on a daily basis, it could extend the decline toward the next key support at $90,000.

The Relative Strength Index (RSI) on the daily chart reads 53, pointing down toward the neutral level of 50, indicating fading bullish momentum. For the bearish momentum to be sustained, the RSI must move below the neutral level. The Moving Average Convergence Divergence (MACD) indicator lines are converging. If the MACD flips a bearish crossover, it would further support the bearish view.

However, if BTC recovers, it could extend its rally toward the $100,000 psychological level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.