What Is the ‘Dogs of the Dow’ Strategy?

The "Dogs of the Dow" strategy involves selecting the 10 highest dividend-yielding stocks from the Dow Jones Industrial Average at the start of each year. These stocks are typically seen as undervalued and may offer higher returns due to their potential for capital appreciation and consistent dividend payouts.

Key Features of the Strategy

Focus on Value: Targets stocks with high dividend yields, often indicating they are undervalued.

Dividend Income: Provides steady income from well-established companies.

Simplicity: Requires minimal monitoring, making it a straightforward strategy for retail investors.

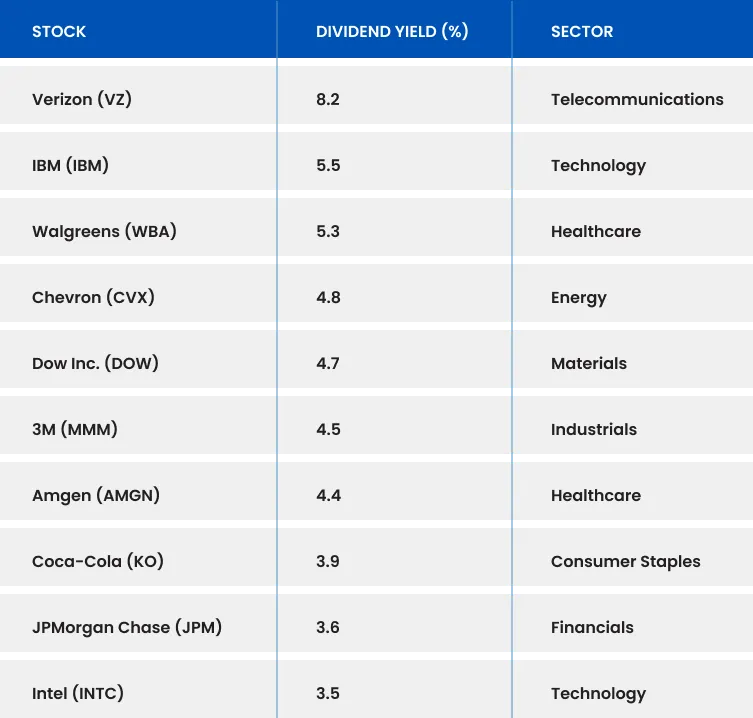

2025 Dogs of the Dow List

Here are the top 10 high-yielding Dow stocks that make up the 2025 Dogs of the Dow (as of January 1, 2025):

Does the Strategy Still Work?

The effectiveness of the Dogs of the Dow strategy depends on market conditions and the investor's objectives. Historically, the strategy has delivered respectable returns, often outperforming the broader market in specific years.

Pros:

Stable Dividends: Focuses on companies with strong cash flows and consistent dividend payments.

Undervalued Opportunities: Targets stocks with recovery potential.

Low Volatility: Typically includes blue-chip stocks, less volatile than smaller companies.

Cons:

Sector Concentration: This may result in overexposure to specific sectors (e.g., healthcare, technology).

Market Underperformance: Can lag during bull markets where growth stocks outperform.

Dividend Cuts: High yields may sometimes indicate financial distress.

How to Invest in the Dogs of the Dow

1. Direct Stock Investment

Investors can purchase shares of the 10 Dogs of the Dow individually. This approach allows customization and control but requires regular monitoring of each stock’s performance.

2. ETFs and Mutual Funds

Several ETFs and mutual funds mimic the Dogs of the Dow strategy, offering diversification and ease of management. Examples include:

ALPS Sector Dividend Dogs ETF (SDOG)

ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

3. Dividend Reinvestment Plans (DRIPs)

Use DRIPs to automatically reinvest dividends into additional shares, compounding returns over time.

4. Combine with Other Strategies

Pair the Dogs of the Dow with other investment strategies, such as growth or international equity diversification, to reduce risk and enhance returns.

Conclusion

The Dogs of the Dow strategy remains a solid choice for investors seeking steady income and exposure to undervalued blue-chip stocks. While its performance can vary year-to-year, the strategy’s focus on dividend yields and long-term potential makes it a reliable approach for conservative investors.

Ready to Invest?

Access the tools and insights you need with TMGM. Whether investing in the Dogs of the Dow or exploring other strategies, TMGM provides cutting-edge platforms and expert resources to help you succeed. Start trading today.