5 Steps To Trading And Investing In Gold in 2026

Trading and investing in gold begins with understanding the difference between gold trading and gold investing. Gold trading focuses on profiting from price movements over shorter timeframes, often without owning physical gold. Gold investing aims to preserve wealth and diversify portfolios through longer holding periods. The second step is understanding the factors that drive gold prices, including demand, supply, central bank activity, currency strength and inflation, market sentiment, and real-economy uses. These factors explain why gold can be volatile in the short term yet retain long-term value. Once you understand how gold behaves, the third step is to choose a method that matches your time horizon and level of involvement. You may favour gold trading if you actively manage positions and seek short-term opportunities. You may favour gold investing if you focus on long-term exposure and wealth preservation. The fourth step is opening a gold trading account with a broker, giving you access to gold instruments like gold CFDs, live price charts, and risk management tools such as stop losses and take profits to manage trades in real time. The final step is to open and manage your first gold trade by choosing a direction, applying a clear strategy, managing risk while the position is open, and closing the trade when your exit conditions are met.

1. Learn What Is Gold Trading And Investing

Gold (XAUUSD) is a precious metal that is globally priced, and its price movements can be accessed through both gold trading and gold investing.

Gold trading is the practice of speculating on the price of gold markets. It is buying and selling based on price fluctuations, with the aim of making returns from gold price movements. Buy, if you believe gold prices will rise. Sell, if you believe gold prices will fall. Gold trading happens over the counter or on exchanges, depending on the instrument you use.

Gold investing is about preserving and protecting wealth by allocating capital into gold as a commodity. Investors can buy gold in its physical form or through securities, aiming to benefit from long term appreciation in gold prices and diversification.

The 5 common instruments for trading and investing in gold include gold CFDs (Contracts for Difference), gold futures, gold options, physical gold, and gold securities.

Gold CFDs are derivative contracts that allow traders to speculate on gold price movements without owning physical gold.

Gold futures are standardized, exchange-traded contracts used for hedging or speculation, with delivery or cash settlement at a future date.

Gold options are contracts that give traders the right, but not the obligation, to buy or sell gold at a predetermined price before or at expiry.

Physical gold is tangible gold, such as bullion, bars, or coins, that investors own and store directly or through vaulting & custodial services.

Gold securities are exchange-traded or listed financial products, such as gold mining equities & gold ETFs, that track the price of gold or are indirectly linked to gold prices without requiring physical ownership.

The table below shows how different gold instruments compare in terms of suitability, capital, leverage, and short selling.

Gold prices can move sharply even within days. For example, the initial price of gold was USD 4,596.43 per troy ounce (31.1 grams) on January 16 2026, before falling to USD 4,594.83 per troy ounce on January 18 2026, an approximate 0.035% dip. This is exactly the kind of price fluctuation that gold traders try to capture, for example.

2. Know The Factors That Move Gold Prices

Gold price factors refer to the market forces and events that influence gold’s price. The 6 main factors that move gold prices are:

Demand

Supply

Central Banks and Reserves

Currency and inflation

Market sentiment

Real economy uses

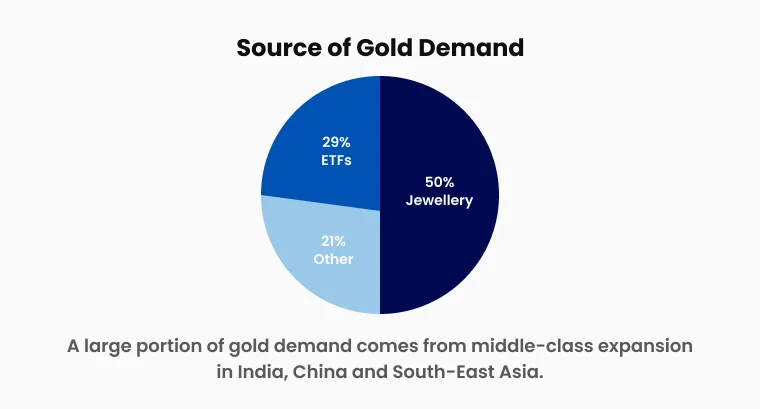

Demand is one of the fastest-moving forces in gold pricing because it can change quickly with investor behaviour and global conditions. In 2024, total gold demand reached 4,974.5 tonnes, while spot gold prices rose 27%, alongside central bank buying of over 1,000 tonnes, showing how strong demand can align with major price moves. Key sources of demand include investment demand, central bank purchases, safe-haven buying, and consumer demand.

