Key Takeaways:

Trendlines are diagonal lines drawn through key highs or lows that act as dynamic support and resistance across markets like forex, crypto, metals, shares, and indices, helping traders in any style from day trading to swing trading quickly see whether price is trending up, down, or sideways so they can align their CFD strategies with the prevailing momentum.

Trendlines help traders in any market clearly see whether price is moving up, down, or sideways, highlight support and resistance for cleaner entries and exits, filter out noisy fluctuations by focusing on key highs and lows, and gauge volatility and momentum shifts by forming chart patterns like triangles, channels, and flags.

To draw effective trendlines, open a clean chart, use the trendline tool to connect at least two swing highs in a downtrend or lows in an uptrend, extend the line into the future, and refine it until it touches three or more key peaks or troughs, turning it into a strong guide for future support, resistance, and trade entries.

Trendlines that connect at least three swing highs or lows are considered confirmed, and the more times price retests them, the stronger and more reliable they become as support or resistance.

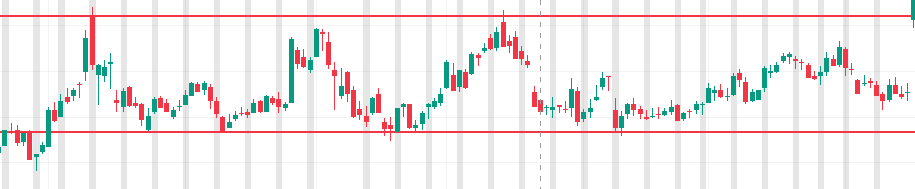

Markets move in three main ways—uptrend (higher lows), downtrend (lower highs), and sideways ranges—and traders use trendlines not only to spot these trends but also to apply strategies like range trading and trendline breakout setups.

Range trading with parallel trendlines means buying near the lower line and selling near the upper, while Breakout trading with strong closes breaking above or below trendlines (often with higher volume) can signal powerful bullish or bearish moves.

Trendlines are only valid when they naturally connect at least two—ideally three—swing highs or lows, gain strength with repeated tests, weaken when too steep, and should always be confirmed with other indicators and market context rather than forced onto uneven price swings.

What is a Trendline in trading?

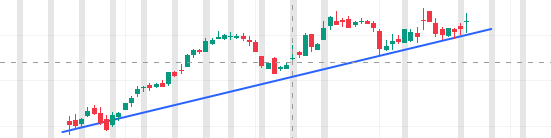

Trendlines are diagonal lines that traders draw on price charts to show the overall direction of price movement, whether it's moving up, down, or sideways. When prices are trending upward, bullish trendlines are created by connecting a series of low points, clearly showing the upward price trend in motion.

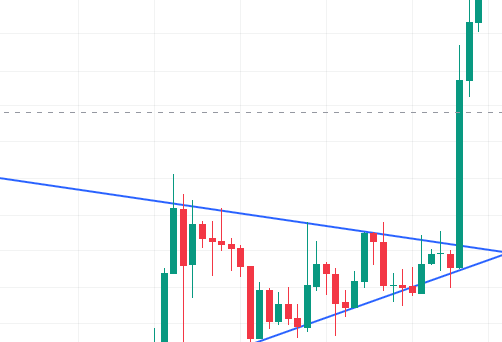

Conversely, bearish trendlines are formed by connecting a series of high points, which reveals a downward price trend. In markets that lack clear direction, sideways trendlines can be drawn by connecting various highs and lows, indicating a trendless or sideways-moving market. An important characteristic of trendlines is their ability to function as support and resistance levels, creating zones where prices often bounce off or potentially break through, making them valuable tools for predicting future price behavior.

Downward trendlines are drawn off the highs and slope down, signalling a bearish bias in forex, energies, or indices markets.

Upward trendlines connect the lows and slope up, indicating bullish momentum in cryptocurrencies, shares, or metals.

Whether you trade forex, crypto, metals, indices, whether you practice day trading, swing trading or scalping, drawing a simple line through key highs or lows instantly reveals the market’s true direction—cutting through the noise so you know when momentum is picking up or slowing down.

By understanding whether the market is respecting these trendlines, traders can align CFD strategies on crypto, gold, or stock indices with the most probable direction of price movement.

