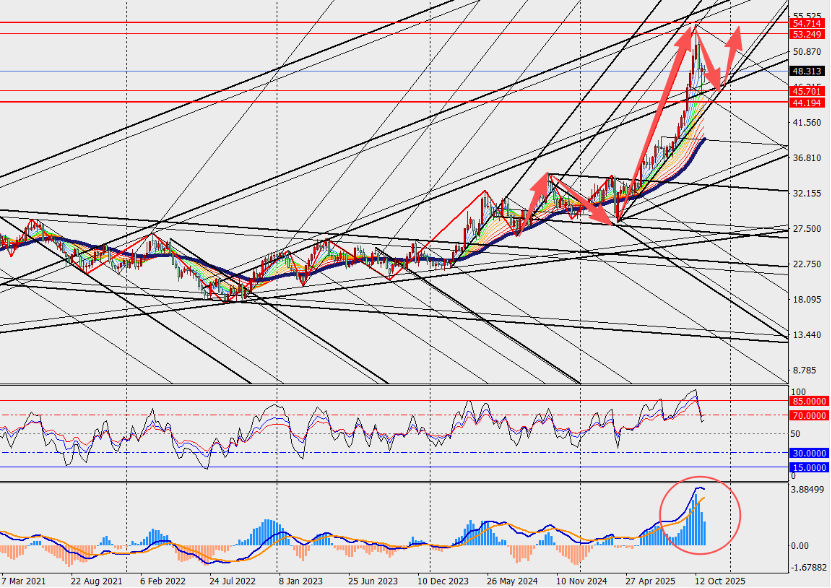

In November 2025, silver prices sit at a critical inflection point. Data show that as of November 7, spot silver was around US$48.28 per ounce. Although the metal has posted hefty gains year-to-date, prices have retreated and consolidated after setting a record high in mid-October.

On the demand side, silver is increasingly viewed as a “strategic metal”—not only as a traditional precious-metal investment but also as a key component in green technologies such as solar power, automotive electronics, and AI sensors.

On the supply side, the global silver market faces structural challenges: while mine output and recycling have both increased, they have struggled to keep up with the dual growth in industrial and investment demand, resulting in consecutive years of supply deficits.

Looking ahead, silver retains multiple pillars of support:

Medium- to long-term demand growth from green technologies (solar, electronics, smart devices) appears sustainable;

If the U.S. dollar continues to weaken, the Fed cuts rates further, or risk aversion rises, silver’s appeal as a lower-priced alternative to other precious metals should strengthen.

However, risks shouldn’t be ignored: a strong global economic rebound, rising rates, or a U.S. dollar recovery could pressure silver. At the same time, if investment buying fades or prices fail to break key technical resistance, the risk of a deeper pullback would increase.