POPULAR ARTICLES

- The Dow shed 350 points on Wednesday amid fresh trade war threats from the Trump administration.

- The Trump team is weighing introducing additional trade restrictions on software exports to China.

- Subprime lending schemes continue to weaken as another lender files for bankruptcy.

The Dow Jones Industrial Average (DJIA) struggled on Wednesday, declining a little over 500 points at its lowest point on the day. Investors are facing fresh risk-off sentiment as the Trump administration continues to toy with making already-tense trade friction between the US and China even worse. Another subprime lender declared bankruptcy, highlighting growing fissures in the credit and lending segment.

The Trump administration, according to sources, is weighing its options on imposing restrictions on the export of software to China, a move meant to lash out at China in response to its recent move to exert further government control over the export of rare earth minerals from within its borders. Key US industries, specifically the tech sector, are critically reliant on having open access to China rare metals markets.

Subprime lender PrimaLend filed for bankruptcy, adding additional pressure to investor sentiment regarding the health of US lending segments. This bankruptcy follows the collapse of an automotive lender in recent weeks.

US farmers lashed out at US President Donald Trump over his convoluted plan to import beef from Argentina in order to make up a shortfall after his administration imposed a 50% tariff on all Brazilian imports. American cattle farmers decried the move, drawing criticism from President Trump, who claimed that American beef farmers for “not understanding” how his tariffs have benefited them.

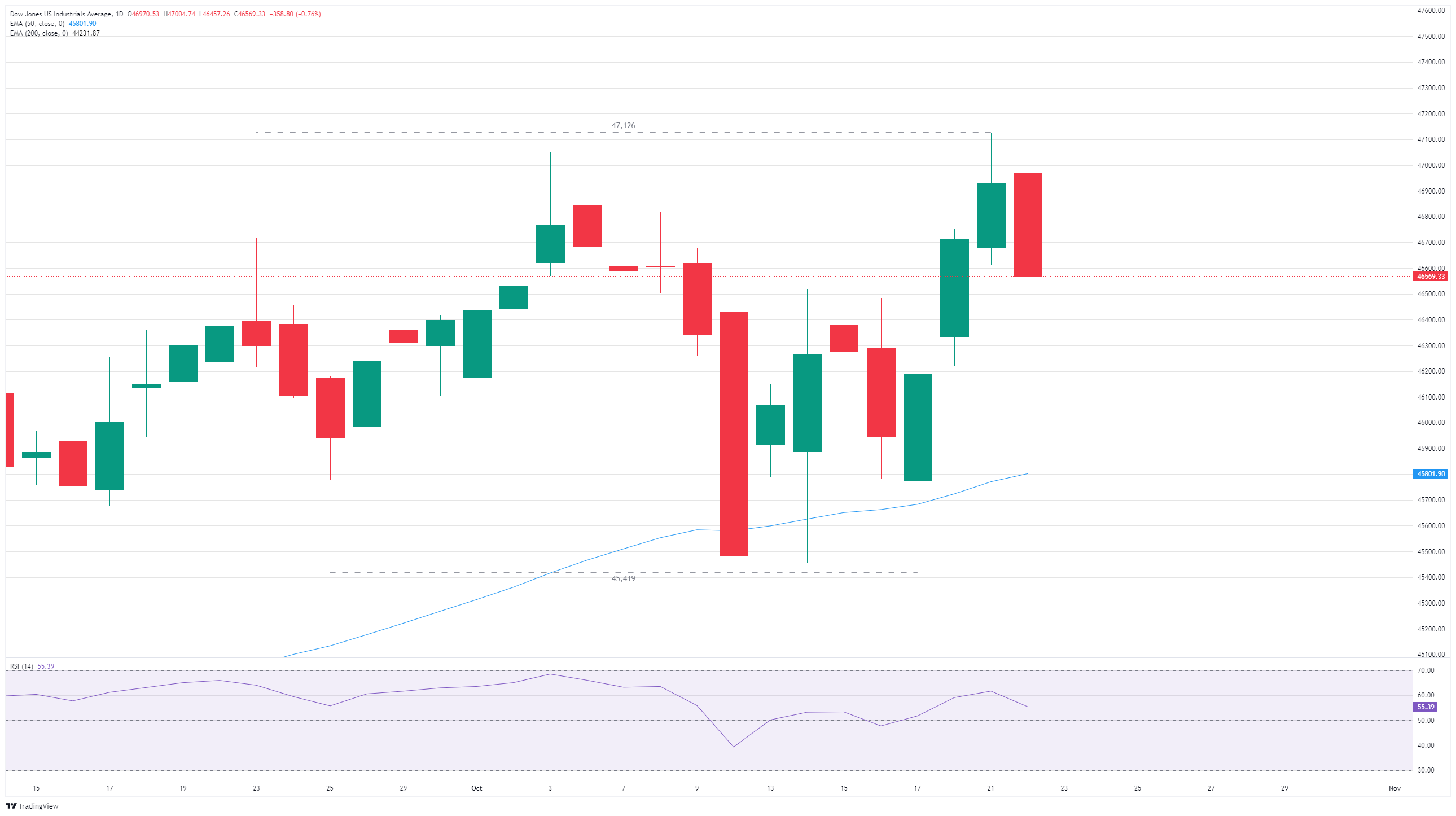

Dow Jones daily chart

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Fri Oct 24, 2025 12:30

Frequency: Monthly

Consensus: 3.1%

Previous: 3.1%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.