Sikat na Artikulo

- Luna Classic surges 20% on Friday, extending its recovery for the fourth consecutive day.

- Roughly 959 million tokens have been burned in December so far, fueling LUNC's recovery.

- Do Kwon's sentence is set for December 11 after he pleaded guilty to fraud over the $40 billion Terra collapse.

Luna Classic (LUNC) price rises by 20% at press time on Friday, a week before its founder Do Kwon’s sentencing hearing over the $40 billion Terra collapse fraud. A boost in token burn of over 959 billion LUNC so far in December inflates demand artificially by reducing available supply. The technical outlook remains strong, but the upcoming sentence hearing warns of a looming bull trap.

Token burns and Do Kwon’s hearing fuel sentiment around LUNC

Do Kwon is scheduled to face a sentencing hearing by Judge Engelmayer on December 11 after pleading guilty to commodities fraud, securities fraud, and two counts of wire fraud on August 12. According to a Bloomberg report, US prosecutors have agreed not to seek more than 12 years in prison, but Kwon also faces South Korean prosecutors demanding a prison sentence of 40 years.

Ahead of this sentence hearing, the sudden surge in LUNC demand risks a bull trap that could catch investors off guard.

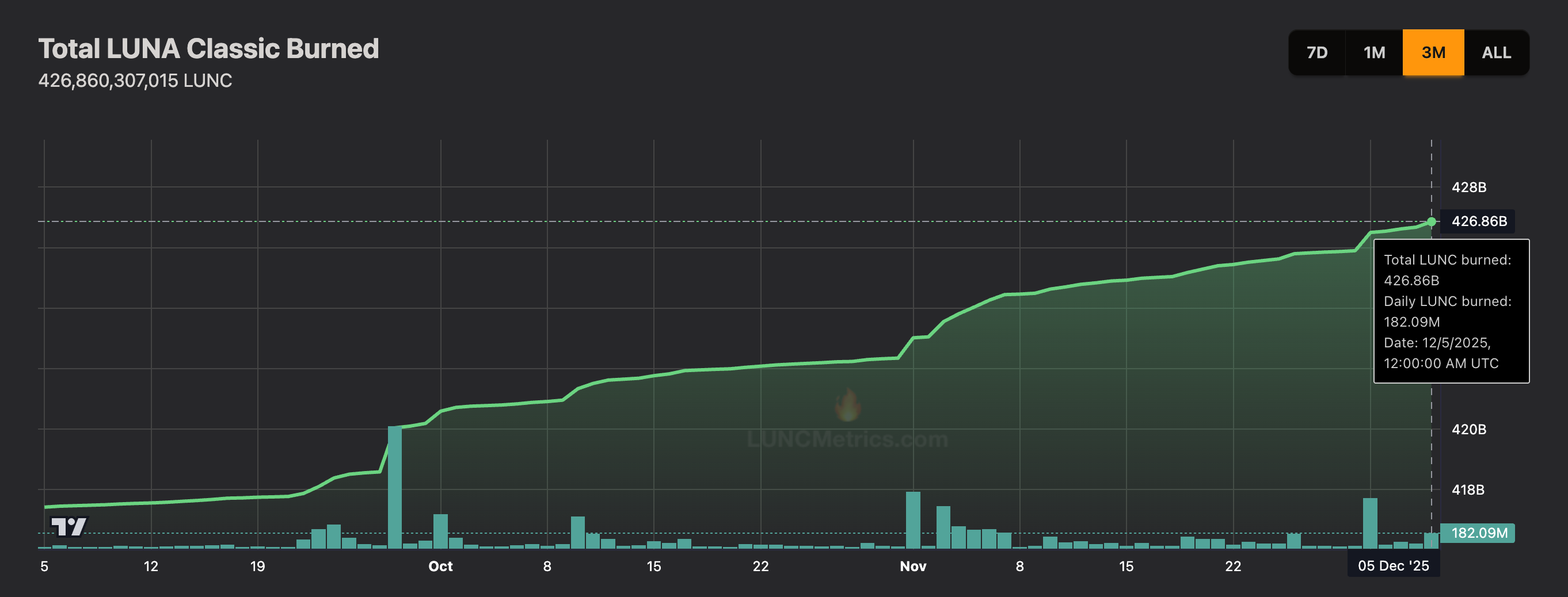

Alongside the hearing, a boost in token burns is inflating demand for LUNC. According to Luncmetrics, the total tokens burned so far in December are 959 million LUNC, with 182.09 million burned on Friday.

Luna Classic’s rebound hits key resistance

Luna Classic is forming a potential bullish Marubozu candle on the daily logarithmic chart with nearly 20% gains at the time of writing on Friday. The fourth straight day of recovery for LUNC faces opposition from the R1 Pivot Point at $0.00003914.

If the token exceeds this level, it could target the R2 Pivot Point at $0.00005107, suggesting a chance to reclaim the $0.00005000 psychological mark.

The momentum indicators on the daily timeframe indicate a surge in buying pressure. The Relative Strength Index (RSI) at 66 shows a sharp increase toward the overbought zone following a bullish divergence between the lows of November 21 and December 1.

Additionally, the Moving Average Convergence Divergence (MACD) shows a steady rise relative to its signal line, accompanied by successively higher green histogram bars, indicating increased bullish momentum.

If LUNC drops below the centre Pivot Point at $0.00003241, it risks retesting the December 1 low at $0.00002485.