POPULAR ARTICLES

- Bitcoin Dolphin addresses could influence price direction, as they hold 26% of BTC's circulating supply.

- Dolphin addresses, which comprise ETFs, corporations and large holders, have accumulated 686,000 BTC in 2025.

- Bitcoin's current liquidity does not cover up to nine months of demand.

Bitcoin's (BTC) next move could be determined by Dolphin holders, which now collectively hold about 26% the top crypto's circulating supply, according to on-chain analytics platform CryptoQuant.

Bitcoin's next move hangs in the balance of Dolphin holders

The Dolphin cohort (wallets with 100-1,000 BTC), comprising exchange-traded funds (ETFs), corporations and large holders, is the cornerstone of Bitcoin's bullish structure in the current market cycle, noted CryptoQuant in a Friday report.

Historically, they have played a critical role in shaping Bitcoin's price direction. In prior cycles, prices have surged upon sustained accumulation from Dolphin addresses and corrected when they began distributing.

-1761357712149-1761357712150.png)

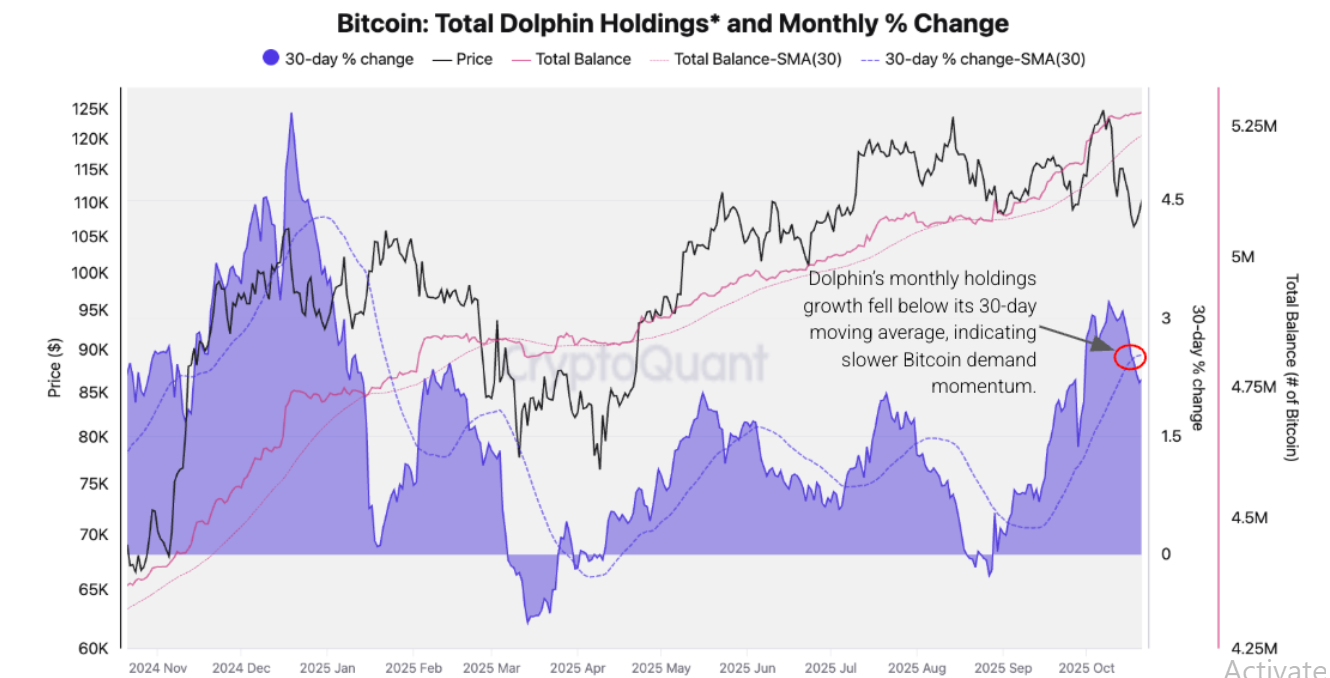

Bitcoin Total Balance Change by Address. Source: CryptoQuant

As Bitcoin surged to new highs in 2025, other cohorts began distributing, but Dolphins continued buying, growing their holdings to over 686,000 BTC since the beginning of the year. Dolphins now control 5.16 million BTC — 26% of the circulating supply — which is the largest among all cohorts.

However, their buying pressure has slowed following deleveraging events and price dips in recent months.

"For the bull trend to resume and push Bitcoin to new all-time highs, the monthly accumulation rate must accelerate again," wrote CryptoQuant analysts. "The next few weeks will be critical: a reacceleration in [Dolphin] accumulation could push Bitcoin to new highs, while continued slowdown risks deepening the correction."

Bitcoin Total Dolphin Holdings & Monthly Change. Source: CryptoQuant

Meanwhile, Bitcoin's Liquidity Inventory Ratio (LIR) has fallen to 8.3 months, indicating current market liquidity does not cover up to nine months of demand.

"Analytically, the decline in liquidity, coupled with increased demand from long-term holders, points to a favorable environment for price appreciation in the medium term," the report states.

Bitcoin is trading at $110,900 on Friday, up 0.4% at the time of publication.