How to Begin Forex Trading for Beginners: A Step-by-Step Guide

Understanding forex trading for beginners unlocks opportunities in the world's largest financial market. With over $6 trillion in daily trading volume, the forex market offers unmatched liquidity and accessibility, enabling you to trade major, minor, and exotic currency pairs 24 hours a day, five days a week. This comprehensive guide covers all essential aspects of forex trading, from foundational concepts to effective strategies, to help you start your forex trading journey.

Key Takeaways

Begin with liquid major and minor currency pairs and grasp the concept of base versus quote currency pricing before trading.

Utilize both fundamental analysis (interest rates, economic data, news) and technical analysis to determine trade direction——buy when the base currency is strengthening, sell when it is weakening.

Manage risk from the start: size your positions appropriately and set stop-loss and take-profit orders.

Practice on a demo account, then trade live on MT4 or MT5 once funded and ready.

Leverage and margin allow for larger position sizes (e.g., 30:1 leverage requires approximately 3.33% initial margin) but also increase potential losses, making prudent position sizing and stop-loss placement critical.

How to Trade Forex for Beginners

1. Select a Currency Pair to Trade

The forex market offers over 80 currency pairs –, ranging from major pairs such as EUR/USD and GBP/USD to exotic pairs like MXN/JPY or SGD/HKD. Trading with TMGM provides access to competitive spreads across a broad selection of currency pairs. When learning forex trading, start with major or minor pairs that offer tighter spreads. TMGM simplifies forex trading by providing highly competitive spreads across an extensive range of currency pairs.

Before choosing a currency pair, perform comprehensive:

- Fundamental analysis: Assess economic indicators, interest rates, inflation figures, political stability, and central bank policies of both currencies in the pair

- Technical analysis: Analyze forex price charts, identify chart patterns, and use technical indicators to forecast potential price movements

Understanding the relationship between the 'base' currency (the first currency in the pair) and the 'quote' currency (the second currency in the pair) is fundamental for successful forex trading.

Figure 1: Illustration of base and quote currency

Currency Pair Structure Explained

In the currency pair EUR/USD:

- EUR is the base currency

- USD is the quote currency

- The price indicates how many US dollars are needed to purchase one Euro

2. Decide Whether to 'Buy' or 'Sell'

After selecting a currency pair, determine your trade direction based on your analysis:

- Buy (Go Long): If you anticipate the base currency will appreciate against the quote currency

- Sell (Go Short): If you expect the base currency to depreciate against the quote currency

For example, if GBP/USD is trading at 1.28000, it means you need $1.28 to buy 1 GBP. You would buy this pair if you believe the British pound will strengthen against the US dollar. Conversely, if you expect the pound to weaken, you would sell. This step is fundamental to learning how to trade forex for beginners and understanding strategic forex trading.

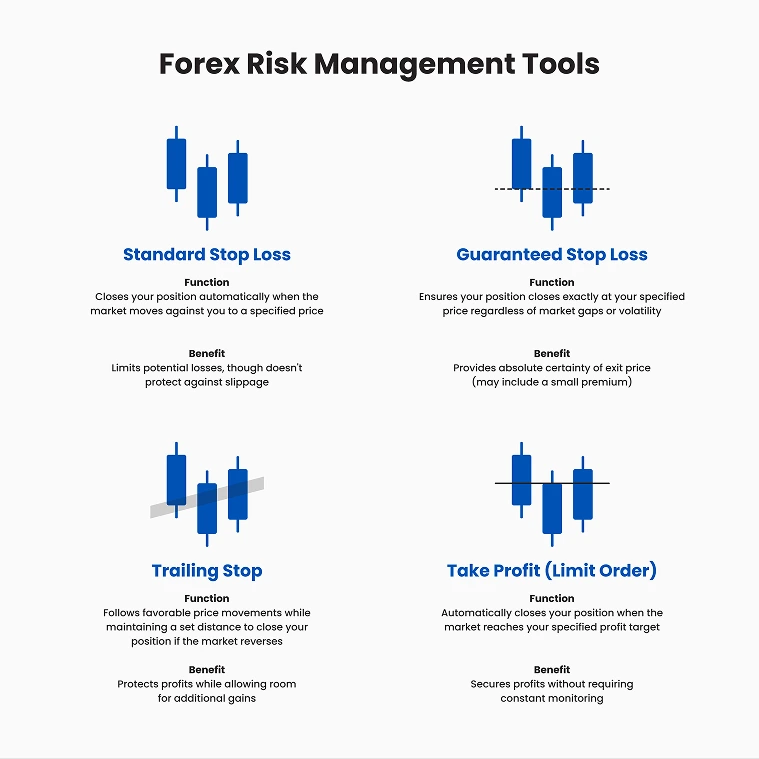

3. Set Your Stop-Loss and Take-Profit Orders

The forex market is known for its volatility, making risk management essential in forex trading. Using stop-loss and take-profit orders helps protect your capital and lock in profits:

4. Open Your First Trade

To start trading forex with TMGM:

Create an account via our streamlined registration process

Complete verification and fund your account using secure payment methods

Access MetaTrader 4 (MT4) or MetaTrader 5 (MT5) on our user-friendly forex trading platform.

Search for your selected currency pair

Enter your position size (lot size)

Choose 'buy' or 'sell' based on your technical analysis

TMGM provides demo accounts for risk-free practice. These accounts enable you to familiarize yourself with the platform and test trading strategies under real market conditions.

5. Monitor Your Position

After entering a trade, staying updated on market developments is crucial for effective risk management and maximizing profits. Traders should regularly review their open positions via the platform’’s portfolio section to monitor performance in real time. Setting up custom price alerts through email, SMS, or push notifications ensures timely awareness of important price moves. Additionally, consulting the economic calendar helps anticipate major economic events that may influence market volatility.

Regularly reviewing technical indicators such as the Relative Strength Index (RSI) can signal potential trend reversals, while staying informed on news and geopolitical developments offers valuable context on broader market conditions. Maintaining a proactive approach enables traders to make informed decisions and adjust strategies as necessary.

This ongoing monitoring is essential for beginners in forex trading. TMGM provides comprehensive market analysis, real-time news feeds, and trading calendars to support informed decision-making on your open trades.

6. Close Your Trade and Realize Your Profit or Loss

When you' are ready to exit a position, you have several options to close your trade efficiently and with control:

Manual Close: Go to your open positions, select the trade, and click "close" to exit at the current market price.

Reverse Trade: Place an opposite trade——if you initially bought, selling the same volume will close your position.

Automated Close: Use take-profit and stop-loss orders to automatically close your position when preset price levels are triggered.

Exiting trades is as important as entering them. Successful traders adhere to their trading plans and avoid emotional decisions, ensuring exits align with their overall strategy and risk management protocols.

Common Forex Trading Terms

Want to learn key forex terminology? Click to learn more about Common Forex Trading Terms!

Advanced Forex Trading Strategies

As you gain proficiency, consider exploring these forex trading strategies:

Trend Following: Identifying and trading in the direction of established market trends

Range Trading: Buying near support levels and selling near resistance in sideways markets

Breakout Trading: Entering trades when price breaks through key support or resistance levels

Carry Trading: Capitalizing on interest rate differentials between currencies

News Trading: Taking positions based on economic announcements and geopolitical developments

Each strategy builds upon the fundamentals of forex trading, helping you advance your skills.

Why TMGM is the Ideal Choice for Forex Trading Beginners

TMGM provides traders with a comprehensive suite of features for successful forex trading:

Ultra-Low Spreads: Trade major currency pairs with some of the most competitive spreads in the industry

Advanced MT4 / MT5 Trading Platforms: Access professional-grade trading platforms equipped with powerful analytical tools

Instant Execution: Benefit from fast trade execution without requotes or slippage

Comprehensive Market Coverage: Trade a wide range of currency pairs including majors, minors, and exotics

Premium Educational Resources: Access webinars, tutorials, and market analysis from expert traders

24/5 Dedicated Support: Receive personalized assistance from our multilingual customer support team

Regulated and Secure: Trade confidently knowing your funds are held in segregated accounts with a fully regulated broker

Flexible Account Options: Choose from multiple account types tailored to various trading styles and capital levels

Free Forex Trading Courses and Resources

Becoming a successful forex trader requires skill, knowledge, and practice. TMGM provides all the tools you need, including a wide range of free forex trading courses and webinars designed specifically for forex traders. We also offer a free demo account funded with US$100,000 in virtual capital to help you build confidence in a risk-free environment before trading live funds.

Additionally, we provide forex trading strategy insights, daily market analysis, and news articles suitable for all experience levels. Whether you' are a complete beginner or an experienced currency trader, TMGM has the resources to support your forex trading journey.

Trade Smarter Today

Account

Account

Instantly