Sikat na Artikulo

- Monero edges lower by over 1% on Thursday, after reaching an all-time high of $800 on the previous day.

- A sudden decline in XMR futures Open Interest at record high levels suggests market sentiment is cooling.

- The technical outlook suggests profit-taking could send Monero to the $640 support.

Monero (XMR) edges lower on Thursday, holding around $700 at the time of writing as the rally cools off after reaching a record high of $800 on the previous day, signaling a potential cycle top. Derivatives data suggest a risk-off shift among traders that could affect the spot market demand. Technically, Monero now flashes downside risk toward $640 as holders lock in profit.

XMR derivatives flash weakening retail sentiment

Monero carries a bullish bias as the privacy coins narrative has dominated the cryptocurrency market over the past two months. However, the recent pullback in XMR aligns with a delay in the CLARITY bill, flashing market-wide bearish caution.

CoinGlass data shows an over 11% decline in XMR Open Interest (OI) in the last 24 hours to $267.27 million – a drop in the notional value of all active positions – indicating reduced demand for Monero derivatives as traders reduce leverage or close positions.

The 24-hour liquidation data show short liquidations of $3.36 million, nearly three times the $1.48 million in long liquidations. However, over the last 12 hours, long liquidations totaling $1.20 million, roughly five times the $239,170 in short liquidations, suggest a shift toward a sell-side bias.

Still, bullish interest in the privacy coin persists, as the OI-weighted funding rate remains steady at 0.0149%, risking a further boost in long liquidations.

Upcycle fatigue cramps the Monero bull run

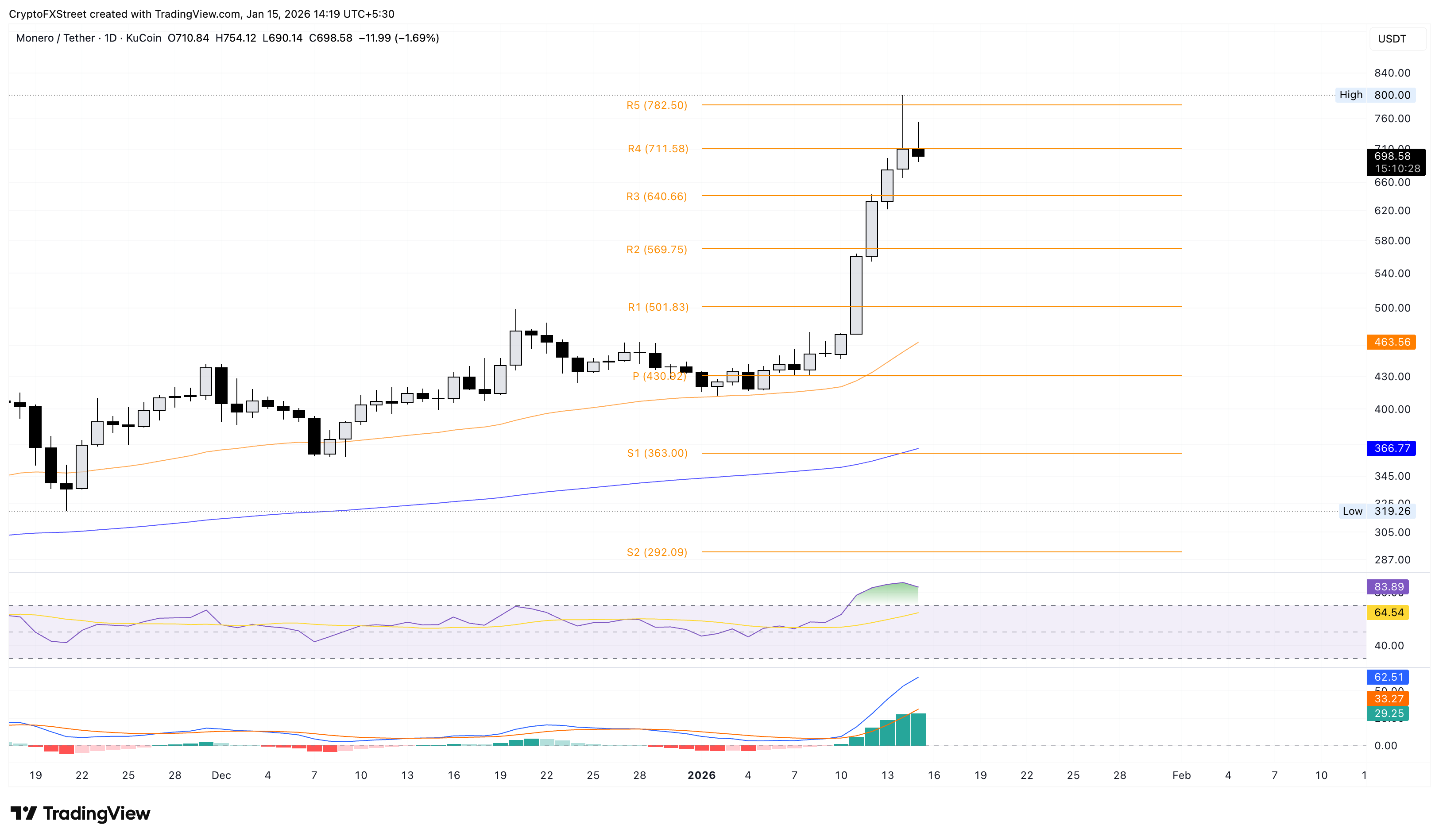

Monero edges lower by over 1% at the time of writing on Thursday, breaking the last seven days of uptrend. The privacy coin trades near $700, struggling below the R4 Pivot Point at $711, with long-wick candles on the daily logarithmic chart.

If XMR closes the day in the red, a short-term bearish bias points to the R3 Pivot Point at $640 as the immediate target.

Still, technical indicators on the daily timeframe largely back the prevailing bullish cycle. The 20-day EMA at $527 rises above the 50-day at $463 and the 200-day at $366, reinforcing a bullish alignment. As long as XMR holds well above these averages, which serve as dynamic supports, it would keep a near-term bias toward higher prices.

Additionally, the Moving Average Convergence Divergence (MACD) indicator extends above the signal line on the daily chart, with both lines holding in positive territory. A widening positive histogram suggests strengthening bullish momentum.

Meanwhile, the Relative Strength Index (RSI) at 83 is overbought, which could cap near-term gains and prompt consolidation.

Looking up, a potential closing above $711 could boost the XMR rally back to $800.

(The technical analysis of this story was written with the help of an AI tool.)