POPULAR ARTICLES

- XRP declines as recovery takes a breather, reflecting dull sentiment across the crypto market.

- Grayscale and Franklin Templeton XRP ETFs launch in the US, recording $67 million and $64 million in volume on day one, respectively.

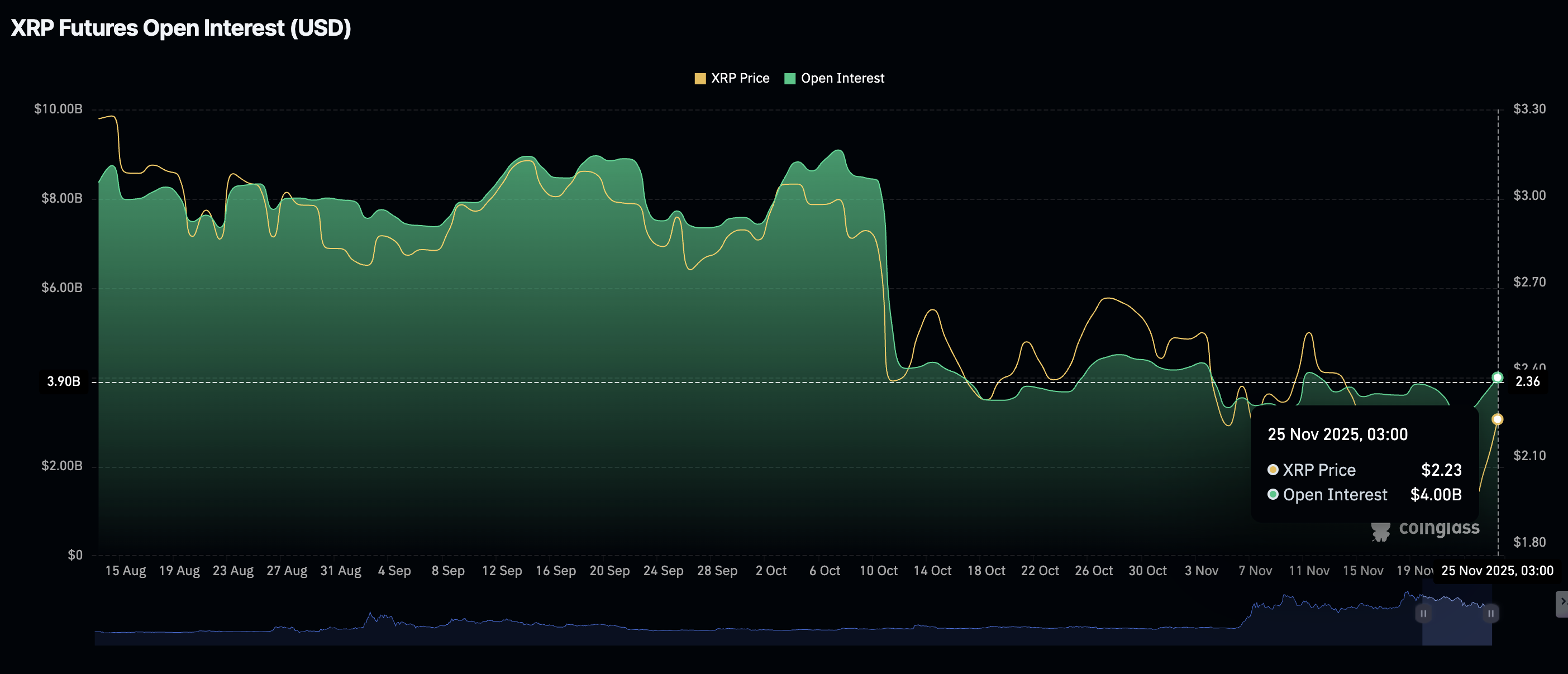

- Retail demand for XRP increases slightly with futures Open Interest above $4 billion.

Ripple (XRP) is edging lower, trading at $2.18 at the time of writing on Tuesday. A bearish wave is budding across the cryptocurrency market, triggering losses amid investors' rush to lock in short-term profits and protect their capital.

If downward pressure persists, recovery toward $3.00 could be a pipe dream, while increasing the odds of another step below the pivotal $2.00 level. However, as retail and institutional demand increase, the path of least resistance may remain upward in the coming days.

