Sikat na Artikulo

- Dogecoin is up almost 2% on Monday from the $0.1332 support level of a consolidation range, a potential rebound is likely.

- Derivatives data show an increase in bullish bets and Open Interest, indicating renewed risk-on sentiment.

- The technical outlook for DOGE remains mixed, as the MACD indicator signals a potential bearish crossover.

Dogecoin (DOGE) edges higher by nearly 2% at press time on Monday, recovering from a 3.57% loss on the previous day. The meme coin risks falling out of a consolidation range amid weak institutional demand and declining bullish momentum. However, the derivatives market sees a surge in bullish bets as traders anticipate a potential rebound, increasing the capital exposure in DOGE futures.

Retail demand strengthens for DOGE, overlooking long liquidations

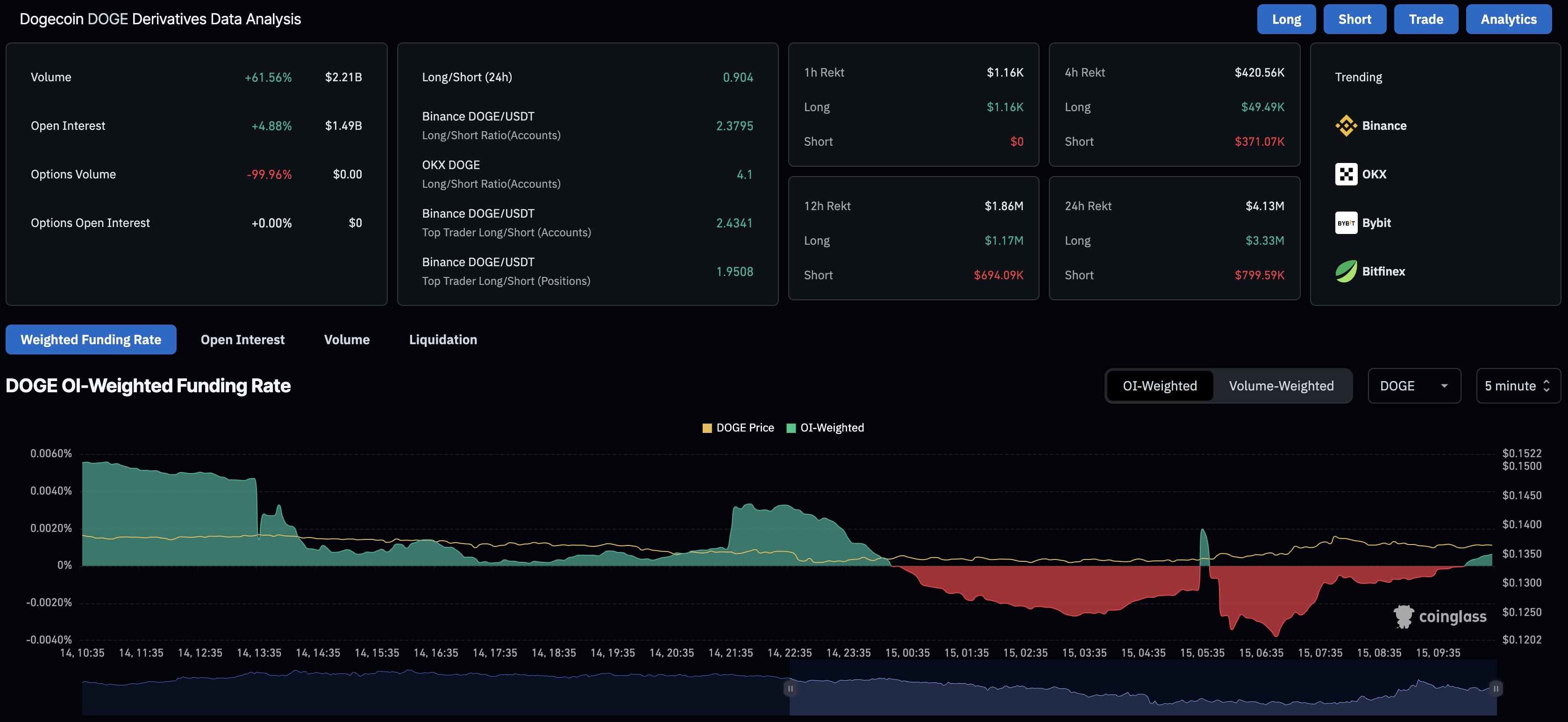

CoinGlass data shows that the Dogecoin futures Open Interest (OI) has increased by 4.88% in the last 24 hours, to $1.49 billion. This indicates an increase in the notional value of active derivatives contracts, possibly due to increased capital or leverage exposure.

