POPULAR ARTICLES

Driven by the impact of a surprise U.S. raid in Venezuela and the capture of its president, the spot silver market kicked off the first trading week of 2026 on a strong note. Intraday gains were significant, extending the powerful uptrend seen over the past year.

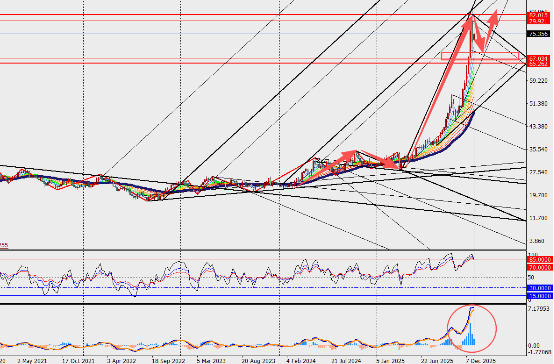

This latest leg higher comes on top of a more than 140% surge in silver prices over the course of 2025 – the biggest annual gain since 1979. The main drivers of today’s silver market clearly point to monetary-policy expectations and safe-haven demand triggered by geopolitics.

First, the Federal Reserve’s rate path is the core factor. Markets broadly expect the Fed to continue its rate-cutting cycle in 2026, with current pricing reflecting two 25-basis-point cuts.

These expectations continue to weigh on the U.S. Dollar, which in turn supports dollar-denominated silver. A lower-rate environment reduces the opportunity cost of holding a non-yielding asset like silver, increasing its appeal to investors. At the same time, possible changes at the top of the Fed add another layer of uncertainty to the monetary-policy outlook, further reinforcing the strategic case for precious metals in portfolios.

Second, safe-haven demand is another major pillar. Against a backdrop of global economic uncertainty, the U.S.–Venezuela conflict, and ongoing tensions such as the Russia-Ukraine war, demand from investors and some central banks for safe assets – including silver – remains solid. The notable rise in gold and silver prices is the result of multiple economic, investment, and geopolitical factors interacting with each other. This diversified demand from both physical and investment channels has helped build a firm floor under silver prices.

Taken together, the 74.00–74.50 USD area has emerged as an immediate support reference. Although both the fundamental and technical pictures remain constructive over the medium term, the market faces specific short-term risks over the next one to two weeks, which are the main sources of current uncertainty. In the coming fortnight, COMEX silver could see selling pressure equivalent to as much as 13% of total open interest, which may trigger a significant repricing and downside pressure on prices. Post-holiday liquidity is relatively thin, which could amplify price swings caused by such position adjustments.

In addition, risk-management measures at the exchange level also warrant attention. Raising futures margin requirements for precious metals means investors must post more cash to maintain positions. While this move is designed to manage market risk, in the short term it may prompt some leveraged traders to adjust or close out positions, thereby increasing volatility.

Market Commentary:

On the weekly chart, silver has fallen back and then rebounded, with MACD lines and histogram gradually contracting. The silver market has started 2026 on a strong footing, and the fundamental backdrop remains solid, but the path ahead is unlikely to be smooth.

As the market enjoys the premium brought by momentum, it must also stay alert to potential technical pullbacks and liquidity shocks. The price action in the coming weeks will play a key role in setting the trading range for silver in the first half of the year.