POPULAR ARTICLES

- Hyperliquid price hovers $37.34 on Thursday after falling nearly 6% so far this week.

- Derivatives data point to weakening market sentiment, with open interest falling and funding rates turning negative.

- The technical outlook signals potential for further downside if HYPE closes below the key $36.51 support level.

Hyperliquid (HYPE) price hovers around $37 on Thursday, having corrected 6% so far this week. The selling pressure continues to weigh on the HYPE price as bearish sentiment builds across the derivatives market. Falling open interest and negative funding rates point to weakening trader confidence. At the same time, technical indicators suggest the risk of a deeper pullback if the HYPE fails to hold its key support level.

Derivatives data lean bearish

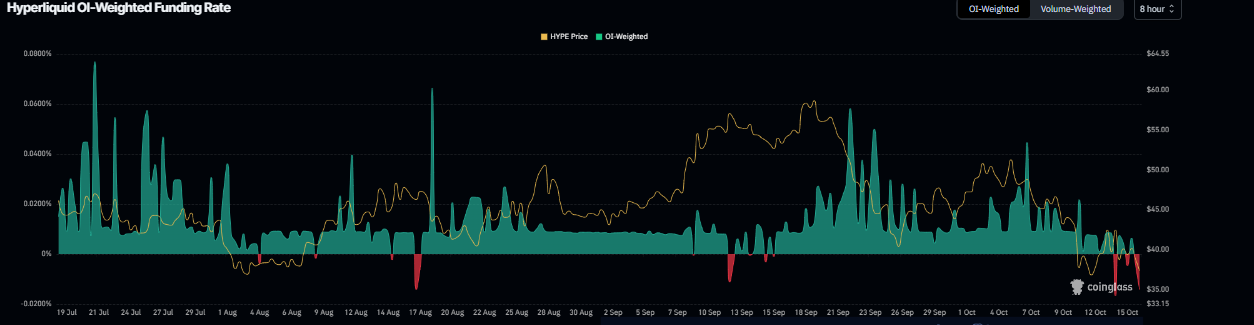

Derivatives data for Hyperliquid support a bearish outlook. Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of Hyperliquid will slide further is higher than those anticipating a price increase.

The metric has flipped to a negative rate and reads -0.014% on Thursday, nearing the level seen during last week's massive price dips. The negative ratio suggests that shorts are paying longs, indicating a bearish sentiment for HYPE.

HYPE funding rate chart. Source: Coinglass

Apart from negative funding rates, the futures Open Interest (OI) dropped to $163.28 million on Thursday, reaching levels not seen since early September, reflecting waning investor participation.

HYPE open interest chart. Source: Coinglass

Hyperliquid Price Forecast: Will HYPE drop to June’s low?

Hyperliquid price found support around the weekly level at $36.51 on Sunday and recovered 15% the next day. However, the price recovery came to an end as HYPE faced rejection around the 61.8% Fibonacci retracement level at $44.48, erasing most of its gains by Wednesday. At the time of writing on Thursday, HYPE hovers at $37.34, nearing the weekly support at $36.51.

If HYPE continues its correction and closes below the weekly support at $36.51 on a daily basis, it could extend the correction toward the June 21 low of $30.92.

The Relative Strength Index (RSI) indicator at 37 on the daily chart suggests that bearish momentum is gaining traction. Additionally, the Moving Average Convergence Divergence (MACD) showed a bearish crossover on October 6, which still holds, further supporting the bearish view.

HYPE/USDT daily chart

However, if HYPE finds support around the weekly level at $36.51 and recovers, it could extend the recovery toward the 50-day Exponential Moving Average (EMA) at $45.29.