POPULAR ARTICLES

- Worldcoin struggles to hold support at $1.00 as risk-off sentiment spreads.

- WLD liquidations surge and open interest extends its decline from July's peak.

- Sell signals offered by the MACD and SuperTrend indicators could suppress any short-term recovery.

Worldcoin (WLD) bulls are facing difficultly, attempting to prevent the previous day's sell-off, triggered by revived inflation concerns in the United States (US), from extending toward the range support at around $0.90.

The token trades around $1.00 at the time of writing amid a significant slump in interest, evidenced by a shaky derivatives market.

Worldcoin faces declining open interest as liquidations surge

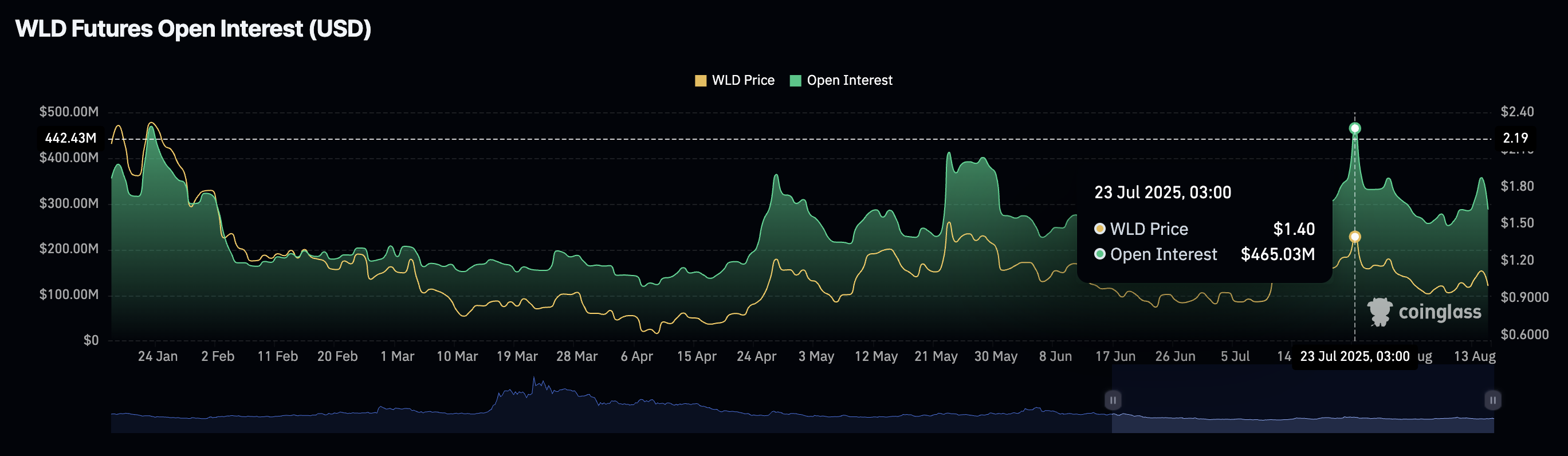

Worldcoin futures Open Interest (OI), which refers to the notional value of outstanding futures or options contracts, stands 38% below July's peak of $465 million.

The steady decline to $287 million indicates that WLD faces low risk-on sentiment as fewer traders bet on the price rising in the short term. If this trend holds, WLD's recovery above the $1.00 level might be a pipe dream in the near term.

