Ethereum price today: $2,930

- BitMine acquired 44,463 ETH last week and began staking a portion of its ETH treasury.

- Chairman Thomas Lee said "year-end tax-loss related selling" is weighing on crypto prices.

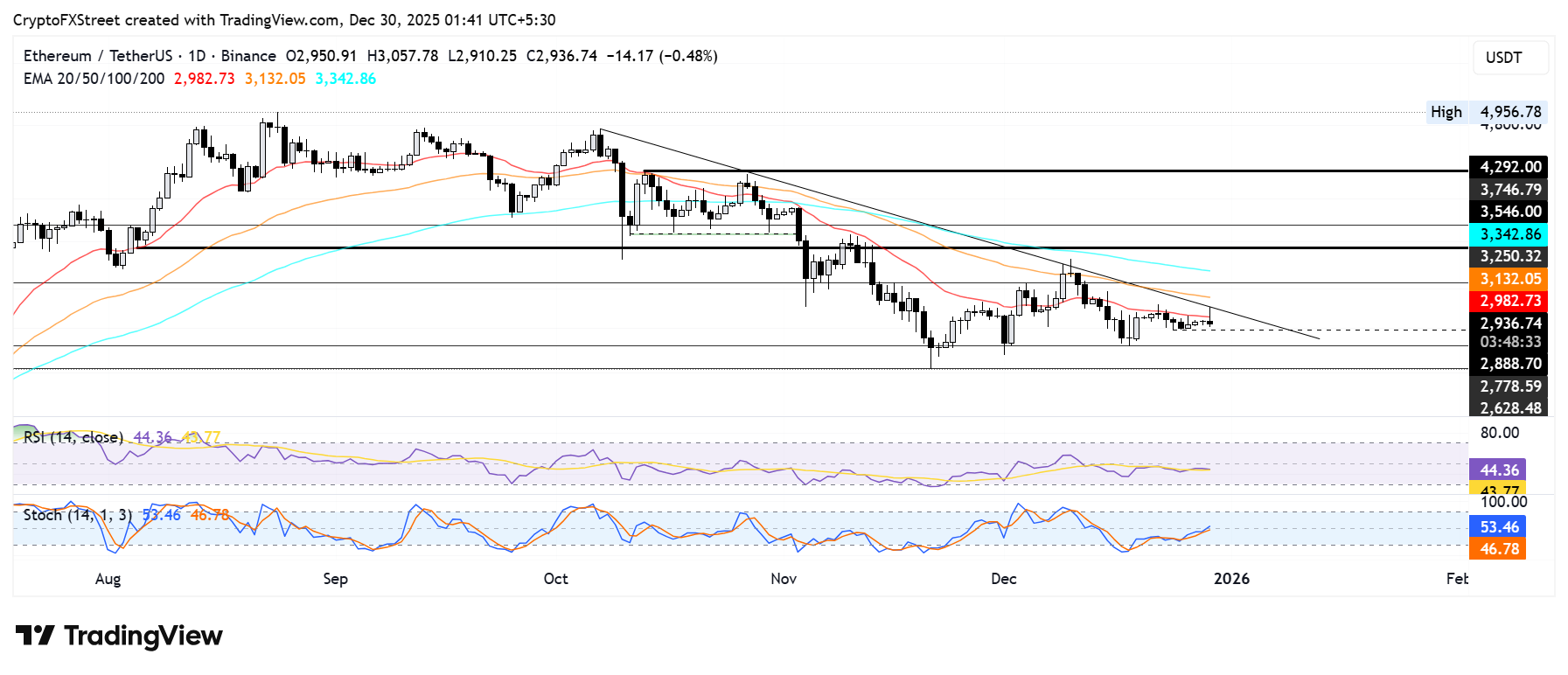

- ETH continues to face pressure before the 20-day EMA and descending triangle resistance.

Ethereum treasury firm BitMine Immersion continued its ETH buying spree despite the seasonal holiday market slowdown.

The company acquired 44,463 ETH last week, pushing its total holdings to 4.11 million ETH or 3.41% of Ethereum's circulating supply, according to a statement on Monday. That figure is over 50% lower than the amount it purchased the previous week.

"Market activity tends to slow as we enter the final holiday weeks of a calendar year," said BitMine chairman Thomas Lee. "Year-end tax-loss related selling is pushing down crypto and crypto equity prices and this effect tends to be the greatest from 12/26 to 12/30, so we are navigating markets with this in mind."

BitMine begins staking ETH holdings ahead of MAVAN rollout

The Nevada-based firm has also begun putting its assets to use, deploying 408,627 ETH across three staking providers. The company plans to stake more of its ETH supply in early 2026 via its soon-to-be-unveiled Made in America Validator Network (MAVAN).

"At scale (when Bitmine's ETH is fully staked by MAVAN and its staking partners), the ETH staking fee is $374 million annual (using 2.81% composite Ethereum staking rate), or greater than $1 million per day," Lee added.

BitMine also reported holdings of 192 Bitcoin (BTC), a $23 million stake in Worldcoin (WLD) treasury, Eightco Holdings and a cash balance of $1 billion.

Ethereum Price Forecast: ETH fails to lift above 20-day EMA

Ethereum recorded $77.2 million in liquidations over the past 24 hours, led by $44.7 million in short liquidations, according to Coinglass data.

ETH failed to establish a firm rise above the 20-day Exponential Moving Average (EMA) over the past week amid a slow crypto market. Following a brief rise above the indicator during Asian market hours, the top altcoin quickly retraced after facing resistance at the upper boundary of a descending triangle.

ETH has to hold the short-term support around $2,880 and flip the triangle's resistance — near the 50-day EMA — to a support trendline before it could test the $3,250 level.

On the downside, ETH could fall toward $2,620 if it declines below $2,770.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending near their neutral levels, signaling a somewhat equal balance between bullish and bearish momentum.