POPULAR ARTICLES

- Chainlink extends its gains, trading above $18.50 on Friday after rallying over 17% so far this week.

- Chainlink announces launch of Chainlink Reserve, a new upgrade centered on creation of a strategic on-chain reserve of LINK tokens.

- Rising open interest in derivatives markets and bullish technical signals point to a potential move above $22.

Chainlink (LINK) is trading in green above 18.50 at the time of writing on Friday after a strong 17% rally so far this week. This price surge was further boosted by the announcement on Thursday to establish “Chainlink Reserve,” which will accumulate LINK tokens converted from enterprise integration and on-chain service revenue. Meanwhile, the rising open interest in LINK and supporting technicals hint at a rally beyond $22.

Chainlink announces reserve plans

Chainlink announced on Thursday the launch of the “Chainlink Reserve,” a strategic LINK reserve pool to accumulate LINK tokens converted from enterprise integration and on-chain service revenue. This news caused the price of LINK to rally nearly 11% that day.

So far, this Reserve has accumulated 65,500 LINK tokens worth $1.16 million.

“We do not expect any withdrawals from the Reserve for multiple years, and thus it is expected to grow over time,” said Chainlink on its X post.

This Reserve utilizes the Payment Abstraction, an on-chain infrastructure that reduces payment friction by allowing users to pay for Chainlink services in their preferred form of payment (e.g., gas tokens and stablecoins). These payments are then converted to LINK tokens and stored in the Reserve.

This announcement is bullish for Chainlink in the longer term as it reduces the circulating supply of LINK tokens in the market, thereby increasing its demand and prices.

Apart from the “Chainlink Reserve” announcements, the recent developments also add credence to the bullish outlook for LINK. Earlier this week, Palladium Labs adopted the Chainlink data standard to help secure its Bitcoin-backed stablecoin, PUSD. Link also unveiled real-time data streams for US equities and ETFs, marking a groundbreaking advancement in the tokenized real-world asset (RWA) market.

These ongoing developments and announcements highlight the expanding network utility, broader adoption, and strengthening market trust.

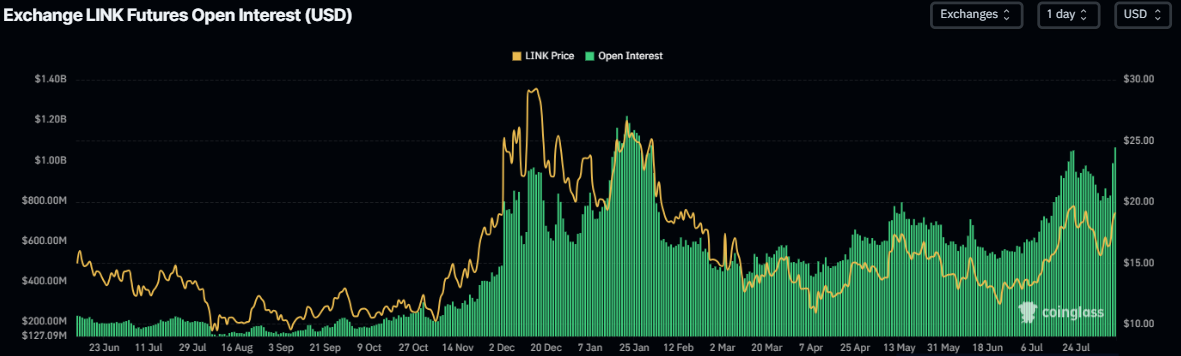

Chainlink’s open interest hit a 6-month high

Futures’ OI in Chainlink at exchanges rose from $825.42 million on Thursday to $1.07 billion on Friday, reaching levels not seen since early February, according to data from CoinGlass. Rising OI represents new or additional money entering the market and new buying, which could fuel the current LINK price rally.

LINK Futures Open Interest chart. Source: CoinGlass

Chainlink Price Forecast: LINK bulls aiming for levels above $22

Chainlink price found support around its 50% price retracement level at $15.61 on Sunday and rallied over 13% by Thursday. On Friday, it continues its gains nearly to its weekly resistance at $18.81.

If LINK closes above its weekly resistance at $18.81 on a daily basis, it could extend the rally toward its February 3 high of $22.05. A successful close above this level could extend additional gains toward its next key resistance at $26.37.

The Relative Strength Index (RSI) reads 61 above its neutral level of 50 and points upwards, indicating strong bullish momentum. The Moving Average Convergence Divergence (MACD) lines are nearing each other on the daily chart. The red histogram bar below the neutral level is also decreasing, indicating fading bearish momentum.

LINK/USDT daily chart

However, if LINK faces a rejection from its weekly level at $18.81, it could extend the decline toward its 50-day Exponential Moving Average (EMA) at $16.33.