Fundamentals: Why did Silver break record high in 2026?

The current 2024-2026 Silver rush is mainly fueled by valuation hype. This occurred due to the rotation of Gold Investors with the aim of Hedging. Understanding the supply-demand imbalance is critical for distinguishing this move from a temporary spike.

1. The Investors’ Demand

The current cycle began in late 2024. Initially, Gold led the charge, driven by central bank buying. As Gold consolidated in 2025, momentum "rotated" into Silver—a classic market phenomenon where the Risk-Aversion Capital rotated from the overvalued (now higher risk of pullback) Gold into the undervalued sibling, Silver.

This can be evident by the fact that the supposed fundamental forces that should drive a healthy rally, which is physical silver demand, has been disproved by The Silver Institute’s World Silver Survey 2025.

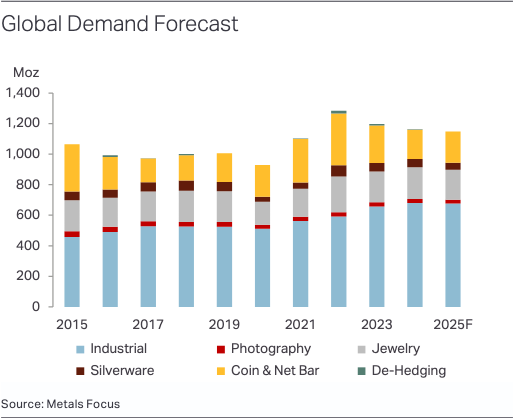

Below shows a chart by Metals Focus detailing the Global Demand Forecast by Sector, which shows that the main driver of physical demand, Industrial and Coins have been reducing and stabilizing instead of increasing.

So while physical demand is weak, hedging demand is strong, accompanied by reduced floating supply on the market both in China’s Shanghai Gold Exchange (SGE) and London Bullion Market Association.

2. Metals Focus: The Supply Cliff

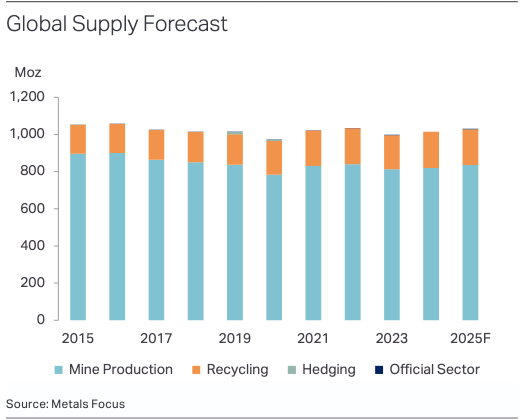

While hedging demand rises, supply is falling.

Mine Production Stagnation: Metals Focus data highlights that global mine output has been flat-to-negative for five years. Major producers like Mexico and Peru are facing declining ore grades and lack of new investment.

The Deficit: The market has been in a structural deficit for six consecutive years. The cumulative deficit (2021–2026) has removed over 800 million ounces from global inventories—effectively wiping out the surplus built up over the last decade.

The World Silver Institute – ”2025 will mark the fifth year in a row of silver seeing a hefty deficit which, for 2021-25, totals almost 800Moz (25,000t). This is clearly unsustainable and so we set out below what may lie in store.”

3. The "Squeeze": Shanghai vs. London (LBMA)

This is the real "smoking gun" for the 2026 rally like mentioned before.

Shanghai Premium: Physical silver in Shanghai is trading at a premium of nearly $10/oz (approx. 11%) above London benchmarks. This arbitrage gap supports that the retail driven scarcity is real—Asian industrial giants and retail markets are paying whatever it takes to secure metal.

Vault Drain: Simultaneously, LBMA (London) vault holdings have dropped to multi-year lows. As gold investors rotate to Silver ETFs (like SLV), bars are removed from the "float," causing lease rates to spike and forcing short-sellers to cover.

This high demand coupled with supply shortage is what is fueling the current Silver Rush.

Technical Analysis: Should you still buy Silver now in 2026?

In short, technical analysis showed that Silver prices is currently still going strong but it has already entered overbought zone. However, overbought assets don't always mean a definite and immediate pullback, in fact, many strong assets, especially those in a so called 'Supercycle' will stay in the overbought zone for a long time.

