Sikat na Artikulo

- Monero recovers nearly 2% on Friday, with bulls aiming to surpass the $419 resistance level.

- Steady interest from large-wallet investors keeps the XMR futures market warm.

- Monero targets its highest close since May 2021, led by a surge in XMR futures Open Interest and bullish bets.

Monero (XMR) continues its steady recovery above the $400 mark at the time of writing on Friday, approaching the $419 resistance level that has capped the price since May 26. Derivatives data shows increased interest from large wallet investors, popularly known as whales, as XMR prepares for a breakout rally. The technical outlook maintains a bullish bias as the Moving Average Convergence Divergence (MACD) indicator flashes a buy signal.

Rising interest in Monero signals refreshed bullish sentiment

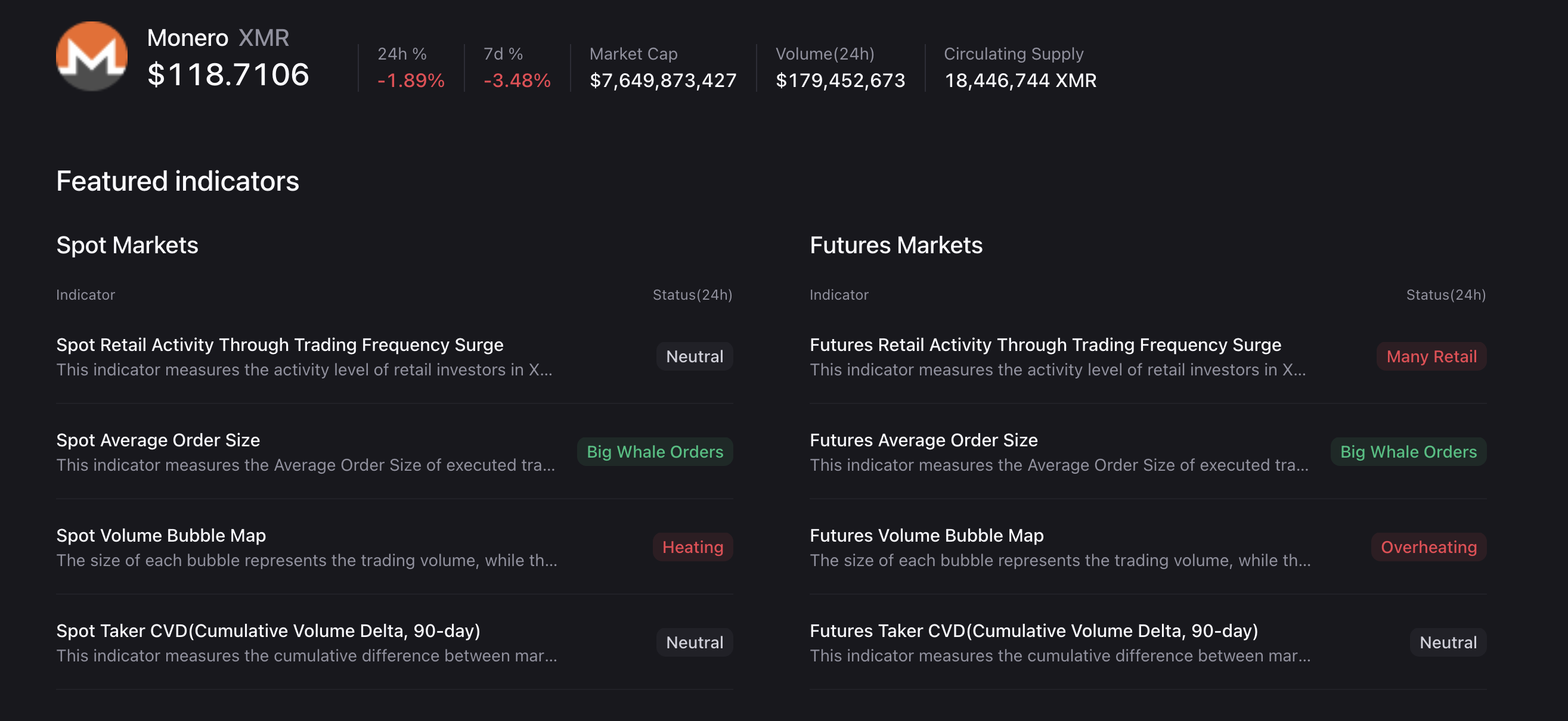

The heightened investor interest in privacy coins now shifts to Monero, as Zcash (ZEC) takes a breather after its October rally. CryptoQuant data shows an increase in high-value orders from whales in XMR futures, driving volumes to overheating levels. This reflects a risk-on sentiment among whales, anticipating an extension in the Monero recovery.

In line with the risk-on sentiment, CoinGlass data shows an 8.09% increase in XMR futures Open Interest (OI) over the last 24 hours, bringing the total to $67.06 million. Furthermore, the XMR long-to-short ratio chart indicates a surge in bullish-aligned positions, rising to 55.79% as of Friday.

Overall, rising optimism in the derivatives market for Monero could support XMR's recovery.

Monero’s rally hits the month-long resistance as MACD flashes a buy signal

Monero holds steady above the $400 mark, printing its third straight day of uptrend so far this week. The privacy coin aims to secure a successful daily close above the $419 level, marked by the May 26 high, after two failed attempts earlier in November.

If XMR closes the day above $419, it would mark the highest yearly close so far, potentially extending the rally to the $471 high from November 9.

Technically, Monero’s recovery is gaining momentum as the Relative Strength Index (RSI) is at 62 on the daily chart, maintaining a steady upward-moving slope. The extra space on the upside for the RSI before it reaches the overbought zone suggests bullish potential.

On a more bullish note, the Moving Average Convergence Divergence (MACD) indicator flashes a buy signal line as the average lines crossover to reinforce an uptrend.

On the contrary, if XMR flips from $419, it could extend the decline below $400 to test the $372 support level marked by the June 3 high.