Supply affects gold prices when the market expects production to rise or fall, driven mainly by gold mining output and recycling activity. World Gold Council (WGC) data shows recycled supply increased 11%, from 1,234.4 tonnes in 2023 to 1,370.0 tonnes in 2024, while the average gold price rose from USD 1,940.5 to USD 2,386.2 per ounce over the same period. This highlights how supply changes influence price expectations rather than acting as an immediate price cap.

Central banks matter because they are large, long-term participants whose buying and reserve decisions influence market expectations. The ECB estimates central banks accounted for over 20% of global gold demand in 2024, compared with around 10% on average in the 2010s, showing how official sector demand has become a major price driver. Shifts in central bank purchasing can support or pressure gold prices over extended periods. Data Source: The International Role of Euro June 2025 Report.

Currency and inflation affect gold prices because gold is widely viewed as a store of value. Empirical research estimates that a 1% increase in the US dollar real effective exchange rate is associated with a 0.496% decrease in gold prices in the long run. This supports the common market pattern where a stronger US dollar pressures gold prices, while inflation concerns tend to increase demand for gold as a purchasing-power hedge.

Market sentiment influences gold prices because gold often reacts to changes in risk perception. In 2024, Reuters reported spot gold reached a record USD 2,942.70 following new US tariff announcements, linking geopolitical risk and inflation fears directly to same-day price movements. Economic data releases, central bank signals, and geopolitical events can rapidly shift sentiment and drive gold price volatility. A good way to gauge market hedging interest and sentiment is to use Gold/Silver Ratio chart. Most Gold traders use it because traditionally Gold/Silver Ratio has been a strong indicator of gold price movement due to its strong relevance to silver price movement.

Real-economy demand affects gold prices over time through industrial use and jewellery consumption. The WGC reports that jewellery demand volume fell 11% to 1,877 tonnes in 2024, while the value of jewellery demand rose 9% to USD 144 billion, reflecting higher gold prices. This shows how rising prices can reduce consumption volumes even as total spending increases, influencing longer-term demand dynamics. Data Source: Gold Demand Trends: Full Year 2024.

3. Choose Your Gold Trading Or Investing Method

Choose the approach of gold trading or gold investing based on your preference of time horizon and level of involvement. Your time horizon is the planned duration you intend to hold a position, whether for trading or investing. Your level of involvement is the amount of active time, effort, and decision-making you are willing to commit to managing those positions.

Gold trading is suitable for you if you:

Prefer speculating on price movements without owning the physical asset

Focus on short-term market moves rather than long-term holding

Aim to profit by timing entries and exits precisely

Look for short-term price inefficiencies in the market

Rely on clear rules and price action to make fast decisions

Are willing to actively trade instead of taking a passive approach

Target small, quick profits on a repeated basis

Hold positions for relatively short periods, such as hours, days, or weeks

A popular gold trading instrument is gold CFDs, as they offer leverage, support short selling, and allow traders to respond quickly to short-term price movements.

Gold investing is suitable for you if you:

Are comfortable holding assets for years rather than days or weeks

Want to build long-term wealth and generate passive income over time

Prefer extended holding periods that focus on long-term trends instead of daily price swings

See investing as a long-term journey that rewards patience and consistency

Want your money to work for you instead of actively trading for income

A popular gold investing instrument is gold ETFs, as they provide liquid, exchange-traded exposure to gold prices and can be easily bought, held, and rebalanced within a long-term portfolio.

4. Open Your Gold Trading Account

A gold trading account is a broker account that gives you access to gold instruments on a trading platform to trade gold price movements by placing buy or sell orders, typically through products such as gold CFDs, spot gold, or gold futures.

A gold trading account also lets you view live gold price charts, manage margin and leverage, set risk controls like stop loss and take profit, track your balance, open positions, and trade history for deposits, withdrawals, and performance.

Here are the 4 steps to opening your gold trading account on TMGM:

Fill in our online form to create a gold CFD trading account

Submit your personal details and contact information

Complete identity verification (KYC) using your identification documents

Log into MT4 or MT5 and start trading gold CFDs

5. Open Your First Gold Trade

Opening a gold trade involves choosing a direction, applying a strategy, and managing the position until you close it.

Understand Gold Price Movements

Make sure you understand how gold prices behave before placing a trade. Gold often reacts inversely to the US dollar (DXY) and bond yields, and price movements are driven by factors such as market sentiment, economic data, and key market participants. This context helps you decide whether conditions favour a buy or sell trade.

Decide Your Gold Trading Direction

Decide whether to go long or short. Open a long position if you expect gold prices to rise. Open a short position if you expect gold prices to fall. Once the position is opened, you are exposed to gold price movements until you close the trade.