Silver’s recent price action also supports that view: after rallying to around $121, momentum appeared to cool and price pulled back to roughly $106, before rebounding to about $116 as of Jan 30, 2026. This kind of dip and recovery is common in strong uptrends, where overbought conditions can persist while the market “resets” through consolidation rather than a deep reversal.

That being said, it is still a good idea to proceed with a 'Cautiously Bullish' approach.

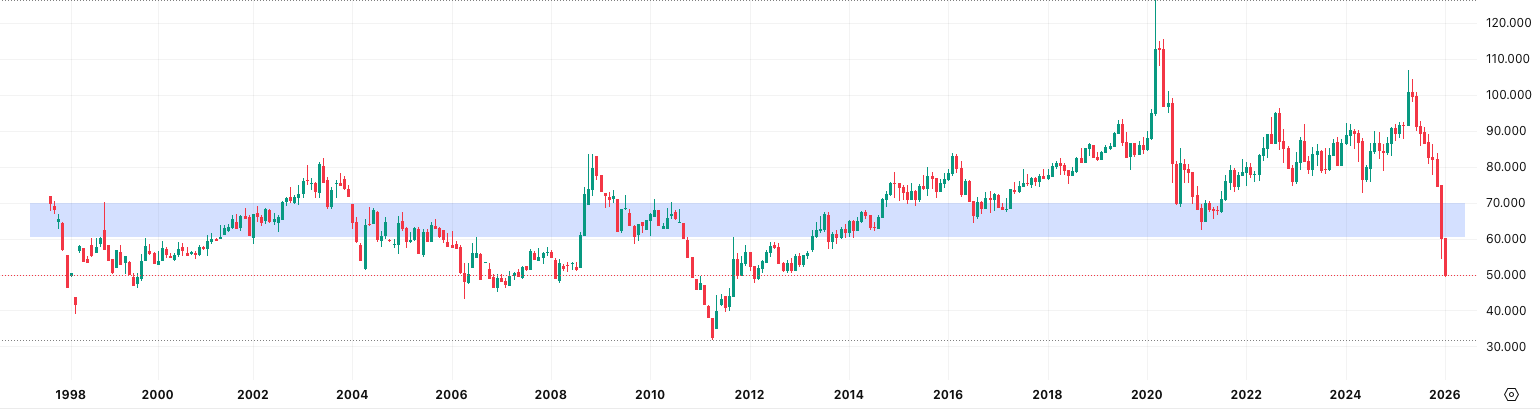

1. Gold/Silver Ratio (GSR)

The GSR is currently hovering near 50:1, down from 80:1.

Historical Extreme: In powerful bull markets, this ratio often overshoots down to 30:1 or even 15:1 (meaning 1 Gold bar can only buy 15 Silver bars).

The Signal: The Gold/Silver Index has been the primary leading indicator. Historically, the Gold/Silver Ratio (GSR) stabilizes around a median range of 60:1 to 70:1. Currently, the ratio is crashing toward 50:1. If this trend continues due to fundamental forces, Silver must outperform Gold significantly to restore historical norms.

If you'd like to learn more about the price relationship between Gold and Silver, check out our article about Gold/Silver Ratio to prepare for your next Gold or Silver trade.

Technical Analysis & Outlook: With the current price action and market structure, it has not shown a momentum slow down or even a temporary pullback. Hence, from a technical analysis point of view, this rally has not shown any sign of weakness, thus supporting a bullish outlook.

2. Silver Weekly Chart: The "Overbought" Warning

On the weekly timeframe, XAG/USD investors had made the chart vertical. However, the Relative Strength Index (RSI) is well above 80, hinting a reason to take a stance of ‘Bullish with Caution” despite no signs of momentum slowdowns.

Why be cautious? Historically, weekly RSI > 80 is a "Sell Zone" for swing traders. It doesn't mean the trend is over, but it can breed high volatility and "washout" events where late longs get liquidated.

Next Support Zone: A weekly close below $86 would act as the first signal of a possible pullback reversal. If that happens, watch the previous resistance level at $70, with a deeper pullback seeking floor from $56 to $64.

