熱門文章

- Dogecoin price steadies at $0.106 on Tuesday after rebounding slightly the previous day.

- On-chain data indicates a mild improvement, with 7-day and 30-day MVRV dropping to undervalued levels, positioning for a potential short-term bounce.

- Traders should remain cautious despite the recovery, as the primary trend remains bearish.

Dogecoin (DOGE) price stabilizes at $0.106 at the time of writing on Tuesday, following a slight rebound the previous day after a massive correction last week. On-chain data suggests the dog-themed meme coin may be undervalued and poised for a near-term bounce. However, the broader technical structure remains bearish, prompting traders to remain cautious.

Dogecoin shows signs of undervaluation

Santiment’s Market Value to Realized Value (MVRV) metric is used to identify whether a token is undervalued or overvalued in a given time frame. The 30-day MVRV ratio (yellow line) for DOGE stands at -14.40% on Tuesday, recovering from -20.80% on Saturday, levels last seen during the October 2025 (US-China trade-war) correction.

During the same period, the 7-day MVRV (red line) for the dog-themed meme coin stands at -1.16% on Tuesday, recovering from -8.52% on Saturday, levels last seen during the same October crash.

This negative MVRV reading indicates that Dogecoin is currently undervalued, as holders are sitting on unrealized losses. Such conditions are often seen as a potential buy signal, generally increasing buying pressure across exchanges. Historically, when DOGE’s MVRVs have fallen to similar levels, the price has tended to rebound in the short term.

[07-1770088379796-1770088379797.31.46, 03 Feb, 2026].png)

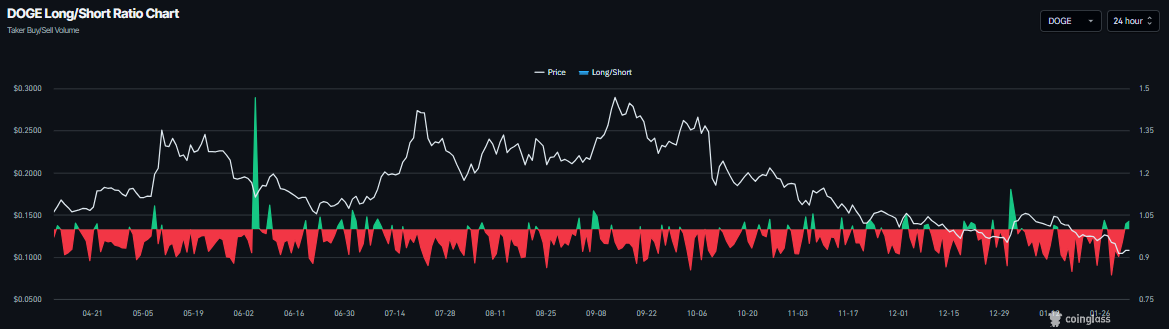

On the derivatives data, Coinglass' long-to-short ratio for DOGE reads 1.02 on Tuesday. A ratio above 1 indicates that traders are betting on the asset’s price to rise, which could support DOGE’s recovery.

Dogecoin Price Forecast: DOGE rebounds from oversold territory

Dogecoin's price closed below weekly support at $0.119 on Thursday and declined by over 11% in the next two days, retesting the October 10 low at $0.095 on Saturday. DOGE price recovered slightly through Monday. As of writing on Tuesday, DOGE is trading at $0.106.

If Dogecoin continues its recovery, it could extend the advance toward the weekly support at $0.119.

However, the primary trend for DOGE remains bearish, so any short-term recovery has a high probability of a dead-cat bounce—a brief price increase within a broader downtrend.

The Relative Strength Index (RSI) is at 31, recovering slightly above oversold levels, hinting at a potential short-term bounce, though downside risks remain. The Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on January 17, which remains intact and thus further supports the negative outlook.

If DOGE resumes its downward trend, it could extend the decline toward the October 10 low of $0.095. A close below this level could extend losses toward the next weekly support at $0.078.