Fed hawks dominate the airwaves as markets scramble for cover

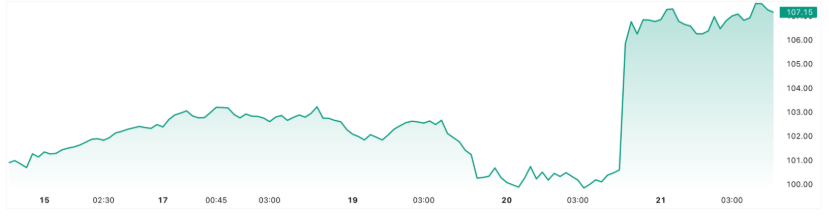

On Thursday (20 November), a series of hawkish speeches from Federal Reserve officials completely reshaped market expectations for monetary policy.

Cleveland Fed President Beth Hammack issued a clear warning: “Further rate cuts could pose financial stability risks.” She argued that with inflation still running above the Fed’s 2% target, cutting rates to support the labour market could prolong the high-inflation environment and encourage excessive risk-taking in financial markets.

Her comments were echoed by Fed Governor Michael Barr, who said he was “concerned that US inflation is still around 3%,” stressing that “the Fed must proceed cautiously in setting policy to balance the risks.”

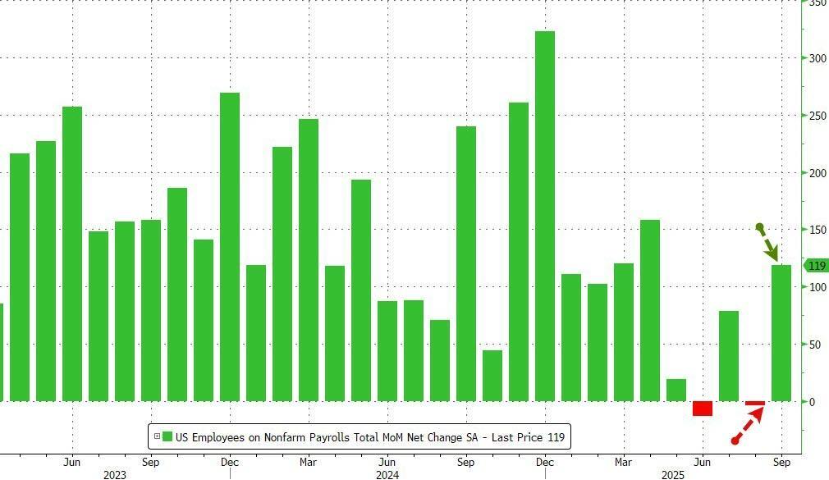

The long-delayed September nonfarm payrolls report showed an increase of 119,000 jobs, far above the market’s expectation of 52,000. The strong data further reinforced the case for the Fed to keep rates higher for longer, with interest-rate swaps continuing to signal that “a December rate cut from the Fed is unlikely.”

According to the latest readings from the CME FedWatch Tool, the implied probability of a 25-basis-point rate cut in December has fallen to 29.8%. Jeff Kilburg of KKM Financial commented: “The buzz around Nvidia has been overshadowed by the drop in December rate-cut odds. The market had been betting on easing, but that narrative has now changed.”

Shortly afterwards, the VIX fear gauge spiked 48% to 28.6, the highest level this year. The Dow Jones Industrial Average plunged 1,100 points, a 3.2% drop and its largest one-day decline of 2025; the S&P 500 tumbled 4.1%, and the Nasdaq Composite sank 5.3%, with tech stocks bearing the brunt of the selloff.

In an emergency note to clients, Goldman Sachs wrote: “Markets are repricing the Fed’s policy path. We recommend immediately reducing exposure to technology stocks and increasing allocations to cash and defensive assets.”

Morgan Stanley Chief Investment Officer Mike Wilson warned: “This is a long-overdue valuation correction. With financing costs remaining elevated, earnings estimates for US equities face broad-based downside risk.”

Nvidia “opens high, closes low” as stellar earnings fail to save the market

Nvidia’s fiscal 2026 third-quarter results released on Thursday were nothing short of stunning. On the earnings call, CEO Jensen Huang vigorously addressed market concerns, revealing that over the next six quarters, sales from the Blackwell and Rubin product lines alone are expected to reach US$500 billion in overseas markets.

He stated: “There is a lot of talk about an AI bubble, but from our perspective, the reality is very different.”

But markets don’t lie. Despite the blowout earnings, Nvidia’s share price reversed from a 5% intraday gain to finish the session down about 3%. Several key factors are driving this unusual price action:

Macro trumps micro: Thomas Martin, senior portfolio manager at Globalt Investments, noted: “Markets need time to digest the current environment and decide how to balance growth versus value exposure.” In the face of a strong hawkish signal from the Fed, not even the brightest single-stock story can turn the tide.

Valuation and bubble concerns: Investor worries about a pullback in AI-related valuations are resurfacing, as markets reassess what a “no more rate cuts” scenario from the Fed would mean for the tech sector.

Profit-taking pressure: Ben Barringer, head of global technology research at Quilter Cheviot, pointed out that concerns about an AI bubble are “less about this quarter or the next few quarters, and more about whether capital expenditure can keep growing one to two years down the line.” After a blockbuster year, investors are beginning to take profits.

Defensive sectors become market darlings as Walmart jumps 6%

While tech stocks sank across the board, Walmart shares bucked the trend, rising about 6%.

The retail giant delivered an across-the-board beat in its third-quarter results: revenue came in at US$179.5 billion, up 5.8% year-on-year, while adjusted earnings per share of US$0.62 topped market expectations. More importantly, Walmart’s e-commerce sales surged 27%, and advertising revenue jumped 53%.

The company also raised its full-year revenue growth guidance from 3.75–4.75% to 4.8–5.1%, underscoring its strong confidence in the upcoming holiday season.

Walmart’s strong performance has become a symbol of the market’s sharp shift in risk appetite. As a classic “defensive stock,” Walmart’s rally is widely seen as a clear signal that capital is rotating out of high-valuation tech and into defensive assets.

Analysts at J.P. Morgan noted that in an environment of economic uncertainty, consumers continue to prioritise essential goods, which benefits retailers like Walmart. Company executives also highlighted that households earning over US$100,000 a year now account for roughly two-thirds of Walmart’s growth, indicating that the retailer’s customer base is expanding further up the income spectrum.