World Coin Futures Open Interest | Source: CoinGlass

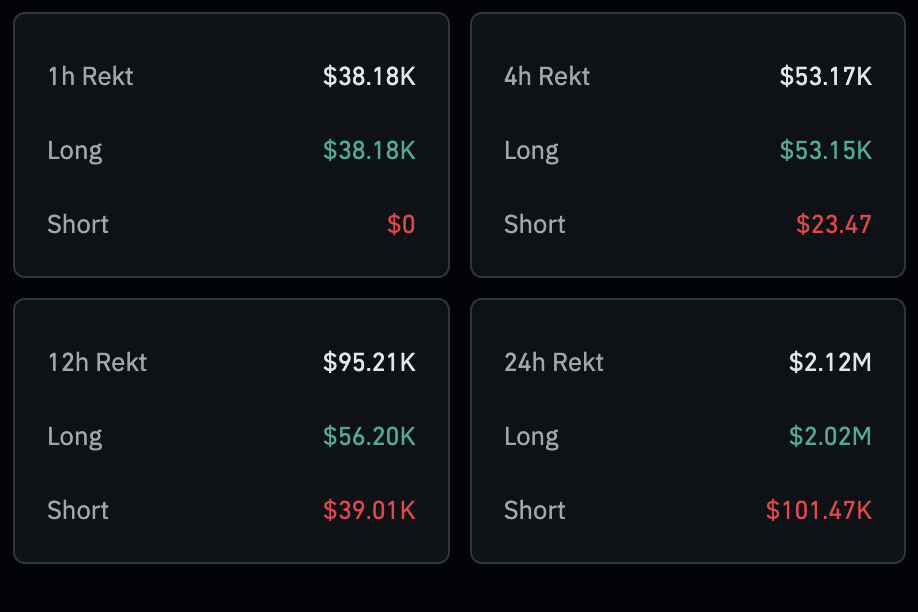

The subsequent surge in liquidations amounting to $2.12 million over the past 24 hours, with long position holders bearing the biggest brunt at $2 million, underscores the bearish momentum.

WLD futures liquidations data | Source: CoinGlass

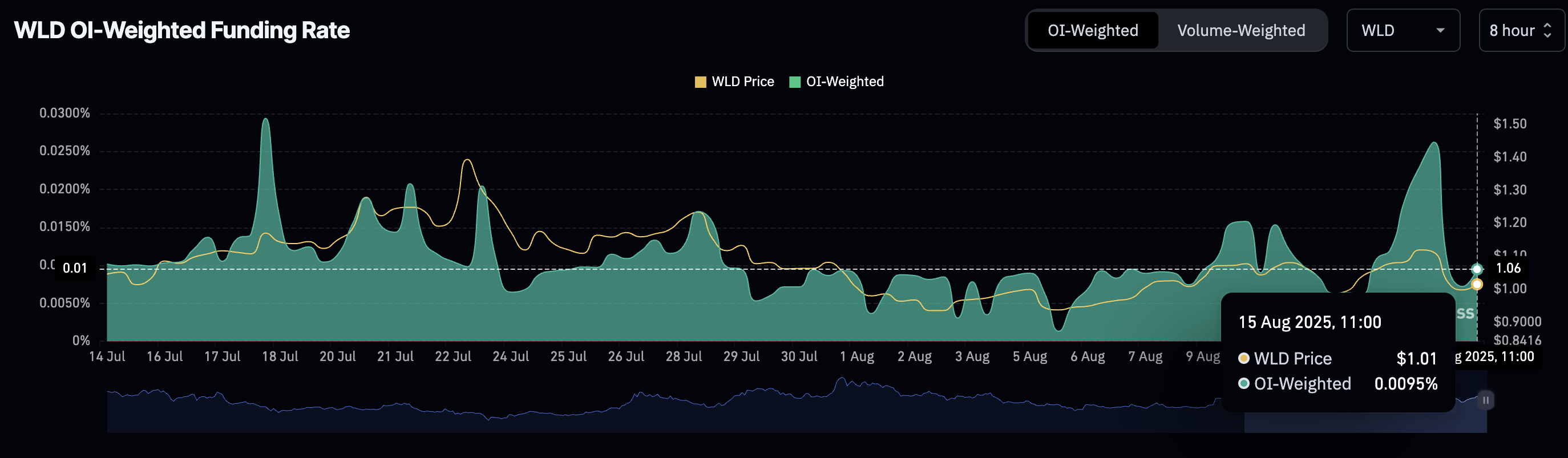

Still, a bullish trend reversal could gain traction in upcoming sessions if the futures weighted funding rate stabilizes in the positive region. A positive funding rate suggests that more traders are leveraging long positions in the WLD, thus increasing the probability of a recovery occurring.

WLD Futures Weighted Funding Rate indicator | Source: CoinGlass

Technical outlook: Worldcoin on the cusp of extending decline

Worldcoin price hangs at the edge of a cliff, with support at $1.00 seemingly weak due to the rampant risk-off sentiment in the broader cryptocurrency market. The token's position below key moving averages, including the 50-day Exponential Moving Average (EMA), the 100-day EMA and the 200-day EMA, all forming a confluence of support at $1.04, puts bulls at a disadvantage.

At the same time, the Moving Average Convergence Divergence (MACD) indicator dons a sell signal, calling on investors to consider de-risking from WLD as the downtrend extends toward the next key support at $0.90. WLD's bearish bias may hold with the blue MACD line remaining below the red signal line.

WLD/USDT daily chart

The Relative Strength Index (RSI), which is declining toward the oversold region, affirms the bearish grip amid a reduction in buying pressure. Traders should monitor support at $0.96, tested on Tuesday, and the lower demand zone at $0.90, tested on August 2. Strong rebounds from these levels could offer entry opportunities for investors who wish to buy the dip.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.