POPULAR ARTICLES

- Forward Industries announced plans to raise $1.6 billion to establish a Solana treasury.

- The initiative will receive support from Galaxy Digital, Jump Crypto and Multicoin Capital.

- SOL is up 5% in the past 24 hours.

Solana (SOL) gained 5% on Monday after Forward Industries (FORD) disclosed that it plans to raise $1.65 billion for a SOL treasury, backed by investment and support from Galaxy Digital, Jump Crypto and Multicoin Capital.

Forward Industries set to launch $1.65 billion SOL treasury

Forward Industries has unveiled a $1.65 billion private investment in public equity (PIPE) deal to roll out a Solana-focused digital asset treasury, backed by Galaxy Digital, Jump Crypto, and Multicoin Capital, according to a statement on Monday.

The company noted that Galaxy Digital and Jump Crypto will deliver infrastructure and advisory support, while Multicoin Capital will provide investment expertise.

"Working with Galaxy, Jump Crypto, and Multicoin – firms with deep expertise and proven track records of investing and building in the Solana ecosystem – gives us a strong foundation to execute this strategy and position the Company as a key player within the digital assets space," said Michael Pruitt, CEO of Forward Industries

Forward Industries added that it aims to generate on-chain yields and enhance long-term shareholder value by actively engaging within the Solana ecosystem.

At the close of the deal, Kyle Samani, co-founder and managing partner at Multicoin, is expected to become Chairman of the Board of Directors at Forward Industries.

"As expected Chairman, I look forward to stewarding the company and helping shape the corporate strategy to take advantage of this significant opportunity," said Samani.

Forward Industries' stock rose nearly 60% on Monday following the announcement.

The company's treasury plan positions it in competition with other notable SOL treasuries, including Upexi (UPXI), which holds more than 2 million SOL, and Sharps Technology (STSS), with $460 million worth of SOL, according to Strategic SOL Reserve data.

Other major competitors include SOL Strategies, with over 435,000 SOL. The company is set to begin trading on the Nasdaq on Tuesday under the ticker STKE, but will maintain its HODL ticker on the Canadian Stock Exchange.

DeFi Development Corp (DFDV), which spearheaded the Solana treasury pivot trend earlier in the year, also holds over $400 million worth of SOL after a further $39 million purchase on Friday.

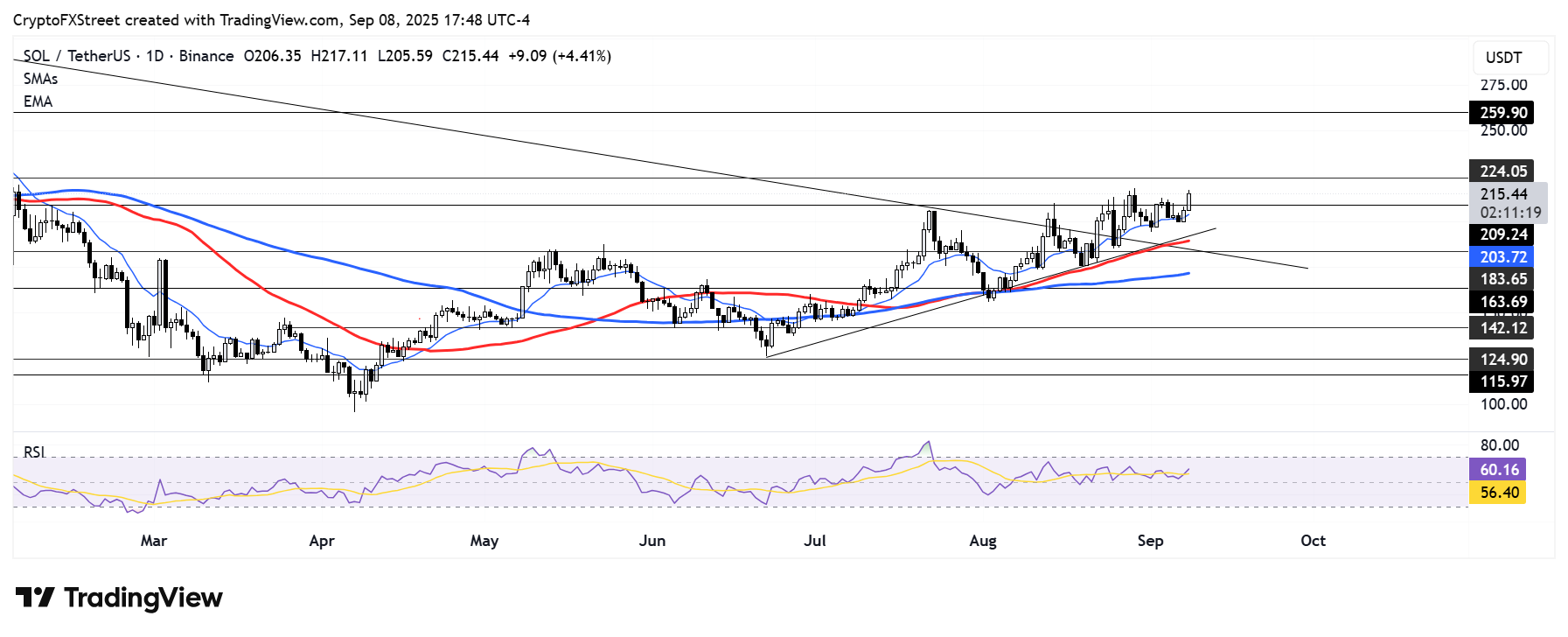

SOL/USDT daily chart

SOL trades around $214, up 5% on Monday after breaking above the $209 resistance. The token is well above a key ascending trendline support, strengthened by the 50-day Simple Moving Average (SMA).