POPULAR ARTICLES

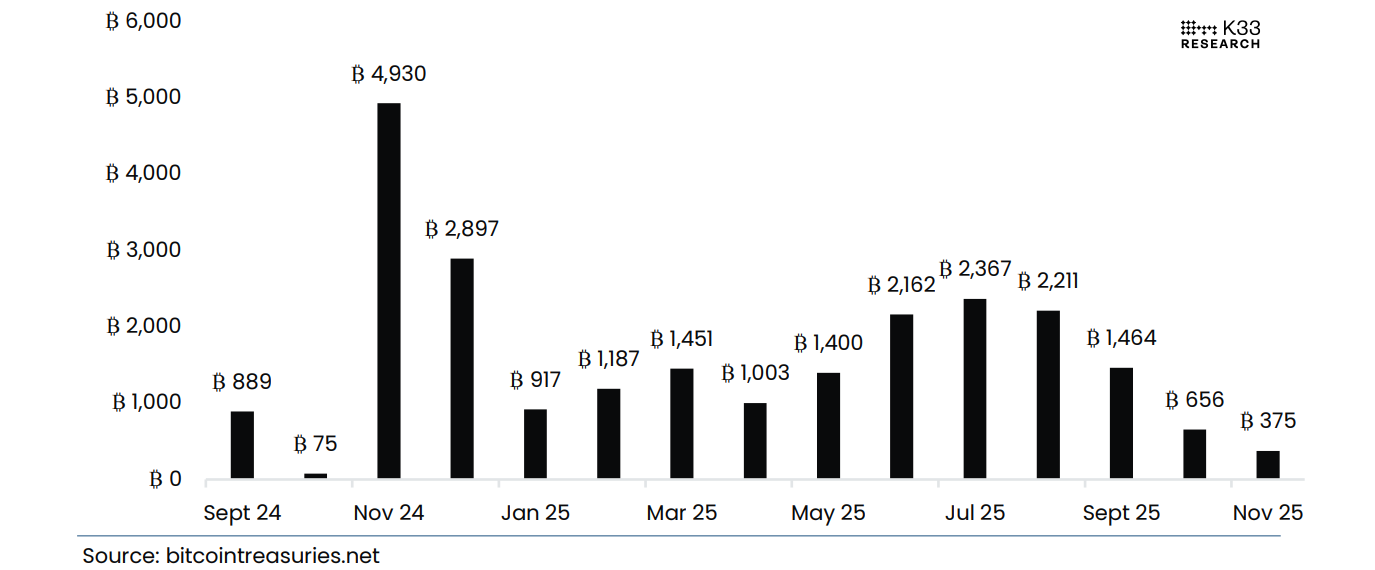

- Bitcoin average daily purchases by public companies reached a one-year low of 656 BTC in October, with demand plunging further in November.

- Half of pure public Bitcoin treasuries trade at a discount to their net assets.

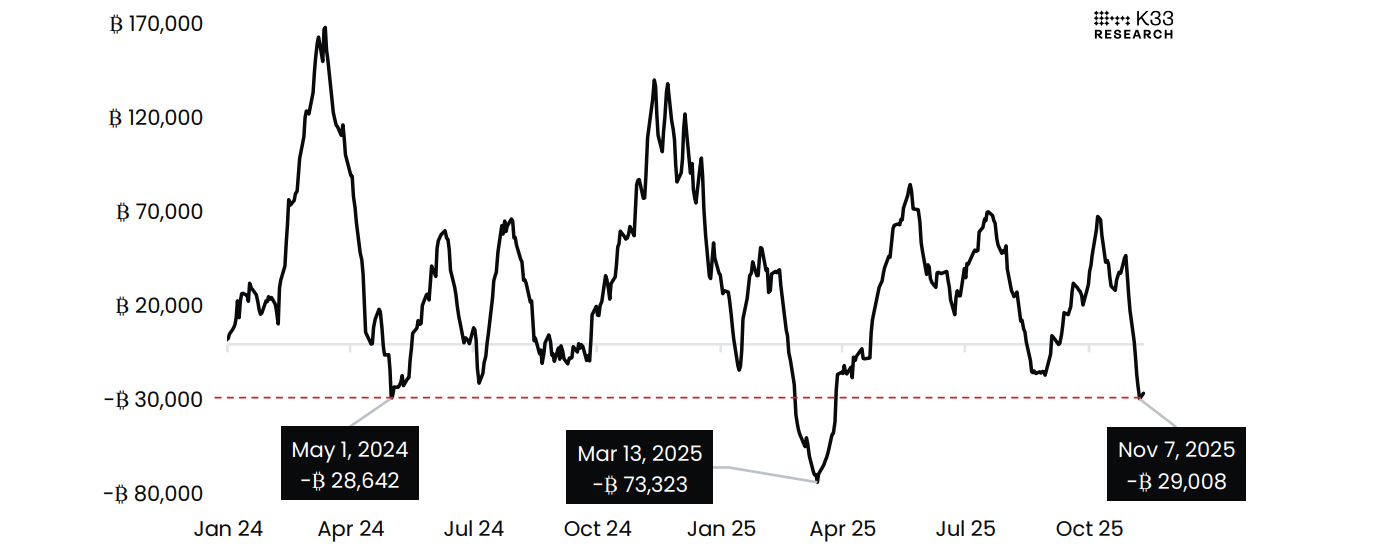

- Bitcoin investment products saw 29,008 BTC in outflows since the October 10 leverage flush.