Benefits of Using Trendlines in Trading

Trendlines offer several practical benefits across all major asset categories:

Visualise the current price movement trend: They provide visual clarity on whether prices are generally moving up, down, or sideways. It is useful for all types of markets.

Identifying support and resistance levels: Prices often react around trendlines offering clear entry and exit zones.

Reduce noise: Trendline also ignores the fluctuations of price movements, focusing only on the highest points and lowest points to predict the next moves, this way it reduces lots of noise especially if the trader is affected by news and other additional information.

Gauge volatility: Drawing multiple trendlines (say 1 above and 1 below) can reveal changes in the behaviour of current momentum by forming triangles, channels and flags. These are also known as ‘Chart Patterns’.

Platforms like MetaTrader 4 and MT5 allow you to draw trendlines manually or automatically connect highs and lows on any market, including gold, forex, cryptocurrency or stock charts, allowing you effectively learn how to draw trend lines step by step.

How do you draw Trendlines?

To draw trendlines, identify a minimum of two "swing points" (highs for a downtrend or lows for an uptrend) on a price chart, then connect them with a straight line. A stronger trendline is formed by connecting more points without the price cutting through the line, and the line should be extended into the future to predict potential support or resistance levels.

Using Trendline in trading very often yield better results regardless of the market like Gold, Forex, Crypto, Commodities and Stock.

Follow these examples shown below to draw accurate trendlines and master trendline trading:

Open a clean chart without indicators in your trading platform.

Identify the highest or lowest price point on the price chart. Say you are looking to go long (buy position), you should be looking for lowest points, then draw a trendline to use it as a support level, and decide your entry on that.

To draw a trendline, you will need to find the trendline tool in the chart that you’re using. Usually, it will look like a slanted line, and might have a description that calls it ‘Trendline’.

Adjust until the trendlines touch at least two significant peaks or troughs—minimum three points for strong trendlines.

Important Note:

Trendlines that are drawn with multiple high points or low points in a row, are considered ‘tested multiple times’. These trendlines are considered as having the strength of ‘confirmation’, and will tend to revisit the trend line again, hence providing reliability as a support level or resistance level.

Therefore, a valid trendline in trading any price chart and any market, like gold, forex, crypto CFDs or any other asset classes, should have the good practice of having at least three swing points. The more touchpoints, the stronger the trendlines signal.

How to Use/Trade with Trendlines

Types of Trends

There are three types of trends:

Uptrend (higher lows)

Downtrend (lower highs)

Sideways trend (ranging)

Besides noticing upward trends and downward trends, there are other Trendline trading strategies that professionals employ like Range Trading and Trendline Breakout Strategy.

Range Trading Using Trendlines

Range trading using trendlines includes using parallel trendlines to form a channel, you can:

Buy (go long) near the lower trendline when bullish indicators confirm.

Sell (go short) near the upper trendline when bearish signals appear.

This works equally well in gold, silver, energies, and cryptocurrencies if you trade CFDs on these markets, exemplifying trading line strategies.

Trendline Breakout Strategies

Breakouts through trendlines can trigger strong moves:

A close above the upper trendline—often on higher trading volume—signals a bullish breakout.

A close below the lower trendline often indicate a bearish breakout.

Open long or short CFD positions on energies or crypto accordingly, using trendlines to time entries.

Important Considerations & Cautions for Trend Trading

Limitations

Markets move in uneven swings, so a trendline alone does not confirm direction and may simply reflect a counter-trend or consolidation.

Always validate trendlines with indicator confluence and the broader context across indices, forex, or commodities before trading.

Considerations

A valid trend line requires at least two swing highs or lows to be drawn, but it typically takes three touches to confirm it.

The steeper the trend line, the less reliable it tends to be and the more likely it is to break.

As with horizontal support and resistance levels, a trend line becomes more significant the more times price tests it.

Most importantly, never force a trend line to fit the market; if it does not align naturally with price action, it should not be considered valid.

Applying Trendlines Across Different Markets

You can apply trendlines in virtually any market:

Indices (e.g., S&P 500, NASDAQ)

Forex majors and minors

Energies (e.g., crude oil, natural gas)

Shares (CFDs on global stocks)

Metals (gold, silver, platinum)

Cryptocurrencies (Bitcoin, Ethereum, altcoins)

Trendline methods are universal: the same principles guide trendlines on crypto, metal, or share charts.