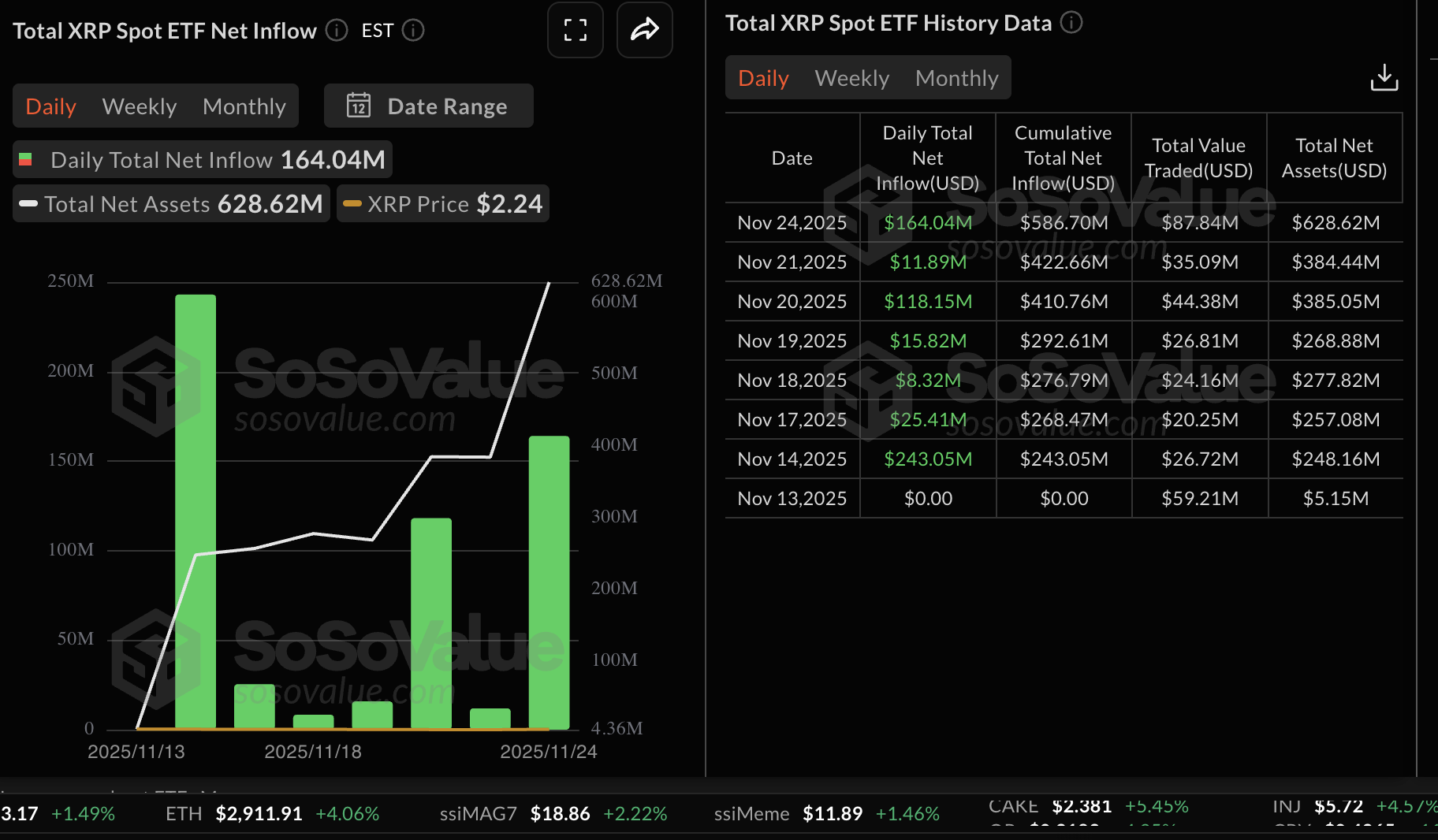

XRP ETFs post steady inflows

Grayscale and Franklin Templeton's XRP Exchange Traded Funds (ETFs) began trading on Monday, bringing the total number of United States (US) spot XRP products to four.

Grayscale's GXRP ETF recorded inflows of $67 million, with Franklin's XRPZ ETF coming second with $63 million on its first day of trading. Previously launched Bitwise's XRP ETF posted inflows of $18 million, while Canary Capital's XRPC recorded inflows of $16 million.

In total, XRP ETFs recorded $164 million in inflows on Monday, bringing the cumulative net volume to $587 million and net assets to $628 million.

Meanwhile, retail demand for XRP derivatives products has picked up this week, as reflected by futures Open Interest (OI) crossing $4 billion on Tuesday, up from $3.61 billion on Monday and $3.28 billion on Sunday.

When OI rises, it supports positive market sentiment, encouraging investors to increase their risk exposure. This creates a health environment that tends to sustain gains.

Technical outlook: XRP risks resuming downtrend

XRP is trading at around $2.18 at the time of writing on Tuesday, while staying below the falling 50-day Exponential Moving Average (EMA) at $2.38, the 100-day EMA at $2.52 and the 200-day EMA at $2.51 as they slope lower and continue to cap rebounds.

The Moving Average Convergence Divergence (MACD) histogram turned slightly positive above the zero line, signaling a bullish crossover. With the Relative Strength Index (RSI) holding at 46 below the midline, upward momentum could remain subdued and the broader tone cautious.

The descending trend line from $3.66 record high limits gains, with resistance seen at $2.68. Meanwhile, the Momentum indicator sits below the zero line and is falling, indicating strengthening bearish pressure. On recovery, the 50-day EMA at $2.38, the 200-day EMA at $2.51 and the 100-day EMA at $2.52 would present interim barriers ahead of the trend line cap. Still, a sustained break above these would improve the outlook, while failure to clear them would keep risks skewed to the downside, targeting lower levels below $2.00.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

(The technical analysis of this story was written with the help of an AI tool)