- Cardano gains nearly 4% on Monday, extending the rally after a bullish RSI divergence.

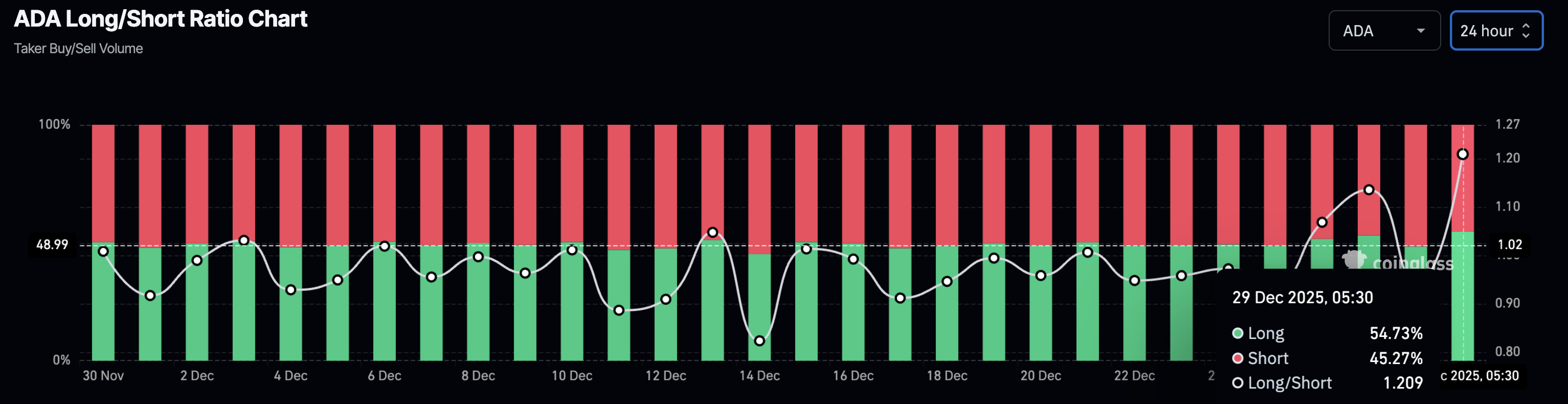

- Derivatives data signals a rise in bullish bets as traders increase their capital exposure in ADA futures.

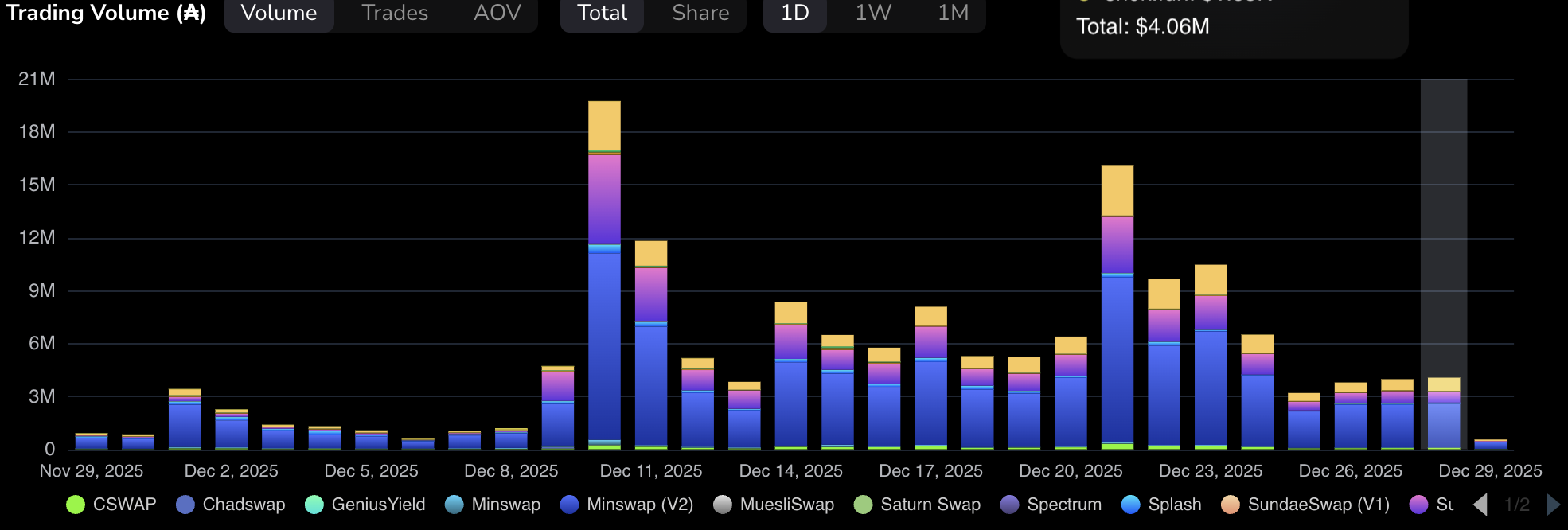

- On-chain data shows a steady rise in DEX trading volume on Cardano, indicating increased user demand.

Cardano (ADA) ticks higher by almost 4% at press time on Monday, approaching the $0.40 mark. Derivatives data suggests a risk-on sentiment among traders as ADA futures Open Interest and bullish bets surge. The technical outlook remains bullish, with ADA targeting an overhead resistance trendline amid a positive shift in momentum.

Bullish bets rise on Cardano’s steady DEX volume

Taptools data shows a surge in trading volume on Cardano’s ecosystem, rising to $4.06 million on Sunday, from $3.19 million on Thursday. This indicates a recovery in user interest, which has held steady since the launch of Cardano’s privacy-focused sidechain, Midnight.

On the derivatives side, CoinGlass data shows that the Cardano futures Open Interest (OI) is up 2.33% in the last 24 hours, reaching $729.41 million. This indicates a buildup in positions as traders increase their risk exposure.

On a more positive note, the OI-weighted funding rate of 0.0054% reflects a bullish tilt in derivatives sentiment, as traders are paying a premium to hold long positions. Additionally, the long-to-short ratio indicates that long positions account for 54.73% on Monday, up from 48.42% on Sunday. A potential leverage-driven rally in Cardano could be seen as the long positional buildup strengthens.

Technical outlook: Will Cardano cross above $0.40?

Cardano edges higher by nearly 4% at press time on Monday, further extending the rebound from a bullish Relative Strength Index (RSI) divergence formed between December 18 and 25 lows. The recovery in ADA targets an overhead resistance trendline connecting the October 28 and December 9 highs, near $0.40, on the daily logarithmic chart.

If ADA successfully clears above $0.40, it could aim for the 50-day Exponential Moving Average (EMA) at $0.4379.

The technical indicators on the daily chart indicate a gradual shift to neutral and bullish momentum. The RSI is at 46, pointing upward toward the halfway line, as selling pressure wanes. Meanwhile, the Moving Average Convergence Divergence (MACD) steadies toward the zero line after crossing above the signal line on Saturday, indicating a rise in bullish momentum.

Looking down, if ADA reverses, the S1 Pivot Point at $0.3283 could serve as support.