Key Takeaways

Intraday Focus: Day traders never hold positions overnight to avoid "gap risk" from after-hours news.

Technical Reliance: Success depends heavily on Technical Analysis, chart patterns, and real-time volume data rather than long-term company fundamentals.

Risk Management: Using Stop Loss orders and proper position sizing is mandatory to prevent a Margin Call.

How to Start as a Beginner: Before risking real capital, beginners must master lower-timeframe chart analysis, understand how to execute specific orders (Market vs. Limit), grasp the severe risks of leverage, and prove profitability in a demo account.

Requirements and Risk Management: Long-term survival requires securing a low-fee broker, maintaining strict psychological discipline to prevent overtrading or revenge trading, and utilizing hard stop losses on every trade to avoid a margin call.

Pros and Cons of Day Trading: The practice offers complete independence, compounding potential, and zero overnight risk, but it comes at the cost of high stress, significant capital risk, and heavy screen time.

Top Day Trading Strategies: Traders deploy specific tactics depending on market conditions, including Scalping (rapid, tiny gains), Momentum (following high-volume trends), Range (trading between support and resistance), Breakout, and Reversal trading.

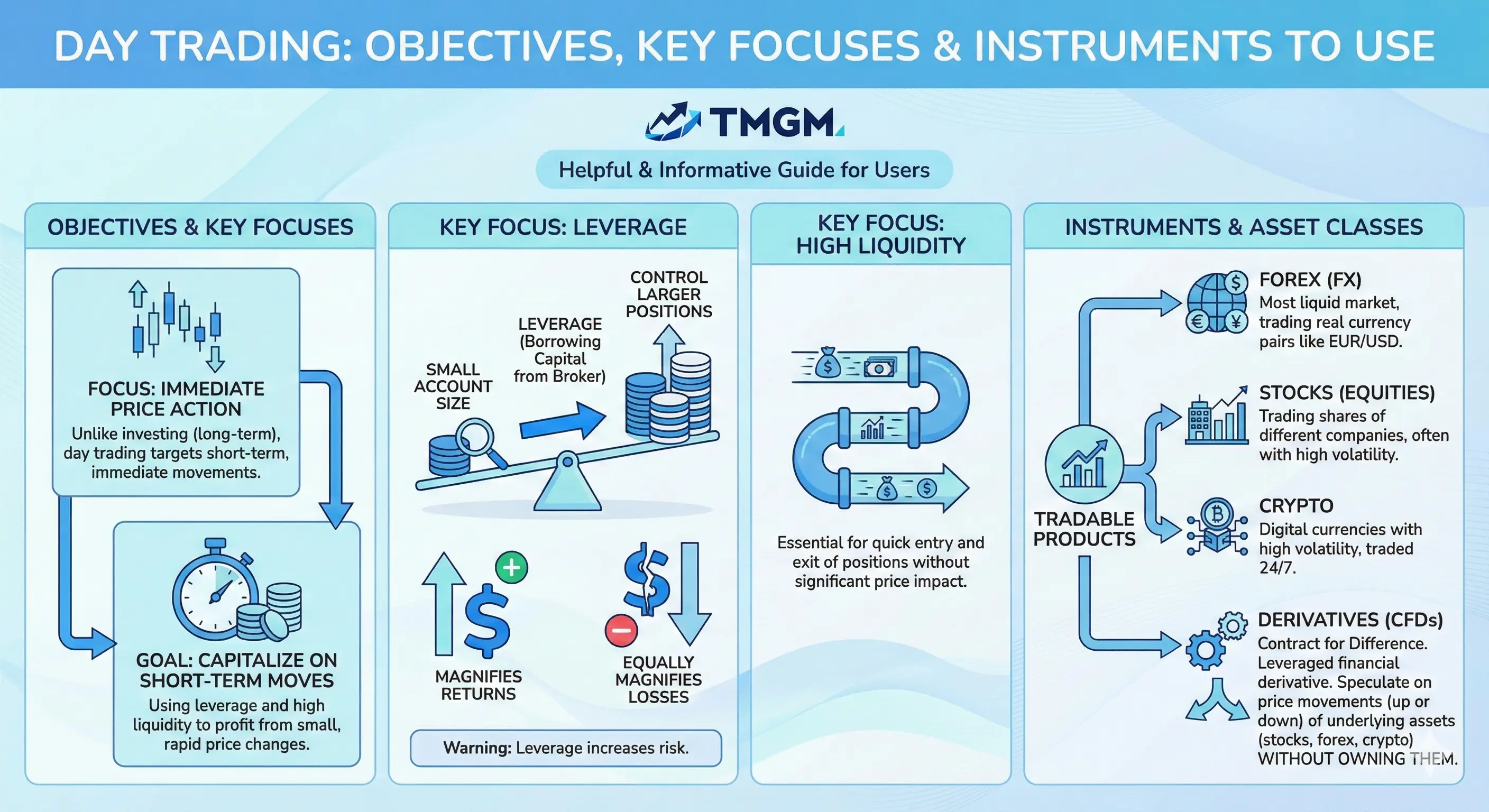

Day Trading: Objectives, Key Focuses and Instruments to Use

Unlike investing, which focuses on long-term growth, day trading focuses on immediate price action. Traders utilize Leverage (borrowing capital from a broker) to control larger positions with a smaller account size, so it makes more profit. While leverage magnifies returns, it equally magnifies losses.

The primary goal is to capitalize on small, short-term price movements using leverage and high liquidity. So what kinds of products/instruments can you trade (buy and sell)?

Instruments and Asset Classes:

Forex (FX): The most liquid market, trading real currency pairs like EUR/USD.

Stocks (Equities): Trading shares of different companies often with high volatility.

Crypto: Digital currencies with high-volatility and are traded 24/7.

Derivatives: CFDs, Contract for Difference, is a leveraged financial derivative allowing traders to speculate on price movements (both up or down) of underlying assets—like stocks, forex, or crypto—without owning them.

Day Trading vs. Swing Trading

The biggest difference with day trading is the time horizon. Compared with its counter-part, swing trading, day trading closes positions within the same day, while swing trading holds positions for more than a day, ranging from several days to weeks or even months.

Day Trading Techniques

To start Day Trading, you need a methodology.

