POPULAR ARTICLES

The U.S. has blacklisted Russia's oil giants, Rosneft and Lukoil, which has triggered concerns in the market. There are fears that major buyers, particularly India, might stop trading with Moscow, potentially threatening the supply of one of the world’s top oil producers. On Thursday, oil prices posted their biggest rise since June 13, when the Israel-Iran conflict erupted.

At the time the sanctions were introduced, global supply seemed relatively abundant, as OPEC+ and other oil-producing countries had been increasing output in response to signs of slowing demand growth. However, if India does significantly reduce its purchases, the question will become whether other countries are willing to fill the gap.

The latest U.S. sanctions on Russia’s largest oil producers represent a significant and unprecedented escalation in Washington’s pressure on Moscow. Combined with recent attacks on Russian oil infrastructure, these sanctions increase the likelihood of major disruptions in Russian oil production and exports, raising the risk of forced shutdowns.

The oil market had already shown signs of oversupply, with the stockpile of oil tankers at sea hitting record highs. The International Energy Agency (IEA) projects that global supply will exceed demand by nearly 4 million barrels per day next year. This has caused the forward price curve to signal growing weakness in the market.

Although abundant supply may buffer the impact of these sanctions, their power should not be underestimated. Rearranging India’s imports will be a challenging task, as more than a third of the country’s imports come from Russia. It is certain that Russia has vast experience in circumventing sanctions, and its maritime oil shipments recently reached a 29-month high.

ING (International Group) pointed out that these punitive measures mark a shift in Trump’s strategy towards Russia and open the door to even harsher sanctions in the future, which could ultimately affect Russia's oil exports. The uncertainty lies in how effective these sanctions will be and the extent of their actual impact on exports.

These U.S. measures represent a significant policy shift. Previous efforts included the G7 imposing a price cap on Russian oil, aimed at limiting Kremlin revenues while avoiding supply disruptions and global price spikes.

Market Interpretation:

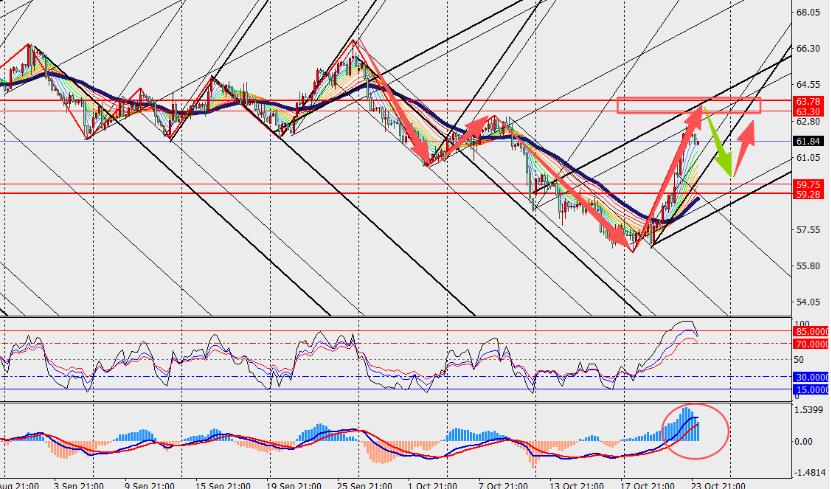

Oil prices have been rising steadily on the 4-hour chart, but with the MACD lines and volume bars shrinking, it seems likely there will be a short-term pullback and consolidation. Oil is expected to trade in the $60-$70 per barrel range. Although investor concerns are shifting from oversupply to supply disruptions, the supply in the Americas remains strong, and OPEC+ could further ease production cuts if necessary.