POPULAR ARTICLES

The US Dollar began the week with gains as depicted by the US Dollar Index (DXY) after US President Donald Trump eased tensions with China, following last Friday’s threats to adding further duties on Chinese goods. Nevertheless, he backpedaled and opened the door for further negotiations, spurring an improving on risk sentiment that pushed US equities higher in the day.

Here’s what to watch on Tuesday, October 14:

The DXY recovered some of last Friday’s losses, is up 0.43% at 99.28 on Trump’s change of rhetoric on China and comments of Treasury Secretary Bessent saying that 100% tariffs do not have to happen, and Trump is on track to meet with Chinese President Xi in Korea. Dovish comments by Philadelphia Fed new President Anna Paulson, capped the Greenback’s advance, to re-test two-month highs of 99.56 hit on October 9. Traders are waiting for Fed Chair Jerome Powell speech on Tuesday.

EUR/USD fell 0.46% as France’s turmoil is set to extend despite efforts of the reappointed Prime Minister Sebastien Lecornu. Reports in French press said the government would present a budget aiming to cut the deficit to 4.7% by the end of 2026. The docket will feature Germany’s inflation figures and a speech by ECB Mario Cipollone.

GBP/USD registers losses of 0.13% and seems poised to consolidate within the 1.3260-1.3370 range on Wednesday. Bank of England Greene said that economic activity is stronger than though a year ago, and that there is a case for higher rates. The UK docket will feature employment figures for September

USD/JPY reclaimed 152.00 as Trump tempered his comments, as an improvement of risk appetite, played against haven FX currencies like the Yen and the Swiss Franc.

AUD/USD steadied on Monday, gaining 0.62% after the Reserve Bank of Australia decided to hold rates unchanged a couple of weeks ago. The release of its meeting minutes will keep traders entertained, during Tuesday’s Asian session, as the pair is back above 0.6500, following last week close at around 0.6474.

Gold prices are poised to end Monday’s session past $4,100 and unless the Fed Chair Jerome Powell strikes a hawkish speech on Tuesday, traders are setting their eyes on $4,150 and beyond. Although major investment banks reviewed their expectations of Bullion prices higher for the next year, it would not be a surprise, that the yellow metal could hit some of those milestones, on the remainder of the year.

Economic Indicator

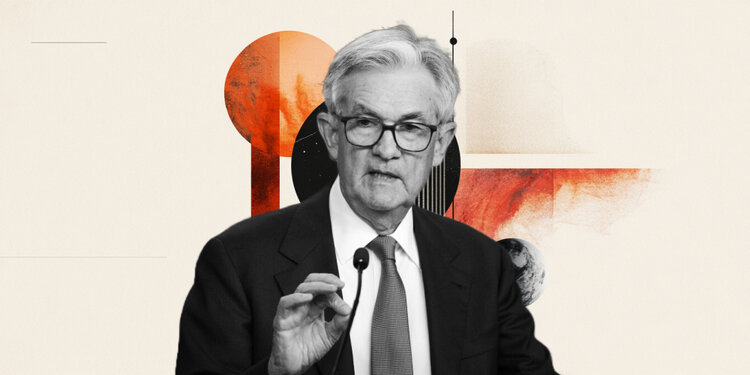

Fed's Chair Powell speech

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

Read more.Next release: Tue Oct 14, 2025 16:20

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve