POPULAR ARTICLES

On Thursday, October 23, the US government shutdown entered its 22nd day, making it the second-longest shutdown in US history. The deadlock between the two parties on the issue of expiring healthcare subsidies persists. As President Trump is expected to travel to Asia later this week, congressional members and aides have indicated that they believe the shutdown will likely extend into November, potentially surpassing the 35-day shutdown during Trump’s first term. The meeting between Trump and Senate Republicans on Tuesday seemed to only strengthen the Republican Party’s resolve to reject negotiations with the Democrats.

Democrats have demanded that Congress provide relief to 22 million Americans who will face soaring health insurance premiums in January as a condition for reopening the government. Senate Democratic Leader and House Democratic Leader have requested a meeting with Trump before his trip to Asia, but Trump stated on Tuesday evening that he would only meet with them after the shutdown ends. The Senate needs at least 8 Democratic votes to overcome the filibuster on the temporary spending bill passed by the House, which is set to expire on November 21st.

The economic impact of the shutdown is deepening, and the White House has warned that it may be unable to use unconventional accounting methods to continue paying military wages and prevent the depletion of federal food assistance next month. The US Dollar Index has rebounded to 99.10, with mixed performances in other currencies. The Australian dollar is fluctuating around 0.6480, the Euro has fallen to around 1.1590, and the offshore Chinese yuan has reached 7.12. Spot gold has fallen to around $4083, spot silver sits at about $48.30, and crude oil has risen to around $60.30.

Fundamentals: ECB Successfully Achieves Soft Landing

An ECB board member has stated that the European Central Bank (ECB) has successfully achieved a soft landing, reducing inflation to 2% while maintaining economic resilience. Interest rate cuts and controlled inflation have created a favorable environment for investment, sustainable growth, and financial stability. Currently, ECB officials are largely satisfied with the pace of inflation slowdown and current borrowing costs. Most officials have indicated they are not inclined to adjust monetary policy unless there is a significant change in the economic outlook.

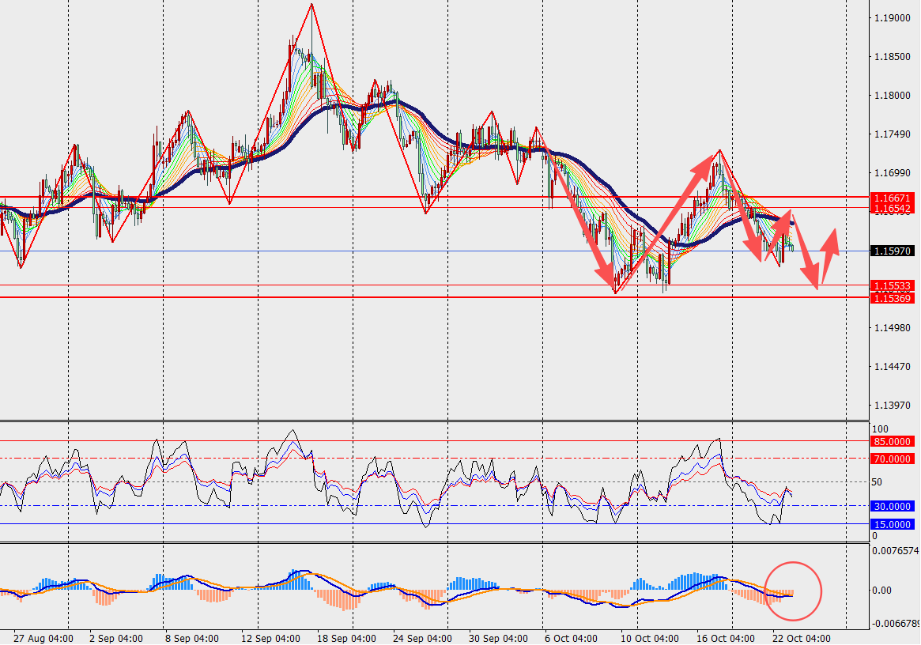

Technical Outlook: EUR/USD Faces Resistance and Pulls Back

On the H4 chart, EUR/USD has encountered resistance and is now trading below the 48-day neutral line. Additionally, MACD lines and volume bars have converged near the zero axis. The global economy is undergoing a transformation, which could present an opportunity for Europe to strengthen the Euro’s role as an international reserve currency.

First Resistance: 1.1650

First Support: 1.1540

Second Resistance: 1.1700

Second Support: 1.1490

Fundamentals: UK Inflation Data Increases Likelihood of Rate Cut

Societe Generale noted that UK inflation data, released on Wednesday, came in lower than expected, strengthening the likelihood of a Bank of England rate cut in December. The overall UK inflation rate remained at 3.8% in September, and core inflation slowed to 3.5%, which was below market expectations. Private-sector wage growth, excluding bonuses, also slowed, and the upcoming UK Autumn Budget is expected to include austerity measures.

Technical Outlook: GBP/USD Faces Downward Pressure

On the H4 chart, GBP/USD is experiencing a pullback and is trading below the 48-day neutral line. MACD lines and volume bars are converging near the zero axis. If further signs of price pressure easing appear in November inflation data, a rate cut by the Bank of England in December could become more likely.

First Resistance: 1.3390

First Support: 1.3280

Second Resistance: 1.3440

Second Support: 1.3230

Fundamentals: Barclays Sees Economic Growth Upward Revision by BOJ

Barclays has stated that the Bank of Japan (BOJ) may revise its forecast for Japan's GDP growth for fiscal year 2025 from 0.6% to 0.8%. Barclays believes this revision is based on reduced tariff uncertainty, the resilience shown in the BOJ’s September Tankan Survey, and strong Q2 GDP growth. However, BOJ Governor may continue to emphasize downside risks, particularly for FY 2026, as concerns over US tariff risks could still be present.

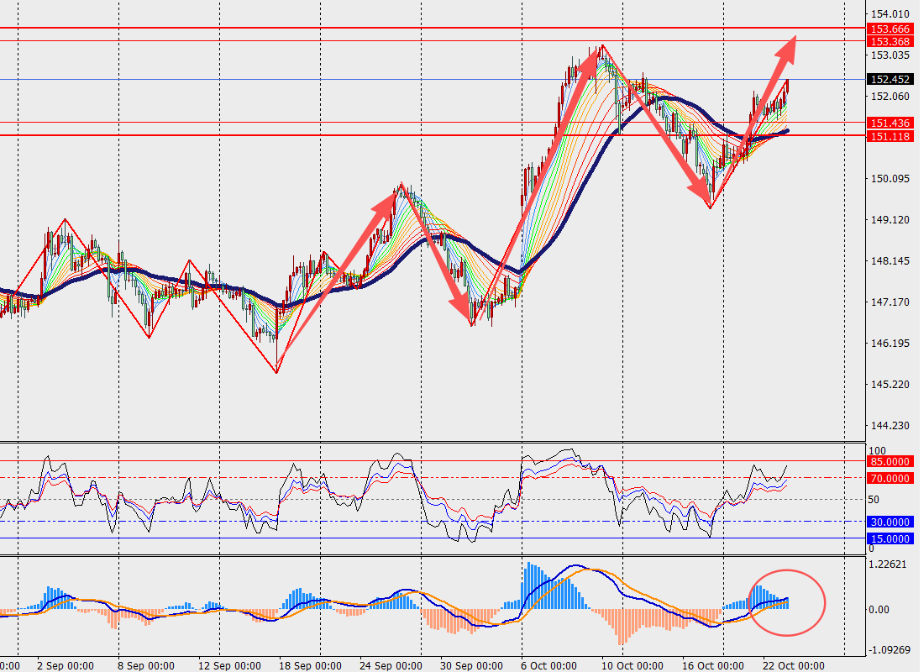

Technical Outlook: USD/JPY Continues to Rebound

On the H4 chart, USD/JPY continues to rebound and is trading above the 48-day neutral line. MACD lines and volume bars are expanding near the zero axis. Barclays expects the next interest rate hike to occur when the BOJ shifts its economic risk balance from a downward bias to neutral, which is expected to happen by January next year.

First Resistance: 153.30

First Support: 151.70

Second Resistance: 154.00

Second Support: 151.00

Fundamentals: Rising Consumer Pressure in Australia

According to a survey from the National Australia Bank, consumer pressure in Australia rose in the third quarter. Although cost-of-living pressures persist, job security has become a major driver of increasing stress. Consumers are struggling to cope with economic uncertainties, which has led to a decline in overall confidence. Over a third of Australians believe the unemployment rate will rise, and fewer expect interest rates to decrease.

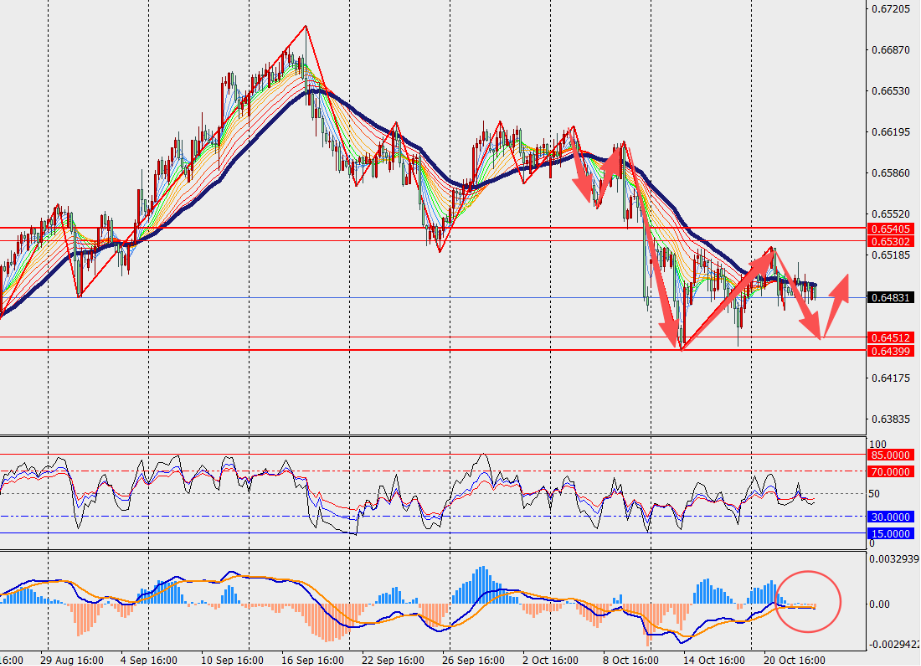

Technical Outlook: AUD/USD Faces Volatility

On the H4 chart, AUD/USD is fluctuating and trading near the 48-day neutral line. MACD lines and volume bars are converging near the zero axis. While two-thirds of Australians expect house prices to continue rising over the next year, half believe inflation, taxes, and other government charges will increase.

First Resistance: 0.6530

First Support: 0.6440

Second Resistance: 0.6570

Second Support: 0.6400

Fundamentals: Gold on Track for Largest Annual Gain Since 1979

Gold has risen 54% so far this year and is on track for its largest annual gain since 1979. It broke through $3000 in March and $4000 in October, marking key psychological resistance levels. This surge has been driven by political tensions and uncertainty surrounding US tariffs, leading to a wave of fear-of-missing-out (FOMO) buying. The nature of the rally has changed, with Western investors now driving the gains, rather than the more stable emerging market buyers of the past two years.

Technical Outlook: Gold Faces Short-Term Pullback

On the H4 chart, gold is experiencing a correction but remains below the 48-day neutral line. MACD lines and volume bars have started to expand below the zero axis. On Tuesday, gold fell by 5%, marking the largest single-day drop in five years. After a sharp surge, a pullback is not uncommon and should be viewed as a healthy correction. The fundamental backdrop for gold remains supportive.

First Resistance: 4097.00

First Support: 4064.00

Second Resistance: 4115.00

Second Support: 4047.00

Fundamentals: Oil Prices Rebound After US Sanctions on Russia's Largest Oil Producer

Oil prices rebounded on Thursday morning after the US announced sanctions on Russia’s largest oil producer. With signs indicating that recent sell-offs may have been excessive, combined with a drop in US crude oil inventories, concerns over supply surpluses have eased. However, signs of global oversupply still put downward pressure on prices, and oil futures are on track to record their third consecutive monthly decline.

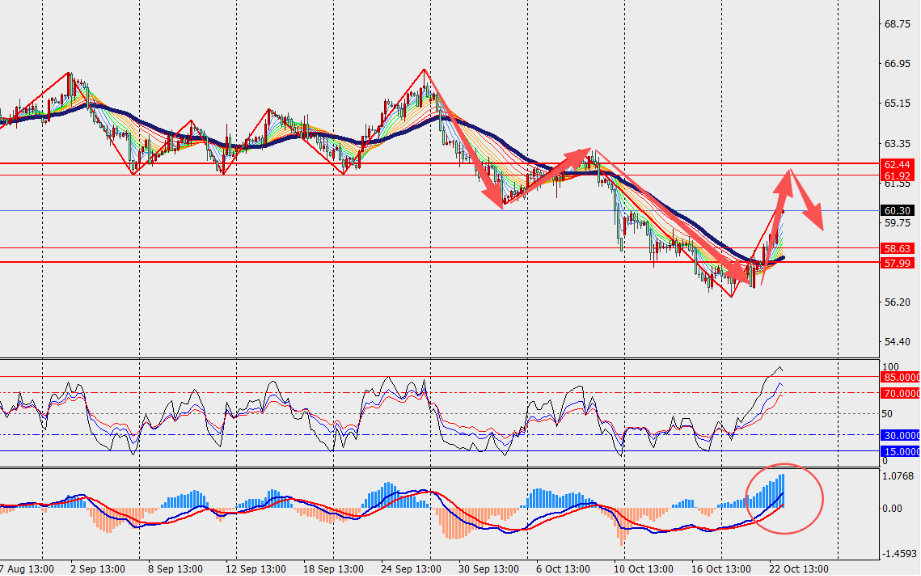

Technical Outlook: Crude Oil Continues to Rebound

On the H4 chart, crude oil is continuing its rebound and is trading above the 48-day neutral line. MACD lines and volume bars are expanding near the zero axis. The US Treasury Department stated that the sanctions will weaken Russia's ability to raise funds for its conflict and that further actions will be taken if necessary.

First Resistance: 63.00

First Support: 58.00

Second Resistance: 65.00

Second Support: 56.00

Fundamentals: Tesla Reports Lower-Than-Expected Q3 Profits Despite Record EV Sales

Tesla reported a lower-than-expected profit for the third quarter, despite record electric vehicle (EV) sales. The company’s earnings report revealed an adjusted earnings per share (EPS) of 50 cents, below the analysts' expected 54 cents. However, the company posted a quarterly revenue of $28.1 billion, surpassing market expectations. Investors expect Tesla’s vehicle deliveries to decline for the second consecutive year.

Technical Outlook: Tesla Stock Faces Slight Pullback

On the daily chart, Tesla stock has experienced a slight pullback and is trading near the 48-day neutral line. MACD lines and volume bars have expanded above the zero axis. Tesla believes its performance depends on broader macroeconomic conditions, its accelerated efforts on autonomous driving, and its ability to scale up the production of key products.

First Resistance: 442.00

First Support: 405.00

Second Resistance: 460.00

Second Support: 387.00