Key Takeaways

Stablecoins are becoming a fundamental element of global digital finance, enhancing Bitcoin liquidity and facilitating institutional access.

The tokenization of real-world assets is broadening Bitcoin'’s role as a collateralized asset within decentralized finance (DeFi).

Bitcoin ETFs are transforming institutional demand and contributing to long-term price stability for Bitcoin.

DeFi is evolving from speculative activity to practical utility, with Bitcoin increasingly utilized in collateral-backed DeFi protocols.

Regulatory clarity anticipated in 2025 is unlocking new capital inflows, reinforcing Bitcoin'’s status as a mainstream financial instrument.

1. Stablecoins Enhancing Bitcoin’’s (BTC) Functionality

Stablecoins are expanding beyond their role as trading pairs to become foundational infrastructure for global finance. In 2024, the stablecoin market capitalization surged 48% to $193 billion and is projected to reach $3 trillion within five years. This growth directly improves Bitcoin'’s liquidity and payment utility, particularly in crypto CFD trading

Key Impacts on Bitcoin (BTC) in 2025:

Bitcoin increasingly utilized as collateral in stablecoin-backed transactions

Stablecoins enhance Bitcoin'’s liquidity by enabling efficient on-chain and off-chain trading

Accelerated institutional adoption through fiat-on-chain payment systems

Stablecoins’ expansion beyond trading strengthens Bitcoin'’s foundational role as digital collateral within a growing tokenized financial ecosystem

2. Tokenization of Real-World Assets (RWA) and Bitcoin Integration: Impact on Bitcoin (BTC) in 2025

The tokenization of real-world assets such as real estate, bonds, and commodities is expected to accelerate in 2025. Excluding stablecoins, tokenized assets grew 60% in 2024, reaching $13.5 billion, thereby expanding Bitcoin’’s utility beyond a simple store of value.

How This Shapes Bitcoin'’s (BTC) Future:

Bitcoin used as collateral for tokenized assets and digital lending platforms

Emergence of new Bitcoin-backed structured products across DeFi and centralized finance (CeFi)

Increased market participation through tokenized Bitcoin derivatives

This evolution enhances Bitcoin’’s role from a store of value to a versatile digital financial instrument.

For traders, integrating these trends with technical analysis tools such asFibonacci Retracement, MACD, or RSI can help optimize entry and exit points.

3. Bitcoin ETFs: Institutional Engagement Reshaping Bitcoin Price Forecasts

The introduction of US spot Bitcoin ETFs in early 2024 was a pivotal development, unlocking substantial institutional capital. By 2025, ETF assets under management (AUM) are projected to exceed $250 billion, further influencing Bitcoin price dynamics.

Key Trends to Monitor: Bitcoin ETFs in 2025

Bitcoin (BTC) ETFs expected to surpass $250 billion in AUM this year

Potential ETF expansion to include altcoins such as XRP, SOL, LTC, and HBAR, enhancing ecosystem visibility

Regulatory support for in-kind creations and staking increases ETF attractiveness

Demand surges as pension funds and family offices enter the market

Bitcoin’’s price trajectory is increasingly aligned with traditional finance through these regulated investment vehicles.

The outlook for Bitcoin in 2025 is closely linked to institutional adoption. ETFs contribute to long-term price stability while facilitating new investor participation.

4. DeFi’’s Revival and Bitcoin’’s Growing Role

DeFi is projected to experience a resurgence in 2025, with rising total value locked (TVL) and advancements in cross-chain interoperability. Bitcoin’’s integration into DeFi protocols is enhancing utility for BTC holders.

Benefits of DeFi-Driven Bitcoin Adoption:

Growing traction of Bitcoin-backed lending and yield generation products

Cross-chain protocols enabling Bitcoin movement across multiple ecosystems

Institutional-grade Bitcoin DeFi platforms gaining regulatory acceptance

DeFi’s renewed momentum cements Bitcoin’’s role within decentralized financial infrastructure. This development also intersects with crypto staking innovations and crypto CFD margin trading opportunities.

