POPULAR ARTICLES

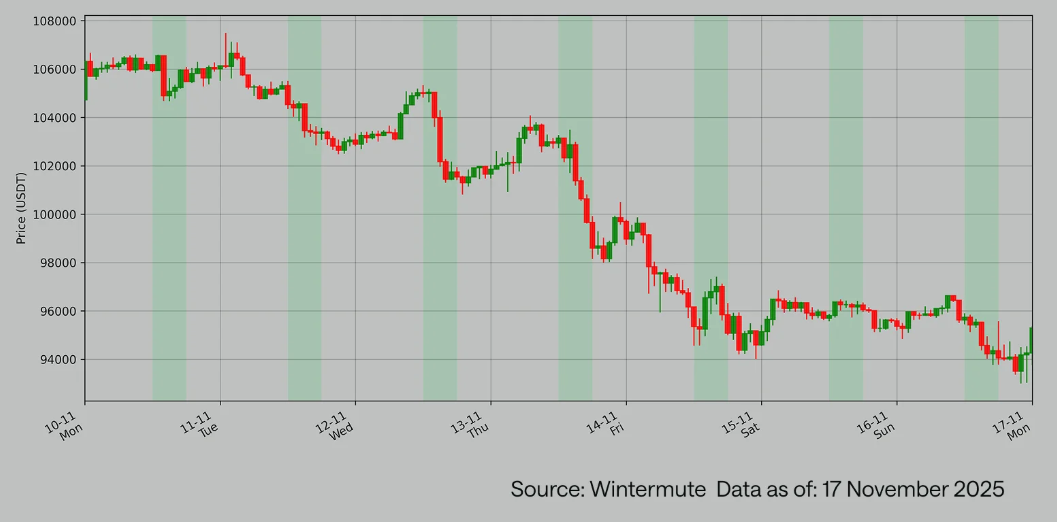

- Bitcoin's further decline last week was mainly driven by a sharp drop in market expectations of a December rate cut.

- The selling pressure intensified during US trading sessions as US investors digested the views of the 12 FOMC members.

- The market remains fundamentally constructive, but a broader recovery is dependent on whether major cryptos regain momentum.

Bitcoin (BTC), along with other top cryptos, continued its downtrend over the past week as risk-off sentiment intensified across the digital asset market.

The top crypto's sell-off last week was mainly driven by a sharp drop in market expectations of a December rate cut by the Federal Reserve (Fed). The probability of a rate cut declined from ~70% to ~42% in about a week, further plunging the already weak sentiment in risk assets, according to digital asset market maker Wintermute in a Monday report.

While risk assets generally experienced a pullback, crypto suffered the largest decline, with a 14% drop, maintaining its strong sentiment-driven nature relative to other asset classes. The move also underscores crypto's negative skew versus equities in 2025.

Unlike the norm in a market-wide downtrend, Bitcoin and Ethereum (ETH) underperformed the average price movement of altcoins. However, all token categories experienced notable weekly drawdowns, including resilient sectors such as L1s, L2s, and DeFi.

"The move was indiscriminate and reflects a full risk-off shift rather than sector rotation," the report states.

Whales' distribution and early derisking intensified the sell-off amid traders' expectations that 2026 could be bearish, based on the four-year cycle pattern, leading to a self-fulfilling prophecy.

A US-led sell-off, market remains constructive

Most of the pressure occurred during US trading sessions as US investors delved into the views of the 12 Federal Open Market Committee (FOMC) members.

"After Powell walked back the idea of a December cut, US traders began drilling into the individual views of the 12 FOMC members, which naturally happens in the US first. As a result, US desks started shading December cut odds lower," Wintermute wrote.

However, the market remains fundamentally constructive, as the broader macro picture points to continued global rate easing. The report highlights that the market is primarily macro-driven, suggesting that "the next catalyst is more likely to come from policy and rate cut expectations rather than crypto native flows."

Still, major cryptos need to regain momentum for a broader market recovery, Wintermute concluded.

Other analysts have predicted a potential recovery in the coming months, spearheaded by progress in crypto regulations, particularly the CLARITY Act, which is gradually advancing in the Senate.

On the other hand, Thomas Lee, Chairman of Ethereum treasury firm BitMine, suggested in a Monday statement that the decline across cryptocurrencies could be due to a hole in a key market maker's balance sheet.

Wintermute is one of the most popular digital asset market makers.

Bitcoin and Ethereum are up 1% and 4%, respectively, over the past 24 hours at the time of publication.