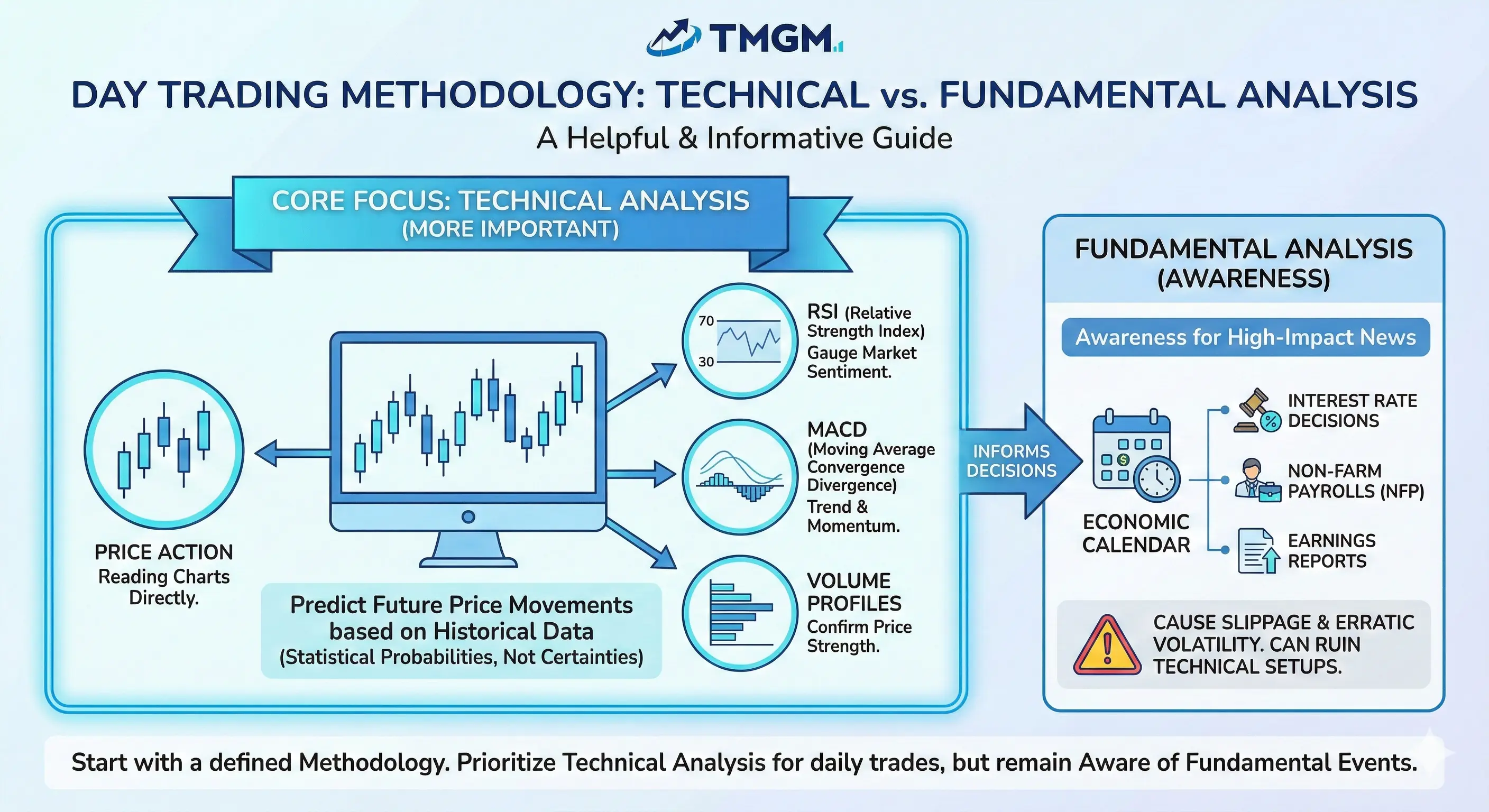

Technical Analysis

This is the lifeblood of a day trader. It involves reading charts to predict future price movements based on historical data. Traders use Price Action, often together with indicators like RSI (Relative Strength Index), MACD, and Volume Profiles to gauge market sentiment. You are looking for statistical probabilities, not certainties.

Fundamental Analysis

While less critical for minute-to-minute decisions, you must be aware of high-impact news. An Economic Calendar is essential to track interest rate decisions, Non-Farm Payrolls (NFP), or earnings reports. These events cause slippage and erratic volatility that can ruin a technical setup.

Expert Insight Never trade through high-impact news events (Red Folder events) unless you have a specific news-trading strategy. The slippage during these times can execute your Stop Loss far worse than your planned exit price.

