POPULAR ARTICLES

- XRP remains above $3.00 support, but resistance at $3.40 limits price action.

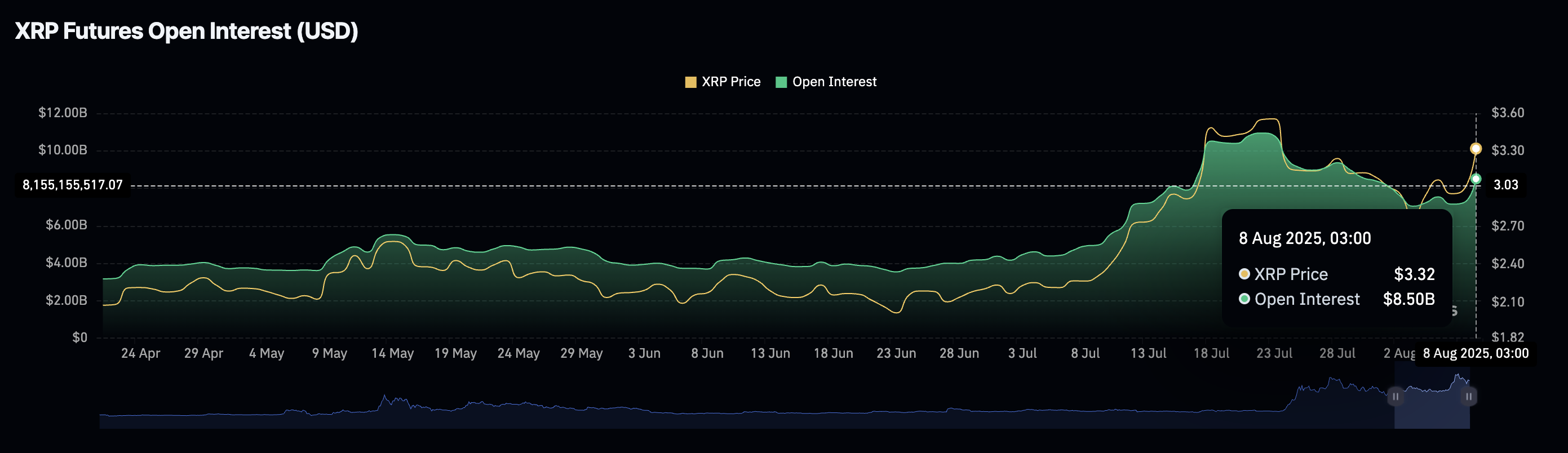

- XRP futures Open Interest edges higher above $8.5 billion, pointing to increasing speculative demand.

- Steady futures funding rates and volume back XRP’s short-term bullish outlook.

Ripple (XRP) price offers signs of consolidating slightly above support at $3.00 on Monday. While the token's technical structure leans largely bullish, profit-taking is dampening the uptrend.

Sentiment is likely cooling in the broader cryptocurrency market following a significant breakout in the prices of Bitcoin (BTC) and Ethereum (ETH) toward the end of last week.

The cross-border remittance token reacted positively to the news that Ripple and the United States (US) Securities and Exchange Commission (SEC) had filed a joint motion to dismiss appeals, paving the way for the resolution of the five-year legal battle. Ripple will pay $50 million in settlement fees out of the $125 million held in escrow.

XRP flaunts a bullish derivatives market

XRP price recovery is happening in tandem with the futures Open Interest (OI). CoinGlass data shows that OI, which refers to the notional value of outstanding futures or options contracts, edged higher and averaged at $8.5 billion on Monday. This represents a 17% increase from $7.05 billion recorded on August 3.

XRP Futures Open Interest data | Source: CoinGlass

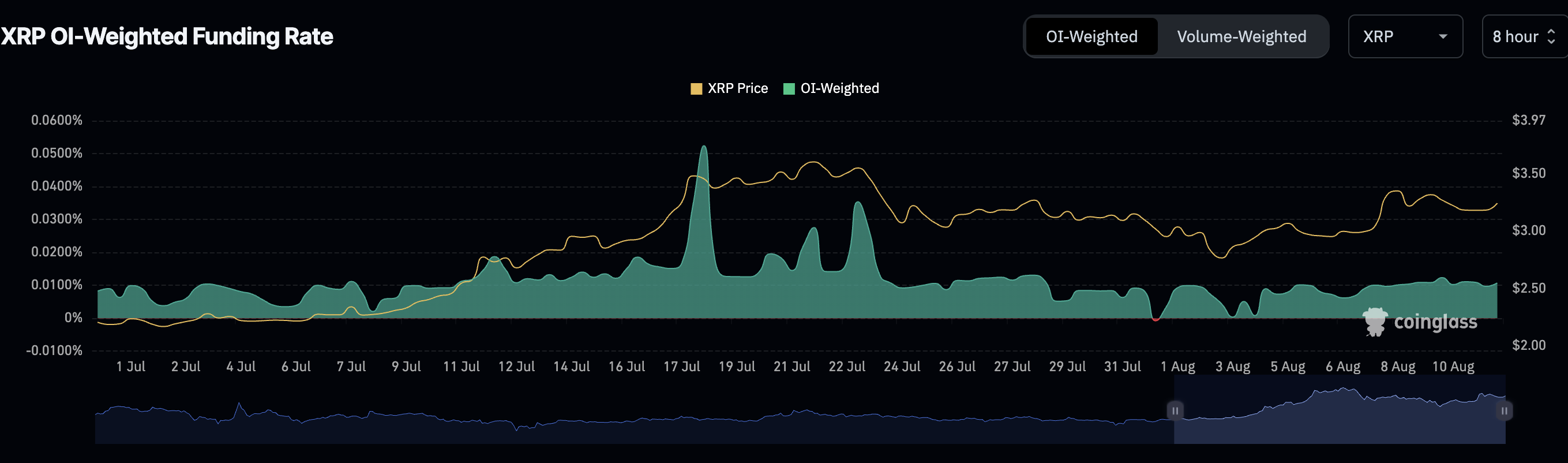

A subsequent increase in the futures weighted funding rates to 0.0108% from 0.0004% over the same period suggests that more traders are leveraging long positions in XRP.

XRP Futures Weighted Funding Rates data | Source: CoinGlass

The increase in trading volume to $12.64 billion as OI and funding rates recover points to expanding market activity.

XRP Futures Volume | Source: CoinGlass

Despite the potential profit-taking following last week’s macro-driven breakout, XRP is consolidating above its $3.00 support and the resistance at $3.40. If the bullish trend in the derivatives market holds, growing interest in XRP could propel the price toward the record high of $3.66, reached on July 18.

Technical outlook: XRP consolidates before breakout

XRP price holds between support at $3.00 and resistance at $3.40. The Money Flow Index (MFI), which has recovered slightly above 40, indicates that more money is flowing into XRP.

A breakout could be anticipated if the derivatives market highlighted above continues its recovery as interest in the cross-border money remittance token increases.

XRP/USDT daily chart

The upward-trending moving averages, including the 50-day Exponential Moving Average (EMA) at $2.88, the 100-day EMA at $2.66, and the 200-day EMA at $2.39.

In the event of a significant recovery below the support at $3.00, these levels could serve as tentative support to absorb the selling pressure and prevent XRP from declining toward the $2.00 level.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.