POPULAR ARTICLES

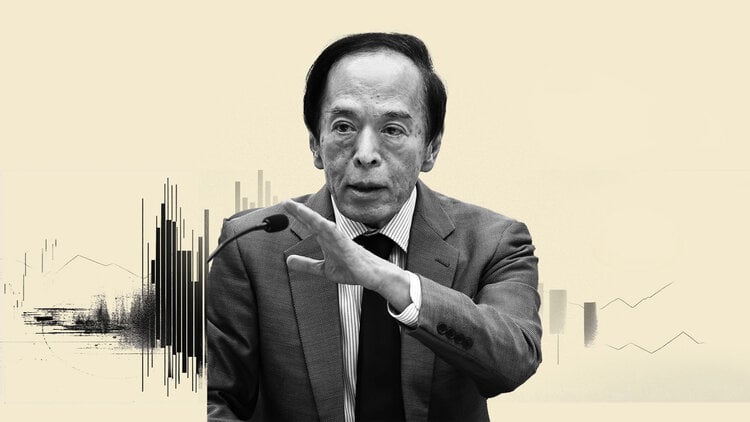

The Trump Administration clearly does not adhere to the established set of norms on many fronts. Yesterday, US Treasury Secretary Bessent not only stated his view that Fed rates should be significantly lower, but he also had advice for the BoJ, Rabobank's FX analyst Jane Foley reports.

USD/JPY to move to 145 on a 3-month view

"In Bessent’s view the BoJ is at risk of falling behind the curve in controlling inflation. What is unclear is whether Bessent was communicating a message about relative JPY weakness vs. the USD. Although BoJ Governor Ueda, may choose to disregard Bessent’s remarks, the Japanese authorities will not want the value of USD/JPY to become more of a concern to the Trump Administration than it already is. We maintain our forecast of USD/JPY 145 on a 3-month view."

"Now that Japan and US negotiators have made a trade deal, which puts a baseline tariff of 15% on Japanese exports to the US, some of the impact of any criticism by US officials around Japanese trade practices will likely be lessened. Nevertheless, given the fluid nature of President Trump’s tariff threats so far this year, Japanese Ministry of Finance would likely prefer not to see Japanese policies coming under scrutiny from the US Treasury."

"In the months ahead, the BoJ will be assessing the primary and secondary impact on the Japanese economy from Trump’s broad-based tariffs policies. Currently market implied rates are not quite fully priced for a 25 bp hike on a 6-month view. While we would expect the rally in the JPY caused by Bessent’s remarks yesterday to peter out, we continue to forecast a move to USD/JPY145 on a 3-month view based on the assumption that BoJ rate hike speculation around the turn of the year remains in place."