Is Gold a Viable Investment in 2025? Analyzing the Advantages, Risks, and Market Dynamics

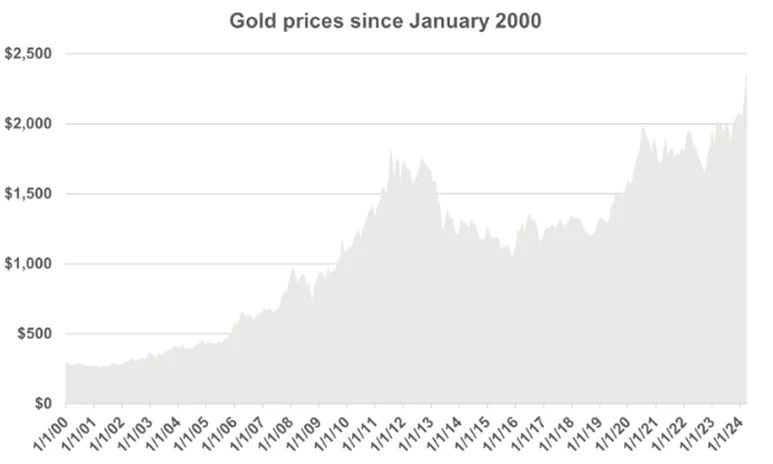

As we approach 2025, global markets are facing unprecedented challenges, influenced by geopolitical tensions, inflationary dynamics, and volatile interest rate environments. For numerous traders, gold continues to be a valuable asset to consider. But is gold a viable investment in 2025? Let’s analyze current market trends, associated risks, and the strategic role of gold within a diversified portfolio, enabling you to make an informed decision regarding its inclusion in your trading strategy.

Why Gold Retains Its Value

A Time-Tested Store of Value: Gold’’s reputation as a reliable store of value is grounded in centuries of financial history. Unlike fiat currencies, which are subject to inflationary pressures and central bank monetary policies, gold possesses intrinsic value that tends to remain stable, making it a preferred asset during periods of economic uncertainty.

Inflation Hedge: Many investors allocate capital to gold to safeguard purchasing power, especially when inflation diminishes the real value of cash or fixed-income securities. Historically, gold has performed well during high inflationary environments, offering a protective hedge.

Global Demand: Gold is a highly liquid, internationally recognized asset. Its widespread use in both industrial applications and investment portfolios ensures sustained demand, underpinning its stability as a long-term investment.

Market Drivers Impacting Gold in 2025

Interest Rates and Gold’ Price Dynamics: There is an inverse correlation between interest rates and gold prices; when interest rates are low, non-yielding assets like gold become more attractive. In 2025, central bank interest rate decisions will be critical in shaping gold’s price trajectory, as policymakers balance inflation control with economic growth objectives.

Economic and Geopolitical Volatility: Gold typically performs well during periods of market volatility, as investors seek safe-haven assets. Given the anticipated economic and geopolitical uncertainties in 2025, gold’s role as a refuge investment is expected to remain prominent.

Currency Movements: A depreciation of the US dollar often correlates with rising gold prices. Should the dollar weaken due to macroeconomic factors, gold prices may increase in 2025, making the metal more accessible to international investors.

Evaluating Gold as an Investment in 2025: Advantages and Disadvantages

Evaluating Gold as an Investment in 2025: Advantages and Disadvantages

Advantages of Gold Investment:

Portfolio Diversification: Gold serves as a strategic asset that helps balance portfolios by offsetting risks from equities and bonds, particularly during market downturns.

Inflation Protection: Historically, gold has delivered returns that can counterbalance losses in cash or fixed-income investments during inflationary periods.

Safe-Haven Demand: Gold’s value typically appreciates amid political or financial crises, making it an attractive option for risk-averse investors.’

Disadvantages of Gold Investment:

No Yield: Gold does not generate interest or dividends, which may reduce its appeal for investors seeking income.

Price Volatility: While generally stable, gold prices can be volatile, particularly due to speculative trading or short-term economic developments.

Storage and Security Expenses: Physical gold requires secure storage solutions, which can increase investment costs. However, alternatives such as gold ETFs provide exposure without the need for physical custody.

Gold Investment Vehicles

Physical Gold: Direct investment in physical gold, including coins and bars, offers tangible asset exposure but involves considerations around storage and security.

Gold ETFs and Mutual Funds: Exchange-traded funds (ETFs) provide investors with exposure to gold price movements without owning the physical metal. They offer liquidity and ease of trading but may carry management fees.

Gold Mining Equities: Investing in shares of gold mining companies offers indirect exposure to gold prices and potential capital appreciation. However, these equities carry operational risks and are subject to broader stock market fluctuations.

CFDs: A Contract for Difference (CFD) enables traders to speculate on price movements of gold without owning the underlying asset. When trading CFDs, investors settle the difference between the opening and closing prices of the contract. CFDs cover a range of assets including stocks, commodities, and forex.

Is Gold Suitable for Your 2025 Investment Strategy?

Whether gold is an appropriate investment in 2025 depends on your individual financial objectives and risk appetite. Gold may be a valuable addition if you aim to diversify against economic volatility, hedge against inflation, or hold a safe-haven asset.’

Conversely, for investors prioritizing income generation or aggressive growth, gold’s lack of yield and occasional price fluctuations might not align with your goals.’

Key Insights on Gold Investment in 2025

Positive Outlook Amid Market Volatility: Considering the economic environment and potential market fluctuations, gold remains an attractive, stable asset.

Inflation Protection Potential: Gold may provide a hedge if inflation persists, preserving purchasing power amid currency depreciation.

Strategic Diversification Tool: Incorporating gold into portfolios can reduce overall risk and enhance long-term returns, especially if equity markets become volatile.

Flexible Investment Formats: Gold exposure can be customized through physical holdings, CFDs, gold ETFs, or futures contracts, offering adaptability to investor preferences.

Why Consider Gold Investment

In 2025, gold is poised to remain a compelling choice for investors seeking stability amid economic uncertainties. Whether facing inflationary pressures, geopolitical tensions, or recession risks, gold has historically served as a safeguard when traditional asset classes encounter challenges.

Is gold a prudent investment in 2025? For many investors, the answer is affirmative, especially as global economic conditions continue to evolve.

To begin exploring gold trading opportunities, visit TMGM'’s platform to access educational resources and tools for building a diversified, resilient portfolio.

Trade Smarter Today

Account

Account

Instantly