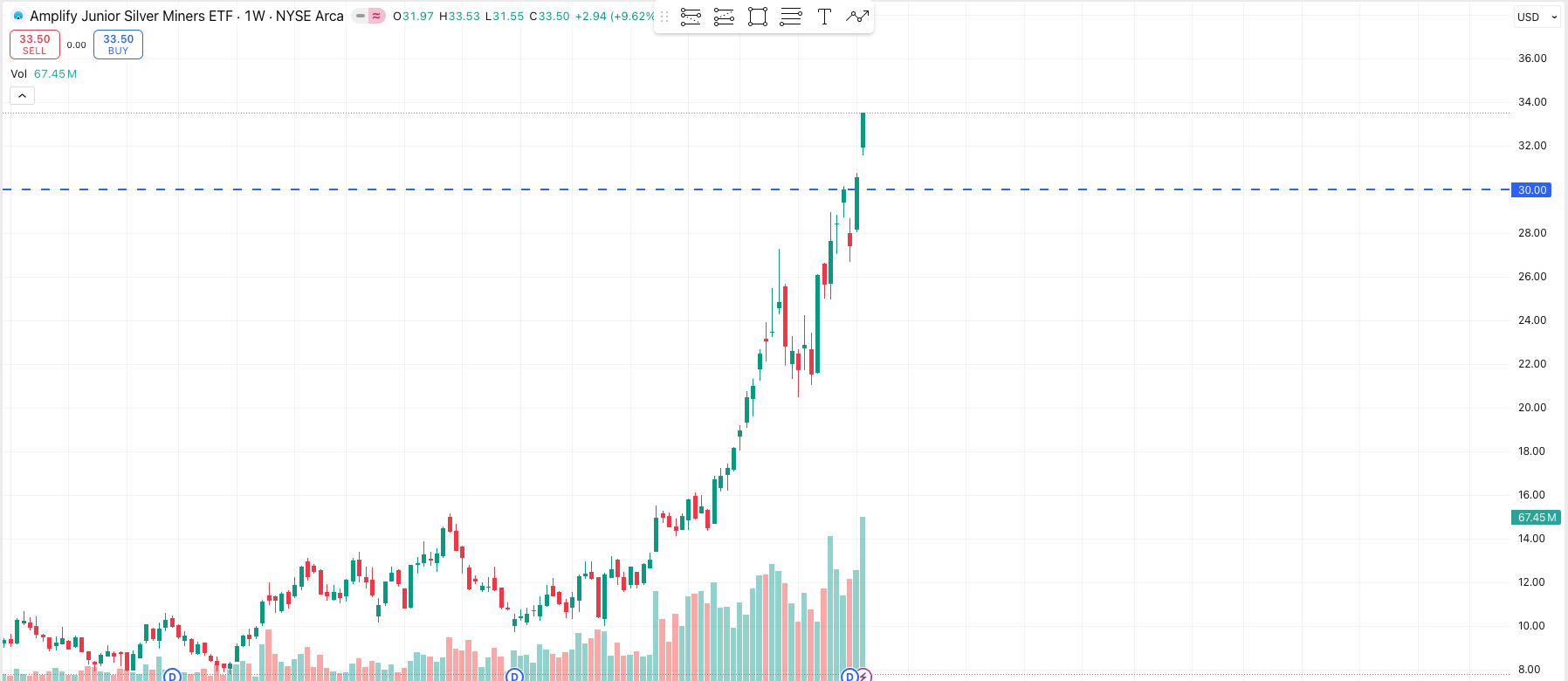

3. Silver Mining Weekly: The Hidden Opportunity

Here lies the "Pro" trade. Silver miners (ETF: SIL/SILJ) have lagged the spot price of silver.

SILJ has recently broken out of a second accumulation base, into price discovery mode. Traditionally, a price action transitioning into the price discovery phase will not slow down unless the fundamentals have changed or institutional investors have lost interest in the asset.

Risk Reminder: Mining stocks carry operational risk. A mine strike or tax hike can tank a stock even if silver prices rise. Use ETFs to diversify this risk.

Silver’s Outlook in 2026 vs the Long Term Game

In Conclusion: The silver fear-greed rally will continue in 2026 but a pullback is inevitable. The current exponential growth won’t be sustainable in the long term, with price movement stabilizing at the median of Gold/Silver Ratio.

That being said, the very long term outlook is still bullish, due to the future demand in specific sectors like Solar and AI industries.