However, the long liquidations of $3.33 million in the last 24 hours outpace the short liquidations of $799,590, indicating a sell-side dominance.

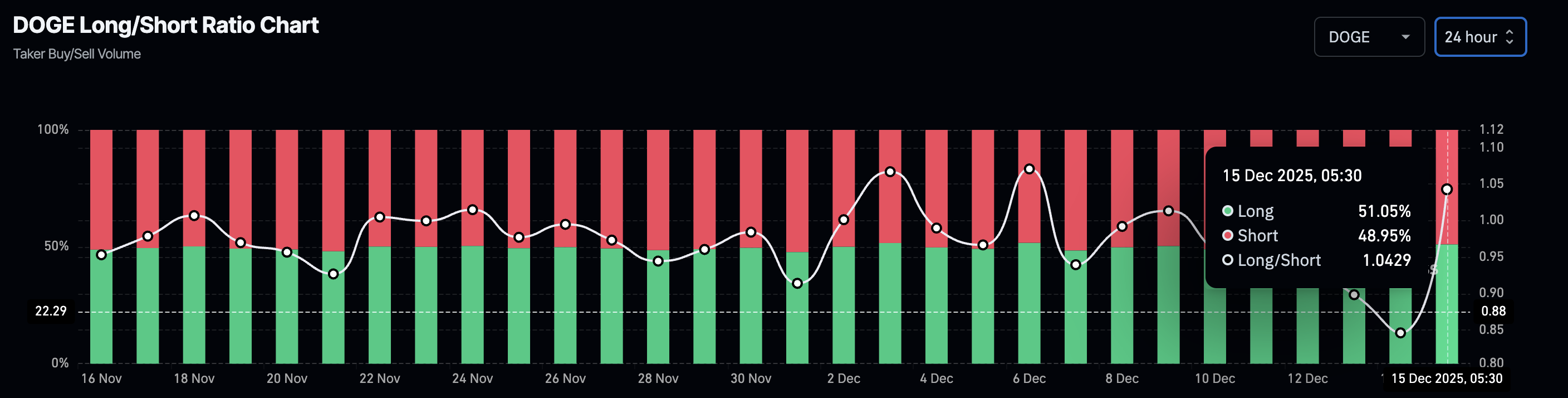

Still, the long-to-short ratio chart shows an increase in long positions to 51.05% on Monday, from 45.83% on Sunday, indicating a steady rise in bullish confidence.

On the institutional side, the Sosovalue data shows that the Dogecoin ETFs recorded $171,920 in inflows last week. The inflow occurred on Wednesday, while the remaining days were recorded as net-zero flows, signaling reduced institutional interest in the meme coin.

