Introduction to Forex Leverage

Definition of Leverage

Leverage is a trading mechanism that allows traders to control a larger position using less capital. It's essentially borrowing money from your broker to increase your trading power.

Purpose of Leverage

- Amplify potential profits

- Access larger market positions with limited capital

- Capitalize on small price movements in the forex market

TMGM Insight: TMGM offers flexible leverage options, allowing traders to adjust their risk exposure according to their trading strategy and experience level.

Why Do You Need Leverage in Forex Trading

Leverage plays a pivotal role in forex trading, enabling traders to maximise their exposure to the market with a relatively small amount of capital. Unlike other financial markets, such as stocks, forex involves minimal price fluctuations—often measured in fractions of a cent. Without leverage, these small movements would yield negligible profits, limiting the potential for meaningful returns. By amplifying purchasing power, leverage transforms these modest price changes into significant opportunities, allowing traders to capitalize on even the slightest market shifts. However, while leverage offers the potential for greater gains, it also introduces increased risks, underscoring the importance of using it wisely.

How Forex Leverage Works

Basic Concept

Leverage is typically expressed as a ratio, such as 1:10, 1:100, or 1:500.

Leverage Examples

- 1:10 leverage: Control $10 for every $1 in your account

- 1:100 leverage: Control $100 for every $1 in your account

- 1:500 leverage: Control $500 for every $1 in your account

Calculation Example

With $1,000 in your account and 1:20 leverage:

- Potential market exposure: $1,000 * 20 = $20,000

TMGM Tool: Use TMGM's leverage calculator to determine your potential market exposure based on your account balance and chosen leverage.

The Power of Leverage: A Double-Edged Sword

Imagine controlling $100,000 in the forex market with just $1,000 of your capital. That's the power of leverage – a financial tool that amplifies your trading potential and risks.

Leverage in Action: A Real-World Scenario

Let's say you believe the EUR/USD pair will rise. With $1,000 in your account and 1:100 leverage:

- Without leverage: You can buy €870 (assuming 1 EUR = 1.15 USD)

- With leverage: You can control €87,000 worth of EUR/USD

If EUR/USD rises by 1%, your profit would be:

- Without leverage: $8.70

- With leverage: $870

TMGM Insight: TMGM offers leverage up to 1:1000, allowing you to amplify your trading power significantly. However, always remember that higher leverage also means higher risk.

Understanding Margin in Forex

Definition of Margin

Margin is the amount of money your account requires to open and maintain a leveraged position.

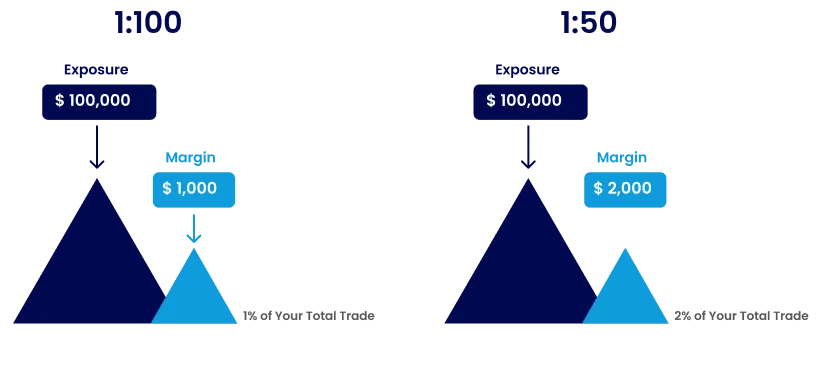

Relationship Between Leverage and Margin

Margin is inversely related to leverage:

Higher leverage = Lower margin requirement

Lower leverage = Higher margin requirement

Margin Calculation

Margin Requirement = (1 / Leverage) * 100%

Example:

1:20 leverage

Margin Requirement = (1 / 20) * 100% = 5%

TMGM Feature: TMGM's trading platform automatically calculates and displays your margin requirements for each trade.

Margin Call and Stop Out

Margin Call

A margin call occurs when your account equity falls below the required margin level.

Stop Out

A stop-out is when your broker automatically closes your positions due to insufficient margin.

How to Avoid Margin Calls

Monitor your margin level closely

Use stop-loss orders

Practice proper position sizing

TMGM Protection: TMGM implements margin calls and stopouts to protect traders from excessive losses.

Benefits and Risks of Forex Leverage

Benefits

Amplified profits on successful trades

Ability to enter larger positions with limited capital

Opportunity to profit from small price movements

Risks

Amplified losses on unsuccessful trades

Potential to lose more than your initial investment

Increased emotional stress due to larger position sizes

TMGM Advice: While TMGM offers high-leverage options, we recommend using leverage cautiously and in line with your risk tolerance and trading experience.

Leverage in Different Markets

Forex

Typically offers the highest leverage, often up to 1:500 or more

Stocks and Indices

Usually lower leverage, often around 1:5 to 1:20

Commodities

Moderate leverage, typically ranging from 1:10 to 1:50

TMGM Offering: TMGM provides leverage across various markets, allowing traders to diversify their leveraged trading strategies.

How to Choose the Right Leverage in Forex

Factors to Consider

- Trading experience

- Risk tolerance

- Trading strategy

- Market volatility

Recommendations for Different Trader Levels

- Beginners: Start with low leverage (1:10 or lower) or no leverage

- Intermediate: Consider moderate leverage (1:20 to 1:50)

- Advanced: May use higher leverage (1:100 or more) with caution

TMGM Flexibility: TMGM allows traders to adjust their leverage levels as they gain experience and confidence in their trading strategies.

Risk Management with Leverage

Position Sizing

Determine appropriate position sizes based on your account balance and risk tolerance.

Stop-Loss Orders

Use stop-loss orders to limit potential losses on leveraged trades.

Take-Profit Orders

Set take-profit orders to secure gains and manage risk-reward ratios.

Diversification

Spread your risk across different currency pairs and markets.

TMGM Tools: TMGM's trading platforms offer risk management tools, including easy-to-set stop-loss and take-profit orders.

Practical Tips for Using Leverage

Start Small

Begin with lower leverage and gradually increase as you gain experience.

Use a Demo Account

Practice using leverage on a TMGM demo account before trading with real money.

Stay Informed

Keep up with market news and economic events that could impact your leveraged positions.

Continuously Educate Yourself

Use TMGM's educational resources to improve your understanding of leverage and trading strategies.

Remember, while leverage can potentially increase profits, it also significantly increases risk. Always use leverage cautiously and in line with your risk tolerance and trading experience. TMGM provides the tools and resources you need to trade responsibly, but the decision on how much leverage to use ultimately rests with you, the trader.