Sikat na Artikulo

- EUR/USD consolidates near 1.1650, with technicals hinting at bearish momentum.

- US inflation aligns with forecasts, while consumer sentiment shows notable improvement.

- Eurozone growth beats expectations, but ECB flags downside inflation risks.

On Friday, the EUR/USD remained steady, poised to finish the week with gains of 0.39%, trade subsided capped by the 1.1650 figure as traders eyed the Federal Reserve’s decision next week.

Euro holds gains; US inflation and sentiment data shape market outlook

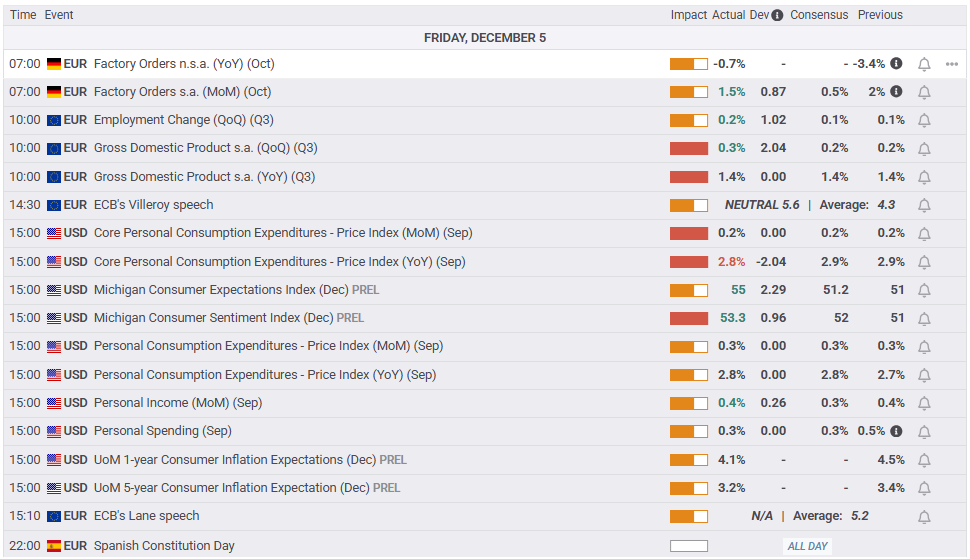

Economic data boosted the US Dollar, which trimmed some of its previous losses against the Euro. Inflation data in the US was mostly aligned with estimates, while Consumer Sentiment revealed by the University of Michigan (UoM) showed signs of improvement.

In the Eurozone, growth figures for the bloc showed the economy’s resilience with monthly data exceeding forecast. European Central Bank (ECB) Francois Villeroy said that the current position of the central bank’s policy doesn’t mean a comfortable position. He added that downside risks to inflation are more significant than the upside.

In the meantime, the lack of resolution of the Russia-Ukraine conflict, keeps the Euro pressured, even though news headlines revealed some progress in the meetings between the Kremlin and the White House, and Kyiv with Washington.

Daily market movers: US Dollar trimming losses, weighed on the Euro

- The Core Personal Consumption Expenditures (PCE) Price Index — the Fed’s favorite inflation gauge — hit 0.2% MoM in September, matching both last months and estimates. On a yearly basis, core PCE dipped from 2.9% to 2.8%, aligned with forecasts.

- The University of Michigan Consumer Sentiment index for December improved, with the index peaking forecasts of 52.0, came at 53.3 above November’s final reading of 51.1. Inflation expectations moderated, with one-year expectations falling from 4.5% to 4.1%, while five-year expectations slipped from 3.4% to 3.2%, signaling a further easing in longer-term price concerns among households.

- Despite the backdrop favors a moderately hawkish stance, money markets odds for a 25 basis points (bps) Fed rate cut next week remained unchanged at 84% revealed Capital Edge data.

- The US Dollar Index (DXY), which tracks the buck’s performance against six major currencies, ended with losses of 0.09% at 98.98.

Technical analysis: EUR/USD dips below 1.1650, eyes on 1.1600

EUR/USD holds steady around 1.1650 for a fourth session, forming a narrow consolidation band between this level and 1.1700. Buyers, unable to crack the latter, opened the door for some bearish momentum, as reflected by the Relative Strength Index (RSI), putting at risk a potential attempt to retest 1.1800 before challenging the year-to-date (YTD) high at 1.1918.

A daily close below 1.1650 opens the door to challenge the the 50-day Simple Moving Average (SMA) near 1.1609. Once surpasses, up next lies by the 20-day SMA at 1.1589, and then the 1.1500 psychological level.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.