Sikat na Artikulo

- Bitcoin remained flat as President Trump's response to the US Supreme Court's ruling on emergency tariffs damped recovery sentiment.

- Trump plans to sign an executive order under Section 122 to impose an additional 10% tariff after the Supreme Court invalidated IEEPA-based duties.

- Ethereum and XRP also traded sideways, alongside most top altcoins.

Bitcoin (BTC) traded flat on Friday, hovering below the $68,000 key level following President Trump's response to the US Supreme Court's ruling on emergency tariffs.

In a Friday post on Truth Social, the President noted he will sign an executive order "to impose a 10% global tariff, under Section 122, over and above [...] normal tariffs already being charged." He also emphasized that the existing tariffs under Sections 301 and 232 remain in effect.

The response follows a 6-3 Supreme Court ruling that the International Emergency Economic Powers Act (IEEPA) does not authorize the "Liberation Day" reciprocal tariffs on all countries and the 25% duties on Canada, China, and Mexico. As a result, the US may be required to refund nearly $175 billion in duties, according to Penn-Wharton estimates.

Crypto stays horizontal amid Supreme Court ruling

Despite the ruling, most top cryptocurrencies remained fairly muted as Trump's response halted any potential improvement in sentiment.

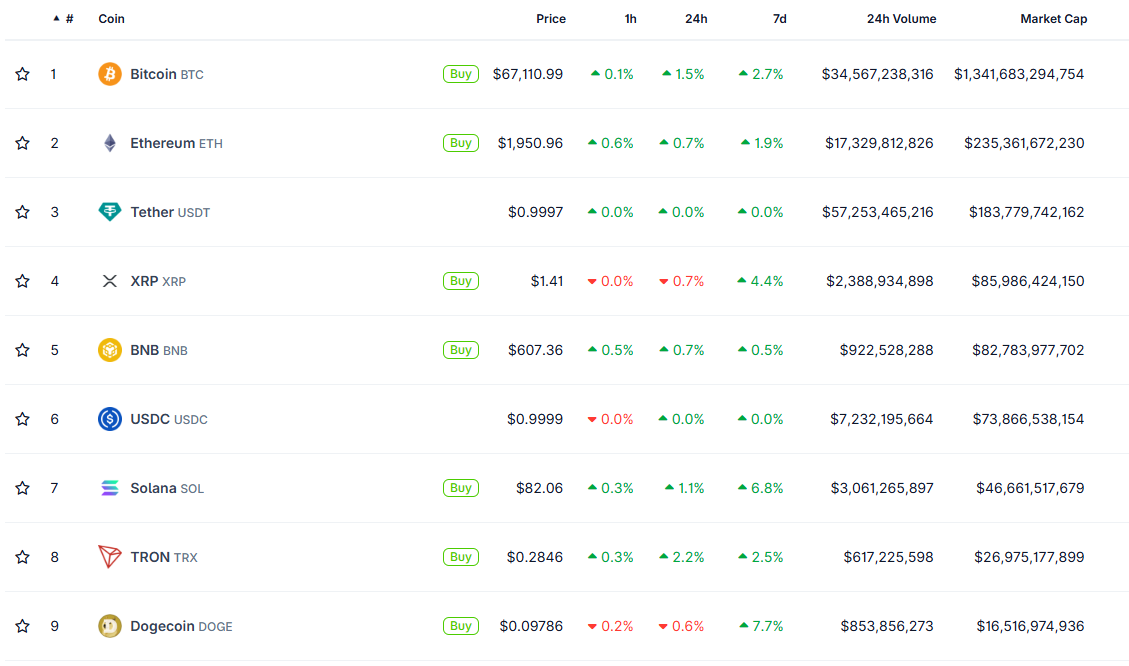

Bitcoin, Ethereum (ETH) and XRP saw modest gains of around 1% over the past 24 hours as of writing.

The move follows a sustained bearish undertone in the crypto market as Bitcoin has seen a 45% drawdown from its all-time high over the past few months. According to analysts at K33, the top crypto may have already found or is nearing a bottom, but could face extended periods of consolidation.

Meanwhile, Bitwise Chief Investment Officer Matt Hougan has previously said that macroeconomic conditions may need to improve for the crypto market to begin recovering.