5. Regulatory Clarity: The Primary Catalyst for Bitcoin in 2025

A critical driver in the outlook for Bitcoin in 2025 is regulatory clarity. Global initiatives to establish comprehensive crypto legislation are setting the stage for broader adoption and enhanced price stability.

Key Regulatory Developments to Watch for Bitcoin in 2025:

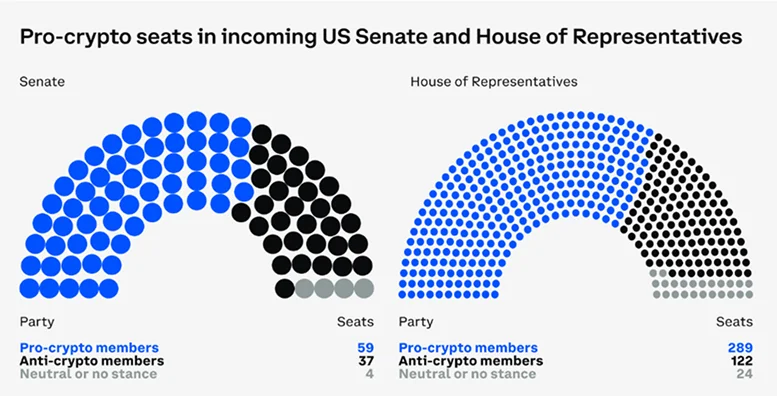

Sources: Stand with Crypto and Coinbase

US bipartisan support for digital asset regulation and stablecoin frameworks

G20 nations progressing towards crypto-friendly regulatory guidelines

Legal clarity expected to unlock new capital inflows into Bitcoin-based financial products

With clearer regulatory frameworks, Bitcoin is increasingly recognized as a legitimate asset class within the broader financial ecosystem.

Summary of the 5 Key Trends in Bitcoin Outlook 2025

1. Stablecoins

Stablecoins are evolving beyond trading applications into wider financial ecosystems. Their growth enhances Bitcoin’’s liquidity, accelerates cross-border payments, and supports Bitcoin as collateral in institutional financial products.

2. Tokenization of Real-World Assets

The expanding market for tokenized assets enables Bitcoin to function as a financial layer in on-chain derivatives, lending, and portfolio management solutions, extending its utility beyond a store of value.

3. Bitcoin ETFs

Bitcoin spot ETFs are attracting institutional capital, with AUM expected to exceed $250 billion in 2025. These developments deepen investor confidence and broaden market participation.

4. DeFi Resurgence

DeFi is expanding through Bitcoin-backed protocols, cross-chain liquidity solutions, and regulated institutional access. This reinforces Bitcoin’’s role in decentralized financial services.

5. Regulatory Clarity

New legislation and regulatory frameworks from G20 nations and the US Congress are fostering a favorable environment for Bitcoin adoption. This is expected to attract additional capital and legitimize Bitcoin’s global use.

Together, these five trends position Bitcoin for broader adoption, enhanced utility, and deeper integration into both traditional and decentralized financial ecosystems throughout 2025.

Trade the Bitcoin Outlook for 2025 with TMGM

At TMGM, traders can access the most significant Bitcoin 2025 market trends via regulated Bitcoin CFD trading. Whether you are day trading, scalping or swing trading, our platform offers:

Access to leveraged Bitcoin (BTC) trading with competitive spreads

Real-time execution and deep liquidity for optimal trade entries and exits

Risk management tools including stop-loss and take-profit orders for smarter trading

24/5 Bitcoin CFD trading without the need for wallet custody

For traders interested in other markets, TMGM also offers forex trading, gold trading, and oil trading across multiple platforms including MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Why Choose TMGM for Bitcoin CFD Trading?

Go long or short based on your Bitcoin price analysis

Maximize market exposure with efficient capital utilization

Trade informed by news, macroeconomic events, and key market catalysts

Ready to capitalize on the Bitcoin 2025 outlook? Open a TMGM Live Account or use our Demo Account to practice your trading strategies risk-free.