What is Price Action?

Price action is the movement of a market’s price over time. It is how the price reacts as traders buy and sell. When you learn price action, you pay attention to how the price moves between levels, how candles form, and how trends develop.

Instead of depending entirely on indicators, price action traders read the chart directly. This can help you understand the market’s mood and the possible direction of price.

What is Price Action in Forex?

In forex, price action refers to how currency pairs move throughout the trading sessions. Forex has constant activity because countries trade at different times. This creates repeating patterns in price.

Price action forex trading simply means observing how the price reacts during trends, pullbacks, breakouts, and when it reaches support or resistance. You are trying to understand what buyers and sellers are doing.

Price Action Patterns

Specific movements in price repeat often. These are called price action patterns. Learning these patterns helps you understand what the market might do next.

Here are a few common ones:

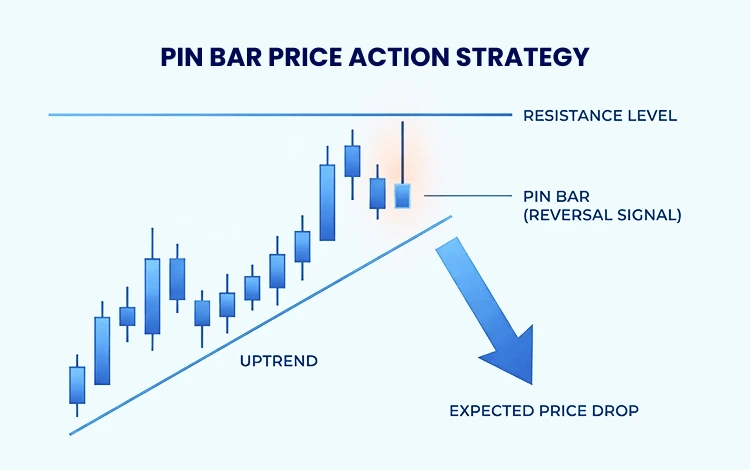

Pin Bar

A candle with a long wick and a small body. It shows strong rejection at a price level. A bullish pin bar rejects the downside while a bearish pin bar rejects the upside.

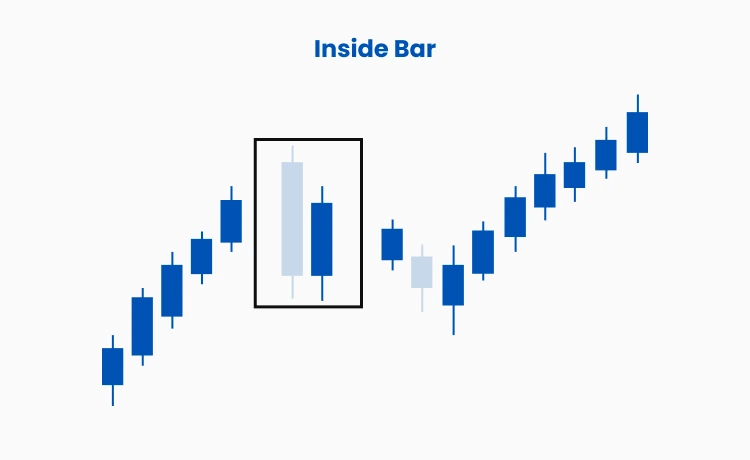

Inside Bar

A candle that forms fully inside the previous candle. It usually shows consolidation before a breakout.

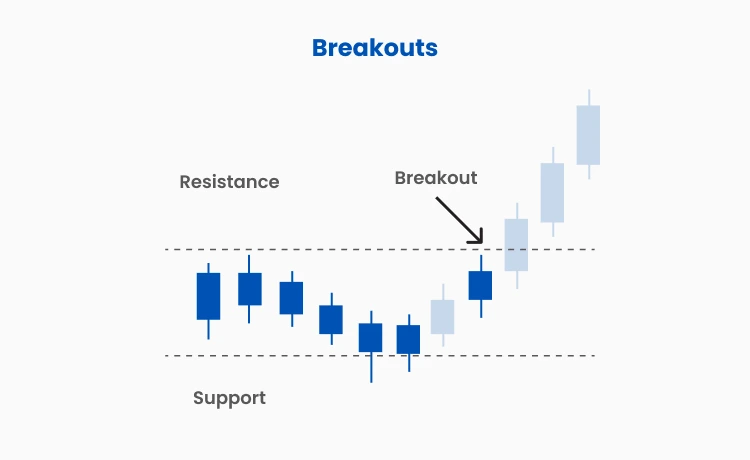

Breakouts

When a price breaks above resistance or below support, breakouts often signal new trends or momentum.

Support and Resistance Reactions

Price often reacts at certain levels. When the price keeps bouncing at the same point, that level is support or resistance.

What is a Price Action Strategy?

A price action strategy is a way to use patterns, trends, and market structure to identify trading opportunities. Instead of buying or selling randomly, you create rules based on the price's movement.

A simple price action strategy example:

Identify the trend direction

Wait for the price to pull back

Look for a price action pattern such as a pin bar

Enter the trade when the pattern aligns with the trend

Price action strategies work well when you keep them consistent and avoid overthinking.

Below are some popular forex price action trading strategies:

Pin Bar Strategy

A pin bar is a candlestick with a long tail (wick), indicating a sharp reversal or rejection at a particular price level. To trade with this strategy, enter trades in the direction of the rejection after confirming the trend or range.

Inside Bar Strategy

An inside bar forms when a candlestick’s high and low are entirely within the range of the previous candlestick. This pattern is to be used as a signal for potential breakout or continuation. Place stop-loss orders just outside the mother candle's range.

Breakout Trading

This is when a trader identifies consolidation periods where the price is “range-bound.” For this, enter trades when the price breaks above resistance or below support, with volume confirmation.

Support and Resistance Bounce

This strategy occurs when the price frequently bounces off support or resistance levels. To trade with this, place trades in the direction of the bounce with clear stop-loss levels below support or above resistance.

Trend Line Strategy

Trend lines connect consecutive highs or lows to illustrate the direction of the trend. To do this, trade in the direction of the trend when the price bounces off a trend line.

How to Learn Price Action Trading

To learn price action trading, take it step-by-step:

Study Support and Resistance

Learn how the price reacts to certain levels on the chart.Understand Candle Patterns

Candlestick patterns can indicate market strength or weakness.Practice Identifying Trends

Look at whether the price is making higher highs or lower lows.Use a Demo Account First

Practice reading price action without risking real money.

You do not need to rush. The more charts you observe, the more natural it becomes.

How to Read Price Action on a Chart

Reading price action means understanding market direction. In an uptrend, the price forms higher highs and higher lows. In a downtrend, however, the price forms lower highs and lower lows. Finally, when a price moves sideways, the market is in a range.

By focusing on these simple structures, you can learn to read the chart without confusion.

Why Price Action Can Benefit Your Forex Trading

Price action helps traders understand the market in a clean, simple way. It focuses on price movement and how buyers and sellers react. With practice, patience, and a clear mindset, price action trading can help you build stronger decision-making in the forex market.

Practice Price Action with TMGM

If you are ready to start forex trading or want to learn more about price action with real charts in a safe way, then TMGM is for you. Open a free demo account and start practicing in live market conditions.