Decide Your Gold Trading Strategy

Choose one of your gold trading strategies before entering the market. Define what triggers your entry, what invalidates the trade, and how you will exit. A common approach traders use is to look for stop runs at marked highs or lows, where price briefly moves beyond a prior level before reversing or continuing.

Open and Manage the Gold Trade

Place the trade on your platform and monitor it according to your plan. Effective gold trading requires active management, prompt decision-making, and a clear understanding of market dynamics, as gold prices can move quickly when volatility increases or sentiment shifts.

Close the Gold Trade

Close the position when your exit conditions are met. This may happen when your target is reached, your stop loss is hit, or your strategy signals an exit, such as a momentum shift, a break back into a range, or a failed breakout.

Gold Trading FAQs

What Are The Advantages Of Gold Trading?

Gold trading offers 7 main advantages:

Gold has high liquidity across bullion, futures, spot prices, and options, allowing traders to enter and exit positions efficiently.

Gold is often seen as a dependable or reliable asset in volatile markets, which can help traders better manage market downturns.

Gold trading allows investors to profit from price fluctuations, making it suitable for active and short-term trading strategies.

Gold trading strategies often focus on market momentum, which supports short-term trading opportunities based on price movement.

Gold serves as a defensive asset, an investment tool, and a speculative instrument, giving traders flexibility across different market conditions.

Gold offers diversification and safe-haven appeal, with the potential to improve risk-adjusted returns within a broader portfolio.

Gold trading is associated with relatively low costs and high flexibility, supported by its liquidity and broad market participation.

What Are The Risks Of Gold Trading?

Gold trading carries 4 main risks:

Gold prices can be volatile, meaning prices may move sharply over short periods and increase the risk of sudden losses

Gold is susceptible to market fluctuations, as changes in economic conditions, interest rate expectations, or investor behaviour can quickly affect prices

Gold carries embedded geopolitical risk, where geopolitical tensions or global events can trigger abrupt and unpredictable price movements

Gold is hard to store, expensive to transport, and doesn’t pay interest, which makes it less efficient for traders who require yield or prefer assets without physical handling considerations

What Are The Gold Trading Hours?

Gold is open for trading 24 hours a day, five days a week, from Monday to Friday. Gold trading hours are shown in one of 4 common formats below, depending on how your platform displays market hours and server time:

24 hours from Monday to Friday

Monday 00:00 and Friday 23:59 (Server Time)

Sunday 17:00 to Friday 17:00 (New York Time)

Monday 07:00 and Saturday 06:00 (Regional Time Formats)

The most accurate way to confirm your gold trading hours is to check the instrument’s Market Hours or Trading Hours inside your trading platform because brokers and platforms use different time zones and server settings.

How Do I Determine The Current Gold Prices?

There are 4 references traders commonly use to determine current gold prices, which include Live Gold Charts and Spot Prices, Gold Futures on COMEX, Forecasts and Market News, and Gold Trading Pairs like XAU/USD.

Live gold charts and spot prices show real-time gold pricing along with the current trend, volatility, and key support and resistance levels across different timeframes.

Gold COMEX futures refer to the primary benchmark for gold pricing, where futures contracts trade on the New York Mercantile Exchange and serve as the main price discovery mechanism that influences spot prices globally.

Forecasts and market news offer commentary and updates that explain what is driving gold prices and highlight events that could trigger volatility.

Gold trading pairs like XAU/USD represent the actual trading instruments most retail traders use on their platforms, showing gold price quoted against the US dollar or other currencies.

What Are The Gold Trading Strategies?

A gold trading strategy is a set of entry, risk, and exit rules for trading gold spot prices, often through leveraged instruments such as CFDs or futures. A good strategy consists of using a robust plan with tight stop losses and applying consistent profit taking rules. Breakout trading, seasonal gold patterns, moving averages and Fibonacci retracements are popular gold trading strategies used among traders.

What Makes a Good Gold Trading Platform?

A good gold trading platform offers a convenient interface for buying and selling gold with low trading costs such as low fees and tight spreads. It typically combines reliable execution, transparent pricing, and strong risk controls. Some platforms also offer zero transaction fees, secure storage, and clear cost breakdowns.

TMGM provides a gold trading platform that makes it easy to buy and sell gold CFDs with competitive spreads, clear pricing, reliable execution, and built-in risk controls such as stop loss and take profit.

How Do I Trade Gold On MetaTrader 4?

Follow these 6 steps to start trading gold on MetaTrader 4 (MT4). Right click the gold symbol and select New Order, then choose your order type as either market or pending. Then set your position size and define your stop loss and take profit levels. Then confirm whether you want to Buy or Sell based on your strategy, and finally place the order and verify it appears in your open trades. The steps are similar for MT5.

Trade Smarter Today

Account

Account

Instantly