POPULAR ARTICLES

Ethereum price today: $4,480

- Ethereum whales have bought over 840,000 ETH in the past two weeks.

- The balance on accumulation addresses grew by a record 5.6 million ETH in September, despite the price decline in the month.

- ETH has broken above the 50-day SMA and is now testing the $4,500 resistance.

Ethereum (ETH) continued its uptrend on Thursday, testing the $4,500 resistance following sustained buying activity across whale and accumulation addresses.

Ethereum whales scoop 840,000 ETH, accumulation addresses set new record

Ethereum whales have increased their buying pressure over the past two weeks, following ETH's dip, and have continued even with the recent recovery.

Since September 18, investors with a balance of 10K-100K ETH have grown their collective holdings by 840K ETH, according to CryptoQuant data. Continued buying pressure from whales during price dips often indicates confidence in a price recovery, which has played out in the past week.

A similar action is evident across accumulation addresses — wallets with no selling activity — which added a record 5.6 million ETH to their balance in September. Accumulation addresses have now set a new monthly buying record for a third consecutive month.

-1759439743118-1759439743120.png)

ETH Balance on Accumulation Addresses. Source: CryptoQuant

Institutional demand has also returned for the top altcoin, with US spot ETH exchange-traded funds (ETFs) recording three consecutive days of net inflows, totaling $755.2 million on Wednesday, per SoSoValue data.

While underlying demand continues to expand, the recent price recovery has pushed a few whales to partially book profits, according to data compiled by smart money tracker Lookonchain.

On the derivatives side, open interest (OI) has remained largely subdued, despite the price recovery seen over the past week. However, signs of a returning risk-on sentiment emerged on Thursday, following a 280K ETH jump in the metric, per Coinglass data. The lag in OI growth suggests that ETH's recent price recovery is largely driven by spot buying pressure rather than leverage.

ETH Open Interest. Source: Coinglass

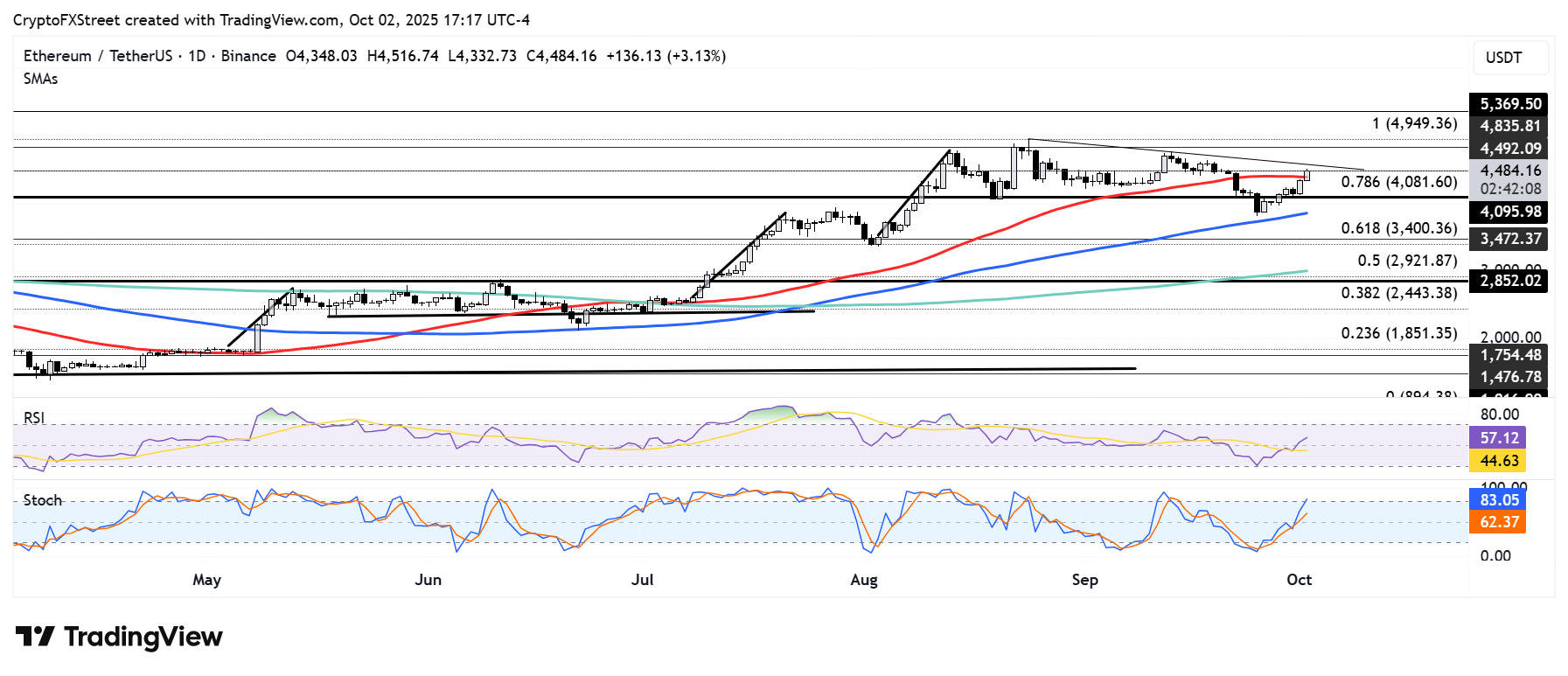

Ethereum Price Forecast: ETH tests $4,500 resistance after clearing 50-day SMA

Ethereum experienced $129.9 million in futures liquidations over the past 24 hours, with short liquidations accounting for $106.2 million.

The top altcoin has crossed above the 50-day Simple Moving Average (SMA) and is now testing the $4,500 resistance, which has proven to be a key level over the past two months. Just above $4,500 lies a descending trendline hurdle that ETH must overcome before a potential move to $4,835.

ETH/USDT daily chart

The $4,100 support and 100-day SMA are key levels to watch if ETH sees a rejection at $4,500.

The Relative Strength Index (RSI) is above its neutral level while the Stochastic Oscillator (Stoch) is slightly in the overbought region, indicating dominant bullish momentum.