POPULAR ARTICLES

- Silver reaches new 2025 high as tariff tensions lift safe-haven demand.

- Bullish momentum remains strong as the white metal rises toward the $38.00 resistance.

- XAG/USD benefits from its dual role as a safe-haven and industrial metal.

Silver (XAG/USD) is trading at a fresh YTD high on Friday as tariff threats and market uncertainty drive demand for safe-haven assets.

The Silver price is trading above $37.60 at the time of writing, as bulls appear eager to test the next psychological resistance level of $38.00.

As the white metal continues along its upward trajectory, US President Donald Trump’s tariff policies and a weaker US Dollar have proven to be prominent drivers of price action.

Throughout the year, a weaker US Dollar and rising prospects that the Federal Reserve (Fed) will need to reduce interest rates have provided a positive catalyst for both Gold and Silver.

Since Silver benefits from its appeal as a safe-haven commodity and an industrial metal, the current environment has amplified its appeal.

With XAG/USD appreciating by more than 30% this year, a move above $37.00 and above the February 2012 high of $37.49, the metal is positioned among the top-performing commodities this year.

Silver extends rally toward $38.00 as bullish momentum gains

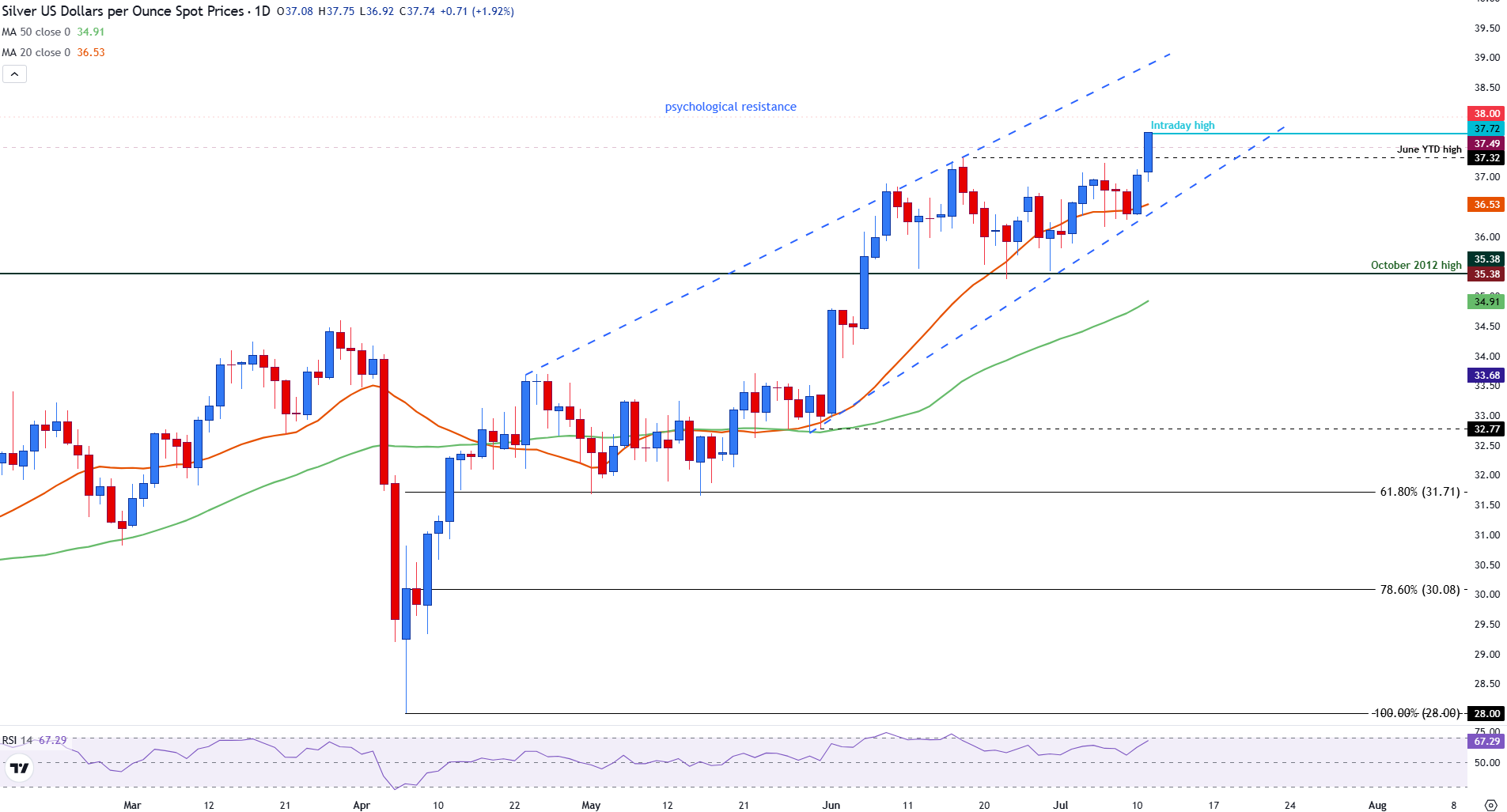

Silver (XAG/USD) has extended its bullish momentum, breaking above the June high of $37.49 (now serving as support) and reaching a fresh YTD high of $37.73 at the time of writing.

The move reflects strong buying interest as the metal approaches the key psychological resistance at $38.00.

Silver (XAG/USD) daily chart

The uptrend currently remains intact within a rising parallel channel, supported by the 20-day and 50-day Simple Moving Average (SMA), providing additional support at $36.53 and $34.91, respectively.

Momentum indicators are also reinforcing the bullish bias, with the Relative Strength Index (RSI) climbing to 67, approaching overbought territory but is not signaling exhaustion yet.

A confirmed breakout above $38.00 could expose the $39.50–$40.00 zone, while a failure to hold recent gains may trigger a pullback toward the $36.50 support.

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.