POPULAR ARTICLES

- The Dow Jones found a new intraday record high on Tuesday.

- ‘Old economy’ stocks rose sharply after quarterly earnings broadly beat the street.

- Despite an earnings glut, fresh concerns struck the tech sector as US-China trade sabre-rattling continues.

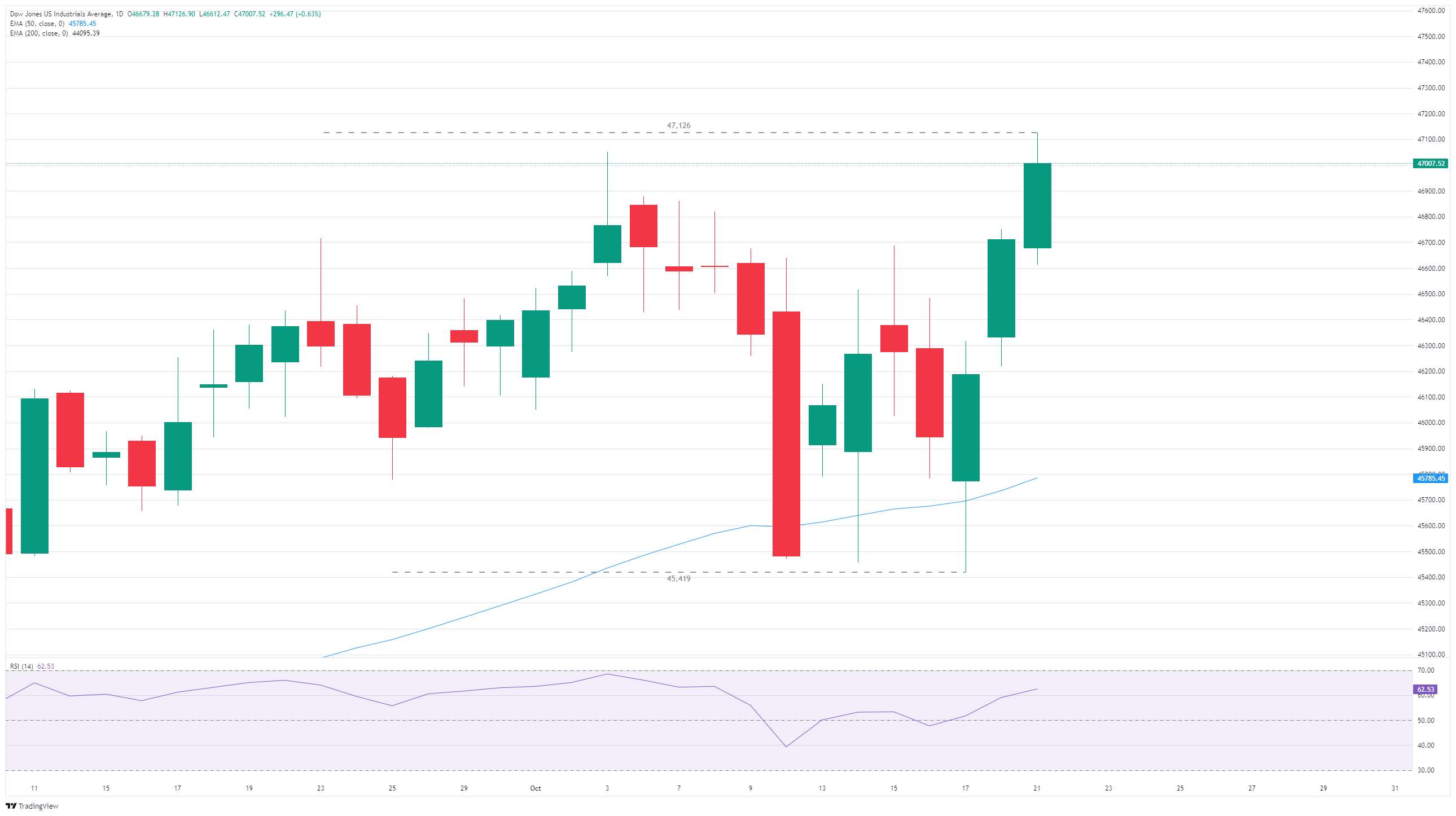

The Dow Jones Industrial Average (DJIA) surged into a record high on Tuesday, testing above 47,000 and posting a new all-time intraday high of 47,126. ‘Old economy’ stocks from companies that produce physical goods rather than information or technology services and hardware rallied hard after the latest batch of quarterly earnings swept past market expectations. On the tech side, internet giants waffled on Tuesday after US President Donald Trump suggested his new trade meeting with Chinese President Xi Jinping might not happen.

Coca Cola (KO) and 3M (MMM) surged 3% and 6%, respectively, after posting above-expectations earnings for the third quarter. Zions Bancorp (ZION) also rose 2% after reporting Q3 profits that beat the same period a year ago. Analysts expected a poorer performance from the regional bank after it disclosed a batch of bad loans weighing on its books. General Motors (GM) soared 15% after the automaker announced to shareholders it now expects to offset more of the fallout from the Trump administration’s automobile tariffs than previously expected.

The tech sector is awaiting further earnings info from ‘Magnificent Seven’ companies before dedicating to another leg higher in the ongoing AI-fueled tech rally. The tech sector remains heavily exposed to supply shocks after the Chinese government imposed strict export controls on rare earth minerals that are critical to tech hardware production and upkeep. President Trump lashed out with a threat to impose an additional 155% tariff on China beginning on November 1 if the Chinese government doesn’t rethink its trade strategy. Trump waved off an upcoming discussion with China’s Jinping, but pivoted to establish a new time and place for fresh trade talks. Now, Trump appears to be second-guessing his own trade talk plans, suggesting that the newly announced trade talks may not happen at all.

Dow Jones daily chart

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Fri Oct 24, 2025 12:30

Frequency: Monthly

Consensus: 3.1%

Previous: 3.1%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.