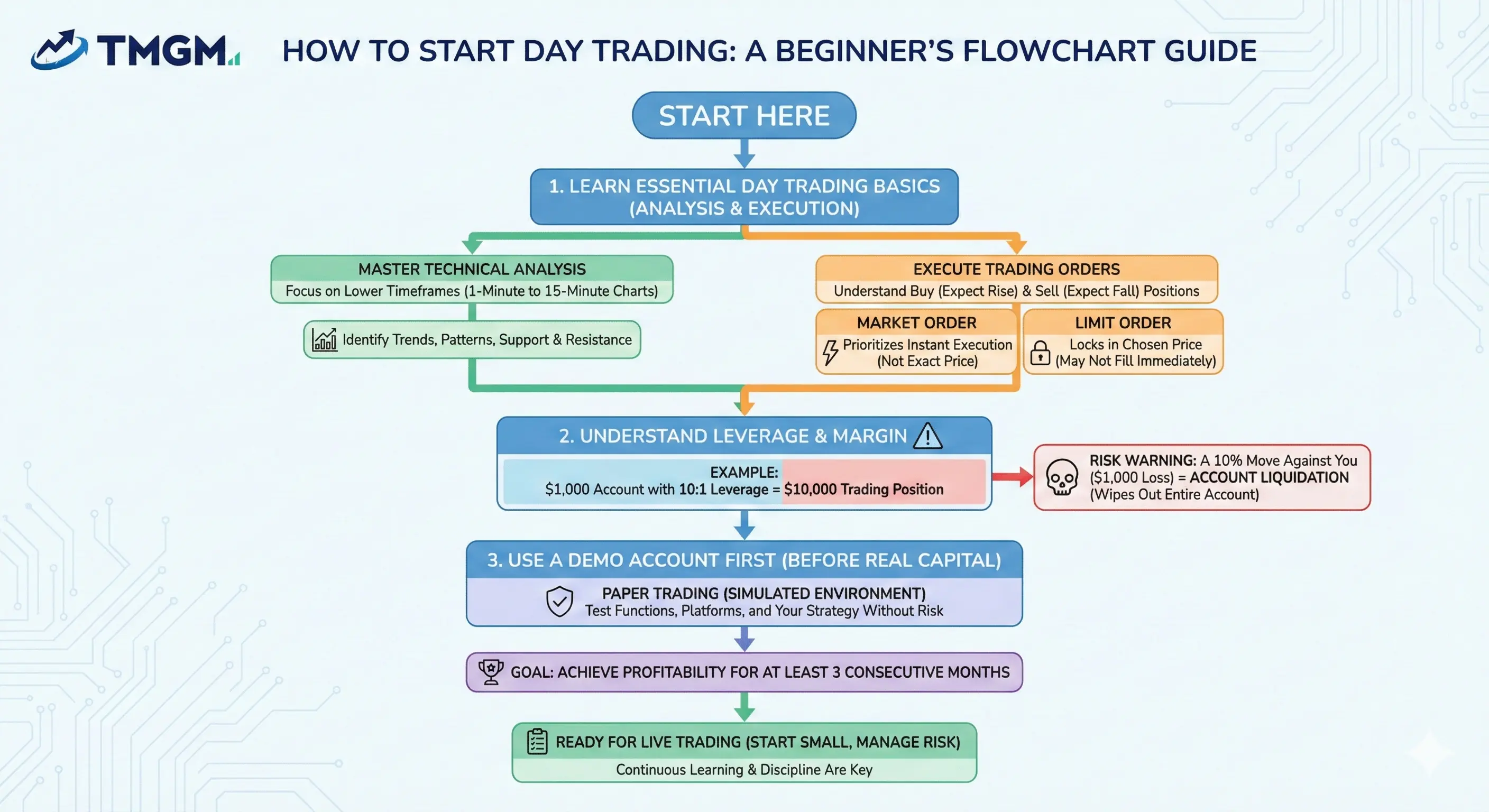

How to Start Day Trading as a Beginner?

1. Learn the Essential Day Trading Basics (Analysis & How to Execute Trading Orders)

How to Analyze: You must master Technical Analysis specifically for lower timeframes (1-minute to 15-minute charts).

How to Execute Buy and Sell Orders: A buy order opens a position expecting the price to rise, while a sell order opens a position expecting the price to fall.

To place either one, you need to choose an order type:

Market Order prioritizes instant execution but not the exact price.

Limit Order locks in your chosen price but may not fill immediately.

2. Learn What is Leverage & Margin

You must also understand Leverage & Margin.

If you have $1,000 and use 10:1 leverage, you are trading with $10,000. A 10% move (+/- $1000 of a $10,000 position) against you wipes out your entire account (Liquidation).

3. Use a Demo Account before Trading

Do not fund a live account immediately. Use a Paper Trading (Demo) account to test functions and your strategy.

You should be profitable for at least three consecutive months in a simulated environment before risking real capital.

Top Day Trading Strategies that You can Learn after the Basics

Scalping

Scalpers make dozens or hundreds of trades per day, targeting very small profit margins (pips or cents).

Pro Tip: This strategy requires low-latency execution and an ECN broker with tight spreads, as transaction costs can eat up profits.

Momentum Trading