Dogecoin’s consolidation at risk as buying pressure wanes

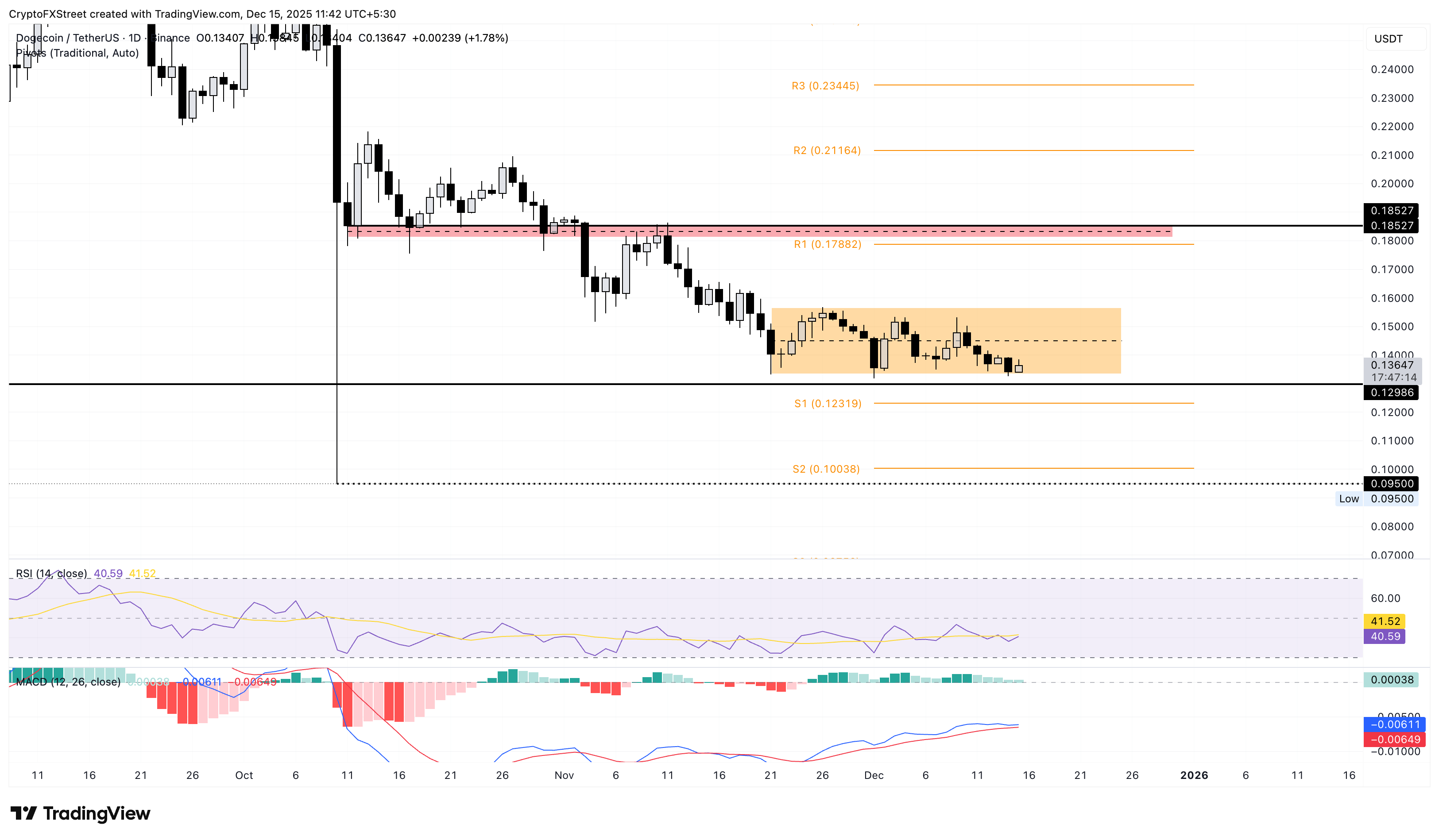

Dogecoin trades in a consolidation range extending between the November 21 low at $0.13321 and the November 26 high at $0.15681. At the time of writing, DOGE struggles to hold ground around the support level with a nearly 2% rise on Monday.

A potential rebound in the meme coin could target the overhead resistance at $0.15681, followed by the R1 Pivot Point at $0.17882, if it breaks free from the mentioned range.

However, the momentum indicators on the daily chart signal a loss in bullish momentum. The Relative Strength Index (RSI) at 40 steadies a lateral trend between the midpoint line and the oversold boundary, reflecting a bearish bias.

Meanwhile, the Moving Average Convergence Divergence (MACD) approaches its signal line, risking a crossover that would confirm a bearish trend in DOGE.

If DOGE clears below the $0.13321 support, it could threaten a decline below April’s low at $0.12986, targeting the S1 Pivot Point at $0.12319.