Key Takeaways

A CFD broker connects traders to the market and executes orders through trading platforms, tools, and pricing feeds.

Retail traders need a broker to access CFDs because they cannot trade these products directly on exchanges.

Trading costs come from the spread or a commission and from overnight funding when positions remain open.

Compare brokers by regulation and client fund segregation, platform quality, product range, education, support, and transparent pricing.

Leverage increases both profit potential and loss risk, so sound risk management and attention to execution quality are essential.

What is a Broker in CFD Trading

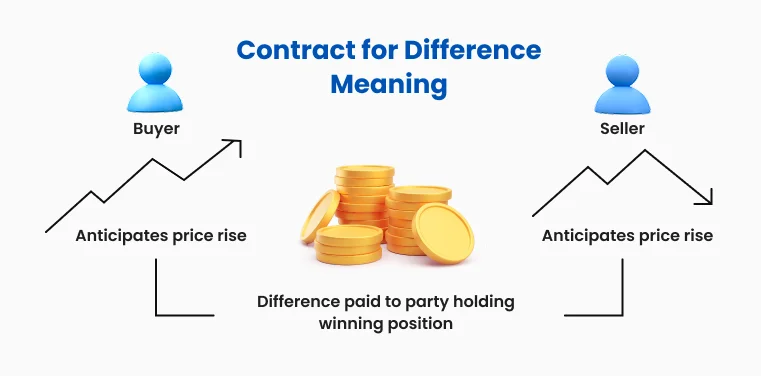

What is a broker in CFD trading? It’s a question every new trader should ask before entering the markets. As Contract for Difference (CFD) trading gains popularity among retail traders, understanding the role of a CFD broker becomes essential.

A broker acts as an intermediary between traders and financial markets, providing the infrastructure, platforms, and tools needed to execute trades. Without a clear understanding of what is a broker in trading, beginners may struggle to navigate the complexities of leveraged products like CFDs.

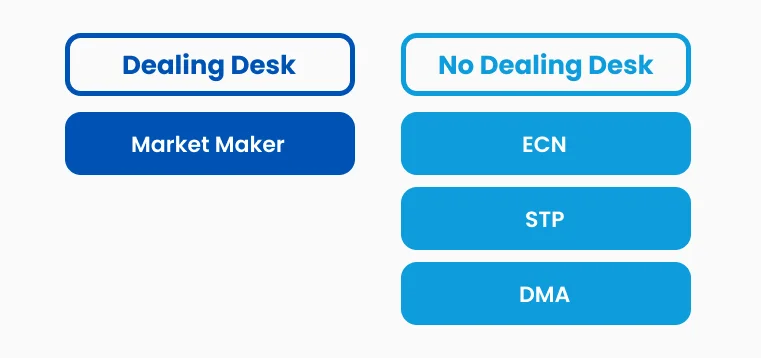

Types of CFD Brokers

The CFD industry includes various broker types with distinct models. Market makers, the most common type, set their bid/ask prices and offer tight spreads with fast execution, making them ideal for active traders.

Electronic Communication Network (ECN) brokers connect traders to liquidity providers, offering transparent pricing and variable spreads. Direct Market Access (DMA) is a type of CFD broker that offers direct access to real-time order books and market depth, appealing to professionals who seek transparency and are willing to pay higher commissions.

Figure 1: Market makers are Dealing Desk (DD) brokers; while ECN, DMA and STP (Straight Through Processors) are Non-dealing desk (NDD) brokers, meaning they connect traders directly to the interbank market instead of facilitating the other side of a client's trade

What Do CFD Brokers Do?

When exploring what does a broker do in CFD trading, it’s clear that CFD brokers play a key role by offering trading platforms equipped with charting tools, technical indicators, and advanced order management systems.

A well-rounded CFD broker like TMGM offers access to a diverse range of financial instruments, including stocks, indices, commodities, currencies, and cryptocurrencies, all through a single account.

Risk management represents another crucial function, as brokers implement margin requirements, stop-loss orders, and position sizing controls to help traders manage their exposure.

To better understand what a broker does, it’s essential to know that their role also includes ensuring regulatory compliance, adhering to financial laws, and maintaining segregated client accounts for added security.

Figure 2: What is a broker in CFD trading, and how does one operate?

How CFD Brokers Make Money

A CFD broker generates revenue through several mechanisms, with spreads being the primary source of income for most market makers. The spread, which is the difference between the bid and ask prices, enables brokers to earn a profit on every trade executed.

Another revenue stream for a CFD broker is overnight financing charges, where interest is applied to positions held overnight, depending on the underlying asset’s financing costs.

Choosing a Reliable CFD Broker

Selecting an appropriate CFD broker requires careful consideration of multiple factors beyond just competitive spreads and commissions. Regulatory oversight is the most critical criterion, as properly regulated brokers must adhere to strict financial standards and maintain client fund segregation.

Traders should verify that their chosen broker holds licenses from reputable regulatory bodies and offers appropriate investor protection schemes.

The difference between broker and dealer becomes particularly relevant when evaluating trade execution models, as some brokers act as dealers by taking the opposite side of client trades, while others function solely as intermediaries.

Reliable customer support, educational resources, and transparent pricing policies further distinguish professional brokers from less reputable operators.

Figure 3: Understanding the inherent risks of being a CFD broker

Risks and Responsibilities

While a CFD broker provides access to the market, traders must understand the risks that come with leveraged trading. The difference between broker and dealer responsibilities becomes crucial in risk assessment, as market maker brokers may have conflicts of interest when clients' losses become their profits.

Counterparty risk is another significant concern, as traders face potential losses if their broker becomes insolvent or fails to fulfil its obligations.

Additionally, traders bear responsibility for understanding the effects of leverage, margin requirements, and the potential for losses exceeding their initial investments.

Trade smarter with TMGM

Understanding what is a broker, particularly in the context of trading, is essential for a successful trading journey. A CFD broker acts as a financial intermediary, providing market access, trading platforms, and crucial tools while ensuring regulatory compliance.

Traders should evaluate the broker’s regulation, trading conditions, and business model, and also understand what a broker does, including how their revenue structure affects trading costs and execution.

Choosing a reputable and well-regulated CFD broker enables traders to manage risk effectively and stay focused on their trading strategy. It also clarifies the difference between a broker and a dealer, which supports better decision-making.

For those interested in exploring CFD trading, it is advisable to test trading strategies first before committing any real funds, using a TMGM demo account. Once users become more accustomed to the platform and trading mechanics, they can sign up for a live trading account with TMGM, using the TMGM Mobile App or desktop app.