This strategy involves identifying a stock or asset moving with high volume in one direction and jumping on board.

Pro Tip: Momentum traders often look for "Green Marubozu" candles or news catalysts that drive FOMO (Fear Of Missing Out) buying.

Range Trading

Markets consolidate more often than they trend. Range traders identify Support (floor) and Resistance (ceiling) levels.

Pro Tip: They buy at support and sell at resistance, placing stop losses just outside the range.

Breakout Trading

When the price breaks through a defined Support or Resistance level with high volume, it often signals a new trend.

Pro Tip: Breakout traders enter the market as the price clears the level, anticipating a volatility expansion.

Reversal Trading

Also known as "fading," this involves betting against the current trend.

Pro Tip: It is highly risky ("catching a falling knife") and requires identifying exhaustion signals like Divergence or Overbought/Oversold RSI readings.

Pros and Cons of Day Trading

Pros

Independence: Be your own boss and work from anywhere with an internet connection.

No Overnight Risk: You sleep soundly knowing you have zero exposure to the market.

Compounding: High turnover of capital allows for faster compounding of small gains.

Cons

High Stress: It requires intense focus, high level of discipline and strong emotional control.

Capital Risk: The majority of day traders lose money in their first year.

Screen Time: It will require long-hours of screen time for both trading and researching.

