POPULAR ARTICLES

- Stellar extends losses for the seventh consecutive day by 1% on Tuesday, after hitting its lowest daily close in nine months on Monday.

- Derivatives data signals a bearish positional buildup as declining prices largely wipe out bullish positions.

- The technical outlook for XLM remains bearish, targeting April’s low at $0.2001.

Stellar (XLM) trades in the red for the seventh straight day, losing over 1% at press time on Tuesday. The closest competitor to Ripple (XRP) in the crypto space is losing retail support, evidenced by rising bearish bets in XLM derivatives. Technically, XLM risks the $0.2000 psychological support as it approaches April’s low.

XLM derivatives warn of bearish bias among traders

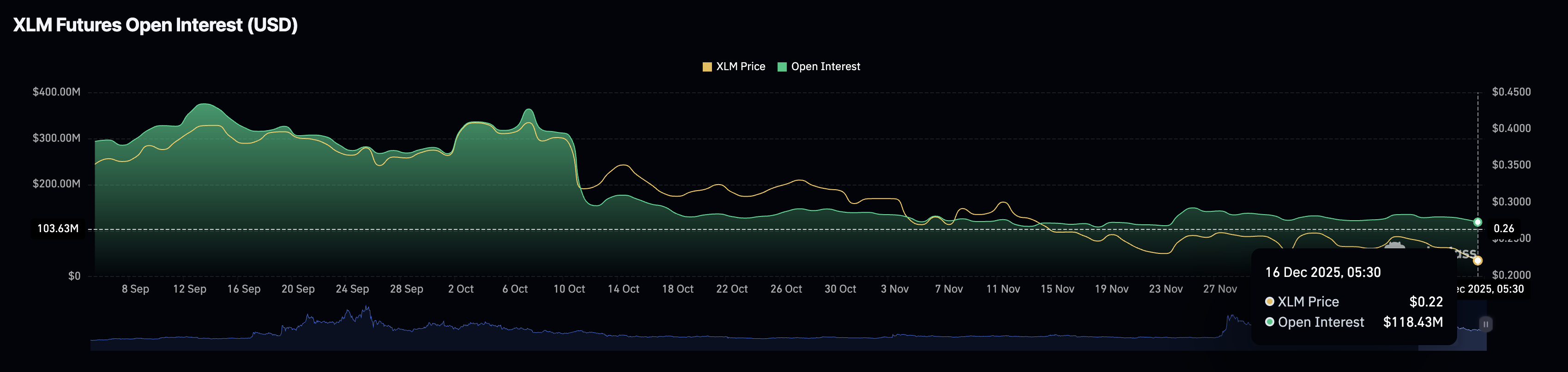

CoinGlass data shows that XLM futures Open Interest (OI) is in a largely declining trend, at $118.43 million, down from $124.72 million on Monday. Falling OI indicates a loss in the notional value of XLM futures, which is the total value of all active positions (long and short), including the leverage.

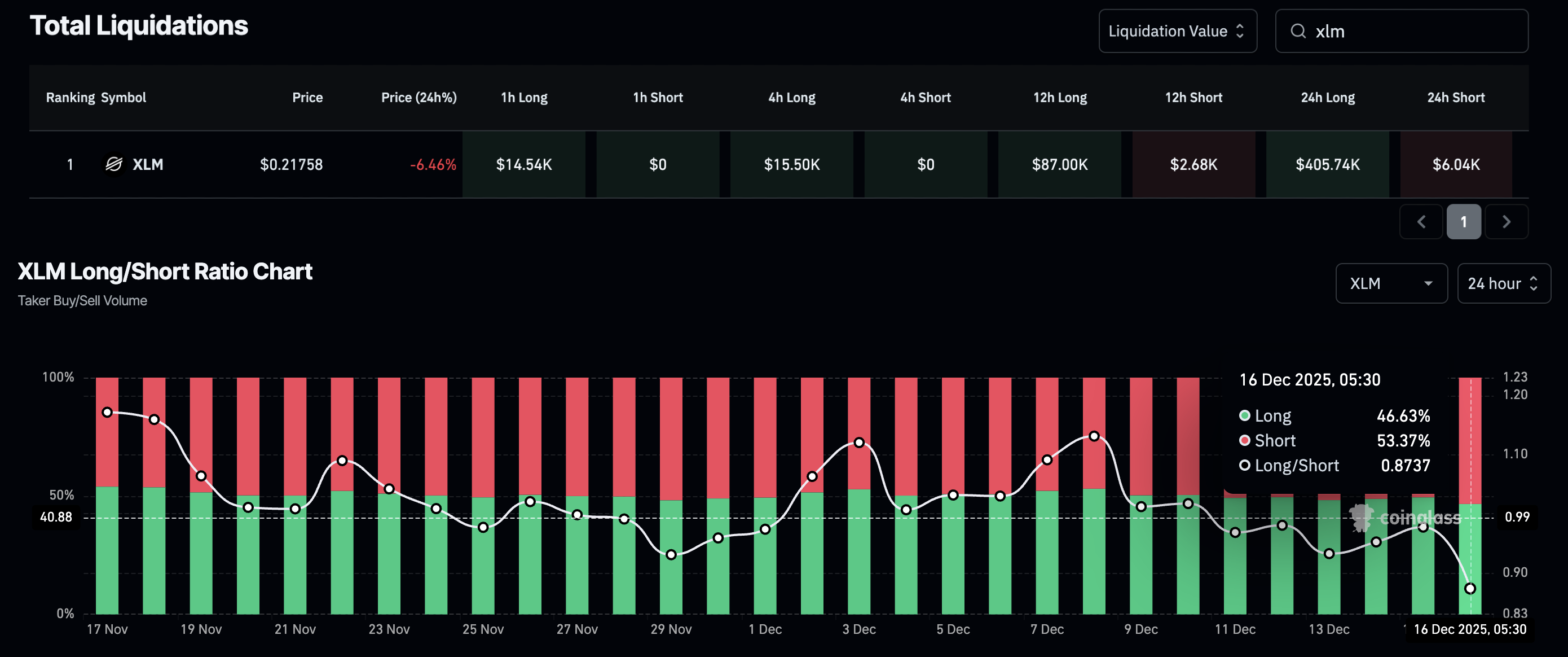

Amid declining risk appetite, long liquidations over the last 24 hours totaled $406,740, outpacing short liquidations of $6,040 in the same period. This increased wipeout of long positions left a larger number of active short positions, creating a sell-side dominance in the XLM derivatives. The long-to-short ratio chart shows that short positions surged to 53.37% on Tuesday, from 50.57% over the last 24 hours.

Stellar’s freefall threatens a key psychological support

Stellar extends its steady downside move after recording the lowest daily close so far in 2025 at $0.2205 on Monday. The declining trend in XLM approaches the $0.2001 level marked by the April 7 low.

If the cross-border remittance token slips below this level, it could aim for the S2 Pivot Point at $0.1642, followed by the annual low of $0.1600.

Technically, Stellar could move further to the downside, as momentum indicators on the daily chart signal a bearish bias. The Relative Strength Index (RSI) is at 33, pointing toward the oversold zone, while the Moving Average Convergence Divergence (MACD) is falling steeply after crossing below the signal line on Monday.

On the upside, a potential rebound in XLM could flip the bearish streak and retest the $0.2579 level marked by the November 5 low, which capped recovery attempts in late November and early December.