Oppenheimer has initiated coverage on IBM with an “Outperform” rating, arguing that IBM’s shift towards software and AI is laying the foundation for sustainable revenue and margin growth. The firm set a 12–18 month price target of USD 360, reflecting strong confidence in the trajectory of IBM’s software business.

IBM’s transformation is accelerating, with structural improvements in technology, market opportunity, and margin expansion. From a technology perspective, IBM is not only doubling down on AI platforms and automation software; its next-generation IBM Z mainframes and hybrid cloud architecture are also emerging as new growth engines.

In the third quarter, IBM’s software revenue reached USD 7.2 billion, up about 10% year-on-year. Within that, “Automation” grew roughly 22%. IBM is also actively building out its quantum computing capabilities: its Nighthawk quantum processor technology has recently drawn significant attention, suggesting that the company holds a first-mover advantage in the converging “quantum + AI” space.

From a market perspective, corporate clients are increasingly turning to AI and hybrid cloud services to boost operational efficiency, cut labour costs, and accelerate digital transformation. IBM says that the scale of its AI-related business has exceeded USD 9.5 billion.

Previously, there were concerns in the market that growth in its cloud software business was slowing (for example, growth at its Red Hat subsidiary decelerated from 16% to 14%), which triggered a short-term pullback in the share price. However, looking at the bigger picture, the combination of a strong infrastructure cycle (driven by the new Z-series mainframes) and its automation platforms has positioned IBM favourably in the “large-enterprise IT modernisation” theme.

On the profit and cash-flow fronts, IBM delivered improvement in both gross and operating margins in the third quarter: non-GAAP gross margin reached 58.7%, while the operating pre-tax margin came in at 18.6%. At the same time, the company raised its full-year outlook for adjusted free cash flow to above USD 14 billion.

This indicates that IBM is not only growing, but also improving the quality of its earnings and its cash-generation capability. Its strategic focus on software and Z mainframes—both high-margin segments—should help lift overall profitability further.

Market Commentary:

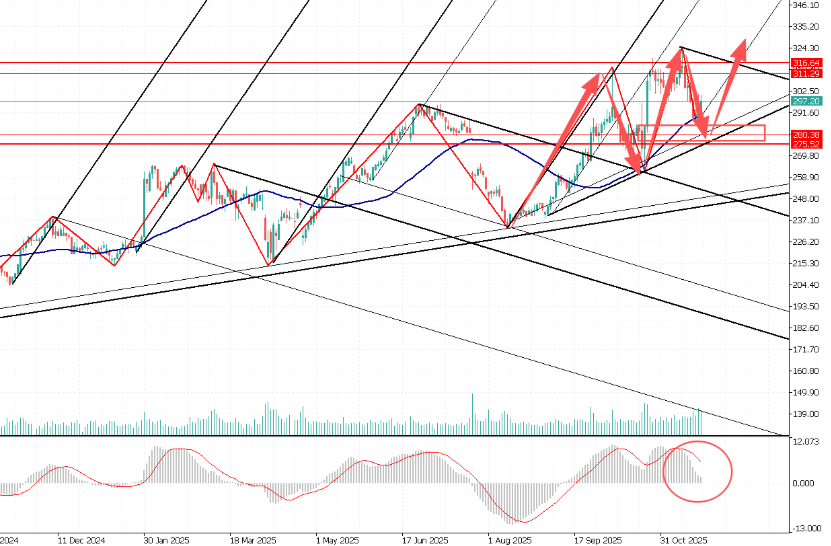

IBM’s share price has been rebounding in a choppy fashion, supported by further commercialisation of its AI and automation platforms—especially the shift from project-based deployments to scaled roll-outs. The acceleration of the mainframe cycle injects structural resilience into its infrastructure business. In addition, the medium- to long-term potential of quantum computing and the hybrid cloud ecosystem provides IBM with a strategic moat for sustaining technological leadership.