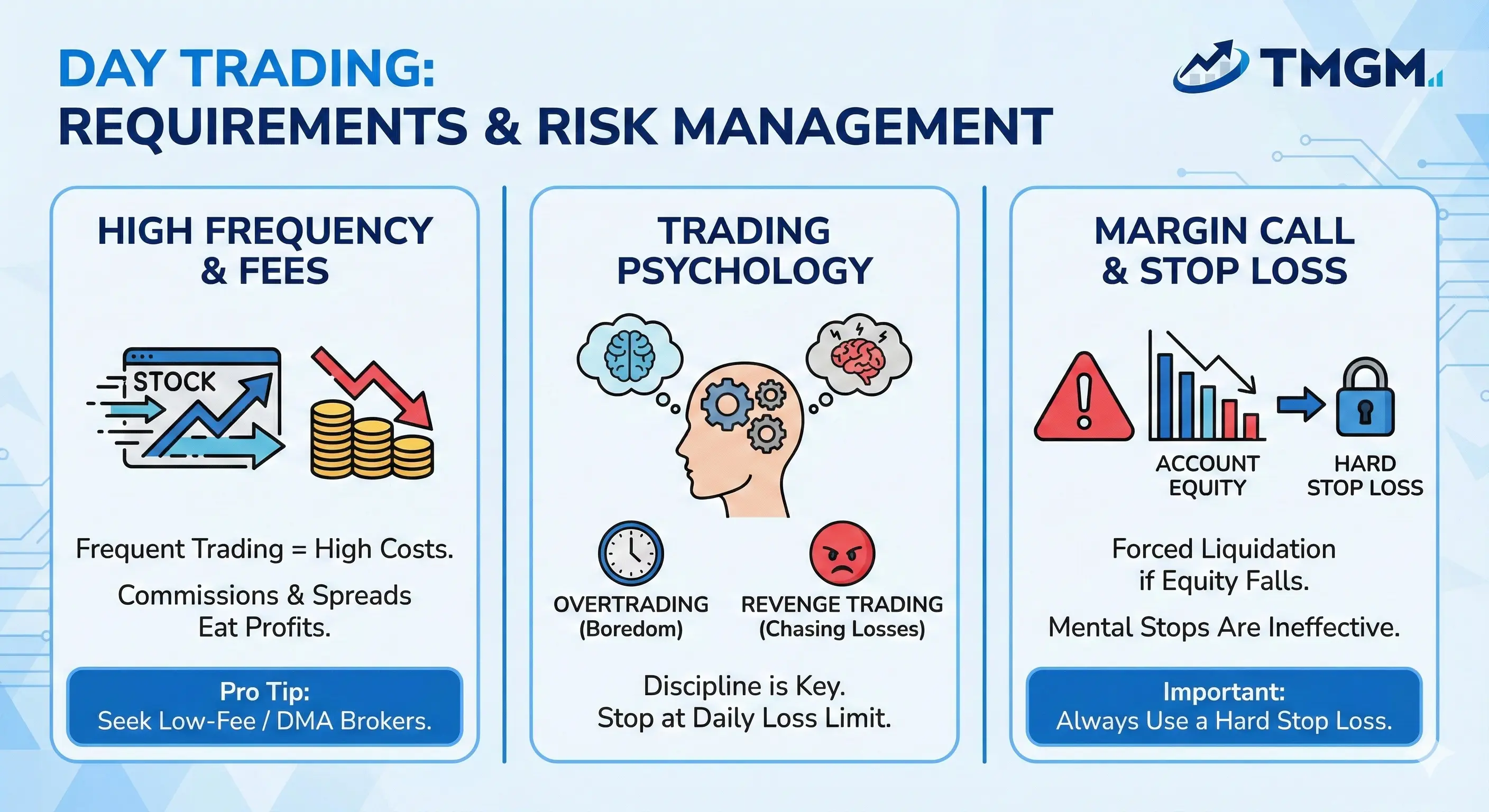

Requirements and Risk Management

High Frequency & Fees

Day trading involves frequent buying and selling. Even if you win every trade, costs from high commissions and wide spreads can still leave you losing money.

Pro Tip: You need a Direct Market Access (DMA) or low-fee broker to survive.

Trading Psychology

The biggest barrier is not the market; it is your mind.

Overtrading (trading out of boredom) are the top account killers. You must have the discipline to stop trading when you hit your daily loss limit.

Revenge Trading (trying to win back losses immediately) is another killer where you take risky trades, sometimes doubling down on position size to try and make back loss money. This is a behaviour that every trader must avoid.

Margin Call

A Margin Call occurs when your account equity falls below the broker's required maintenance level. The broker will forcibly liquidate your positions to cover the potential loss.

Important Always use a Hard Stop Loss on every trade. Mental stops are ineffective because in the heat of the moment, you will likely rationalize holding a losing position until it causes significant damage.