Metals Focus: The Demand Shock (Solar & AI)

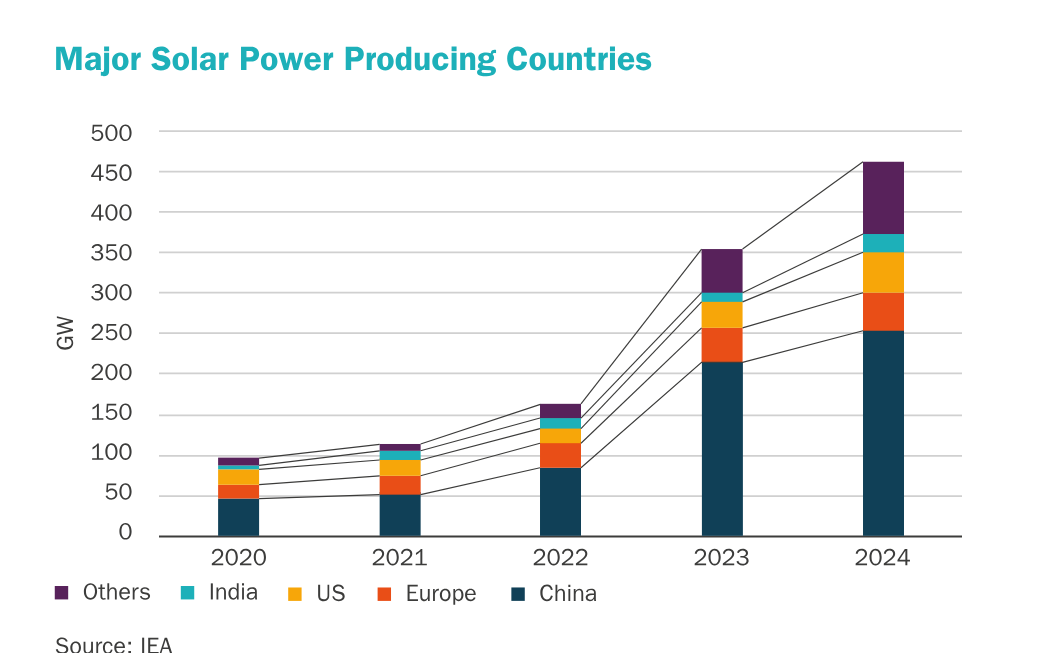

While general industrial demand is softening, however, high-tech demand (Solar/AI) is hitting record highs. This solidifies the outlook for a solid and stable price floor in the long term future.

Solar: “Demand was also boosted by applications linked to artificial intelligence (AI), which contributed to growth in consumer electronics shipments. As a result, electronics & electrical demand posted another record high in 2024.The automotive and aerospace industries, among others, also underpinned growth in demand for brazing alloys.” – from Silver Institute’s World Silver Survey 2025.

AI: “Further support could also emerge if AI developments lift sales of novel electronic devices and as power hungry data centers continue to be built.” Reference: The World Silver Survey 2025.

Solar PV: The shift to N-type solar cells (TOPCon) has increased silver paste consumption per watt. Despite "thrifting" efforts, the sheer volume of gigawatt installations means the solar sector now consumes nearly 20% of total annual supply (~232 Moz).

Figure: Silver demands in solar photovoltaics in the past 5 years by LBMA (London Bullion Market Association). Reference: Facing Facts: Silver Demand in Solar Photovoltaics to Leapfrog in the Next Five Years

The "AI" Factor: A new, unexpected driver is Artificial Intelligence. AI data centers and high-performance computing require massive amounts of silver for high-conductivity connectors and circuit breakers. This sector was negligible in 2023 but is now a major industrial competitor.

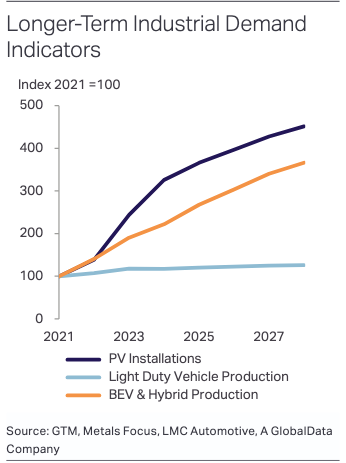

However, in the very long term, silver demand should rise consistently and considerably due to the rise in Industrial Demand (Solar) and Artificial Intelligence, where photovoltaic infrastructure that requires silver will boom exponentially.

Expert Quote:”At the same time, we remain optimistic for industrial demand. Short-term pressure could emerge if the world economy suffers from the escalating trade war. However, structural changes (often bound up with decarbonization such as a shift to BEVs and PV installations) should mean silver’s industrial demand outperforms global GDP.” – Reference: The World Silver Survey 2025