POPULAR ARTICLES

- Bittensor approaches the $450 mark, extending its fourth consecutive day of profit.

- A double-digit surge in Bittensor subnets market capitalization fuels the TAO rally.

- A nearly 20% rise in TAO futures Open Interest suggests a risk-on sentiment among traders.

Bittensor (TAO) edges higher by 7% at press time on Tuesday on the back of increasing demand for its subnets. Both the subnets market capitalization and the TAO futures Open Interest have increased by 11% and 19%, respectively, in the last 24 hours, indicating a surge in demand.

Technically, the symmetrical triangle pattern breakout rally on the 4-hour chart points to further potential gains for the Artificial Intelligence (AI) token.

Subnets are gaining traction

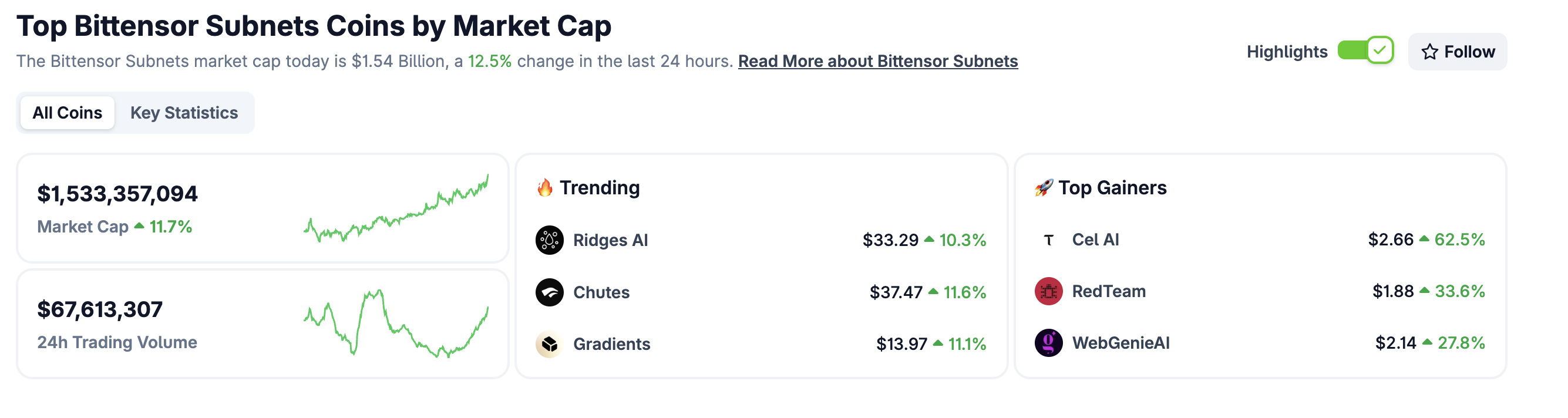

Bittensor is a blockchain-based network for machine learning models, called subnets, that use native tokens called alpha tokens. Over the last 24 hours, the subnets market capitalization has increased by 11.7%, indicating a sudden surge in demand for niche machine learning models or AI agents.

Bittensor subnets market capitalization. Source: CoinGecko

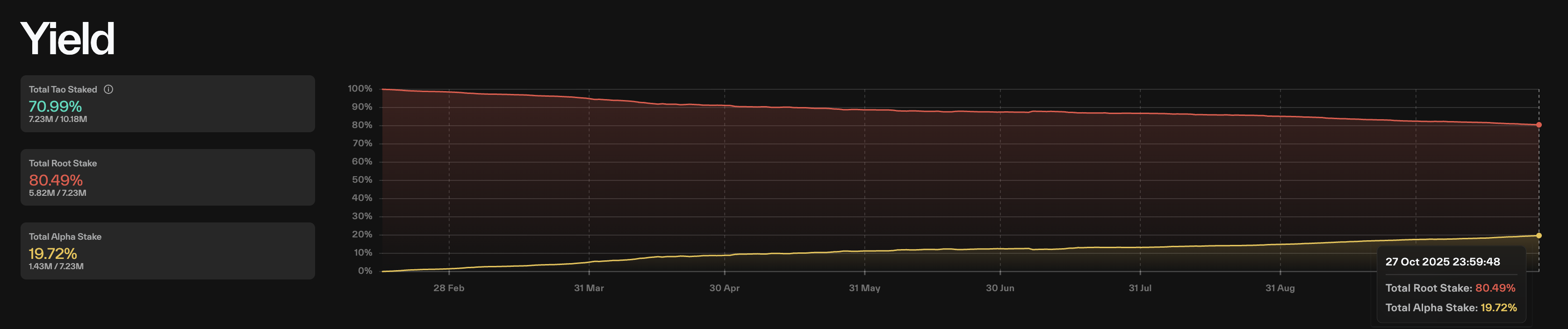

On the other hand, out of the total 7.23 million TAO tokens staked on the network, 19.72% (1.43 million tokens) have been swapped for alpha tokens, indicating that users are increasing their risk exposure to subnets.

TAO staking distribution. Source: Taostats

In short, as users shift their attention to subnets and alpha tokens, the network activity and demand will increase.

Bittensor’s breakout rally aims for the $500 mark

Bittensor breaks out of a symmetrical triangle pattern on the 4-hour price chart, approaching the R1 Pivot Point at $451. The breakout rally has also surpassed the red Supertrend line, indicating a renewed uptrend.

If the AI token successfully closes above $451, it could extend the rally to the R2 Pivot Point at $499.

Adding to the bullish potential, retail demand for TAO is increasing, according to CoinGlass data, with futures Open Interest (OI) rising 19.19% over the last 24 hours to $333.12 million. This indicates an increase in the notional value of all TAO futures contracts as traders either increase leverage or add new long positions.

Bittensor derivatives data. Source: CoinGlass

Corroborating the bullish shift, the technical indicators on the 4-hour chart suggest an increase in buying pressure. The Stochastic Relative Strength Index (Stoch RSI) shows the K and D lines rising towards the overbought zone, after a crossover earlier in the day.

The Relative Strength Index (RSI) is at 69 on the same chart, suggesting that the buying pressure is reaching overbought levels. Typically, RSI values near 80 are considered dangerously high, foreshadowing potential reversals.

TAO/USDT 4-hour price chart.

On the flip side, the $400 round figure remains a key support for Bittensor.