Bitcoin accumulation from public companies has slowed significantly over the past month as macro pressures sent the top crypto's price tumbling, according to K33's head of research, Vetle Lunde, in a Tuesday report.

The analysts noted that the daily average buying pressure from these companies reached a 12-month low of 656 BTC in October. The trend accelerated in the first ten days of November, with their daily average accumulation falling by 42% to 375 BTC.

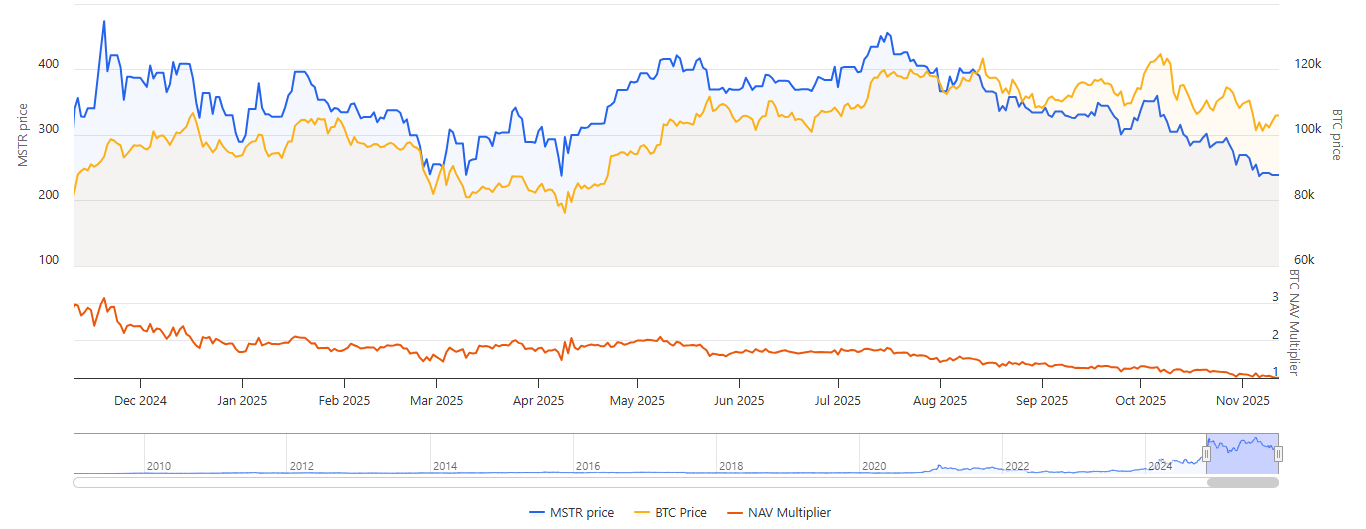

Declining market cap-to-net asset value (mNAV) has been the primary reason for the slowdown in accumulation. "Examining pure-play BTC treasury firms, 50% trade at market caps below the market value of the BTC on their balance sheet," the report stated.

For pure public Bitcoin treasuries, an mNAV below 1 indicates the company is trading at a discount to its NAV, and an mNAV above 1 indicates it is trading at a premium. Fueled by strong bullish momentum in Bitcoin, BTC treasuries led by Virginia-based Strategy raised billions of dollars between Q2 and early Q3 by issuing shares at a premium to their NAVs.

However, as those premiums have recently collapsed, some companies have been selling portions of their BTC holdings to pay obligations or launch share buyback plans to cover mNAV gaps.

"For BTC, the consequence is a considerably lower spot demand than the one enjoyed throughout Q2, 2025," wrote Lunde.

Strategy led the decline in mNAV, reaching 2023 lows

Notably, Strategy's BTC accumulation slowed considerably in 2025, dropping from 18.3% in Q1 to 13.1% in Q2 and 7.1% in Q3. So far in Q4, it has bought just 1,661 BTC. The impact is evident in the firm's mNAV, which declined to 1.009 on Wednesday, one of its lowest levels since 2023, according to BitcoinTreasuries data.

"Weak mNAVs are a reflection of prolonged dilution, a saturated treasury company scene, and soft demand," noted K33.

Popular short seller Jim Chanos emerged as one of the major winners from the decline in Strategy's MSTR premiums. Chanos reportedly earned over a 125% return last week after closing a two-legged strategy from November 2024 that involved shorting MSTR and buying Bitcoin.

While Chanos benefited, several retail investors suffered losses. Analysts at 10X Research said in October that retail investors lost around $17 billion due to new shareholders overpaying for Bitcoin exposure in digital asset treasuries.

The trend has sparked increased caution from investors. Since the October 10 leverage flush, Bitcoin investment products have seen outflows of 29,008 BTC as of Monday, "marking the worst 30-day flow since March 2025 and weaker flows than any period in 2024," according to K33. However, the analysts noted that the recent outflows are "a temporary reflection of de-risking and expect 30-day flows to trend higher from here, with 30-day flows of -29,008 BTC marking the bottom for H2 2025."

Bitcoin trades around $101,000 on Wednesday, down 2% over the past 24 hours at the time of publication.