ARTIGOS POPULARES

- Ripple hovers around $2 on Monday, after reaching $1.84 low during the Asian session sell-off.

- US-EU trade wars and the CLARITY Act bill delay flash downside risks for Ripple.

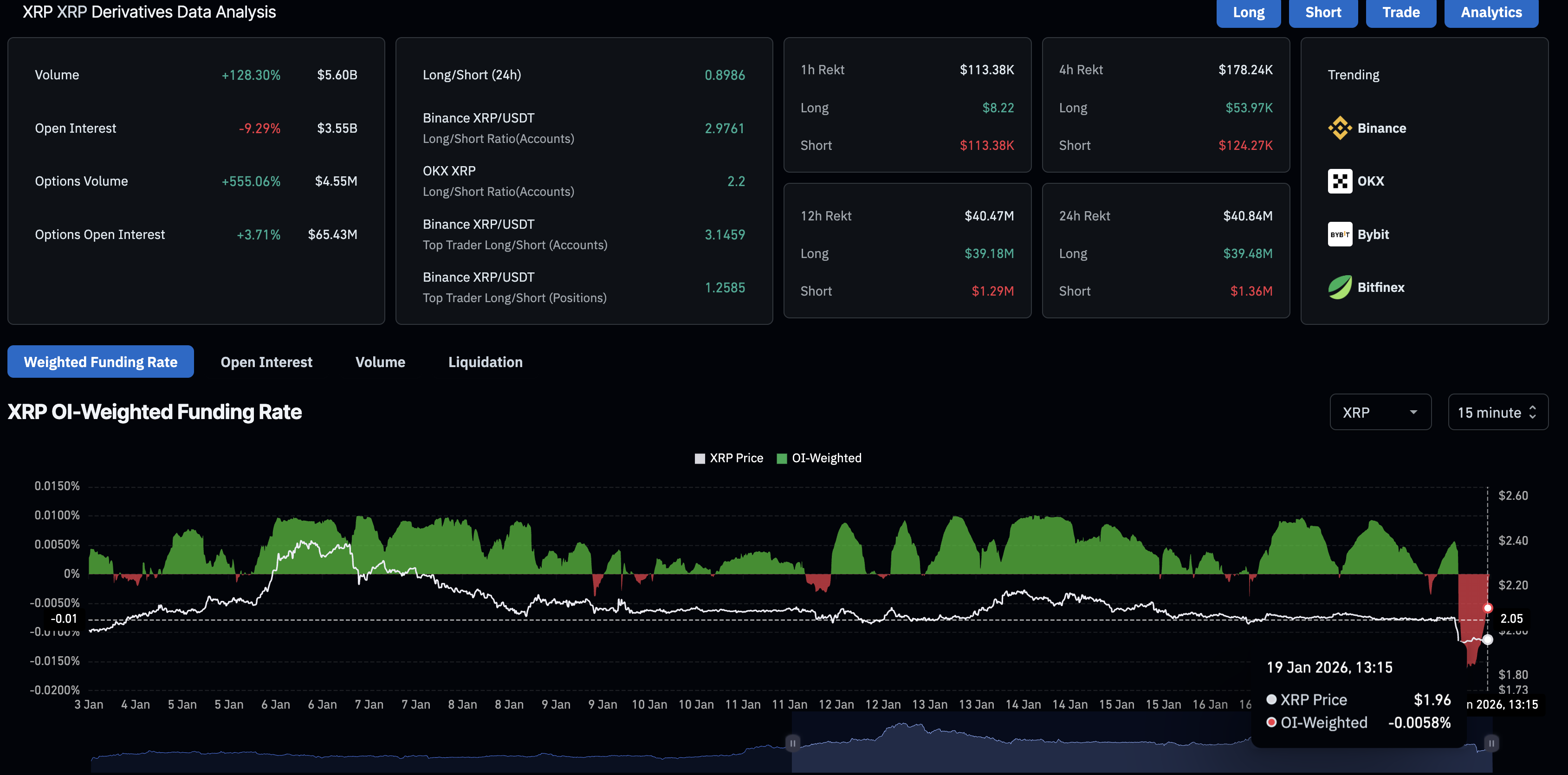

- Derivatives market shows capital outflow from XRP futures Open Interest, falling to roughly $3.5 billion in the last 24 hours.

Ripple (XRP) trades in the red below $2 at press time on Monday, as the broader cryptocurrency market remains under pressure from US President Donald Trump’s threat of a 10% tariff on 8 European nations in pursuit of Greenland. The emerging crack in the NATO alliance could spark a tectonic shift in global politics and financial markets.

XRP mirrors the broader market pullback, adding to the pressure from the delay in the US CLARITY Act bill discussion, with its Open Interest dropping to roughly $3.5 billion in the last 24 hours.

Focus on tariffs, CLARITY Act bill, and XRP’s cross-border payment growth in Europe

US President Donald Trump announced a 10% tariff on eight European nations, including Denmark, Sweden, France, Germany, the Netherlands, Finland, Britain, and Norway, from February 1 until the US is permitted to purchase Greenland. The tariff threat sent a shockwave across the crypto market, wiping out over $800 million in the last 24 hours.

Last week, Ripple announced it secured a preliminary approval for its Electronic Money Institution (EMI) license from Luxembourg's Commission de Surveillance du Secteur Financier (CSSF) to scale its cross-border transfers across Europe.

Additionally, the Senate Banking Committee cancelled the markup of the CLARITY Act bill on Thursday after Coinbase withdrew its support, extending negotiations among crypto and banking leaders.

Overall, the delay in the CLARITY bill discussion and the US-EU ongoing trade war overshadow Ripple’s infrastructure expansion in Europe, bending market sentiment toward risk aversion.

Retail sentiment weakens, institutional demand at risk

CoinGlass data shows over 9% decline in XRP futures Open Interest (OI) over the last 24 hours, to $3.55 billion. Reduced OI reflects risk aversion among traders, either by closing positions or reducing leverage.

The $39.48 million in long liquidations, compared with $1.36 million in short liquidations, reflects a larger wipeout of bullish-aligned positions, consistent with the risk-aversion thesis. Additionally, the funding rate remains negative at -0.0058%, reflecting a sell-side bias in new positional buildups.

Ripple forecast: Will XRP extend the correction below $2?

XRP is trading around $2 at the time of writing, recovering from the $1.84 low reached earlier on the day. The cross-border token holds below the 20-day Exponential Moving Average (EMA) at $2.05 and the 50-day EMA at $2.07, both sloping downward. The 200-EMA at $2.31 remains overhead, reflecting a broader bearish bias.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart maintains the sell signal from Friday as the average lines decline and the negative histograms widen, suggesting intense bearish momentum.

The Relative Strength Index (RSI) is at 44 on the same chart, easing toward oversold territory from the midline, reinforcing caution.

A close above the 20-day EMA at $2.05 could ease pressure toward the 50-day EMA at $2.07.

However, a failure to rise above the moving averages would keep sellers in control, threatening the November 21 low at $1.82, which has acted as key support. A deeper pullback could put the April 2025 low at $1.61 in focus as the next crucial area of demand.

(The technical analysis of this story was written with the help of an AI tool.)