What are Forex (FX) Options and How to Trade them?

FX options trading offers an exciting and flexible way to engage with global currencies. At its core, FX options involve buying one currency and selling another to profit from price movements. The purchase or sale of a currency pair at a pre-determined price is called the strike price, and the expiry date is the set date when the option expires. FX options always involve a forex pair, allowing traders to bet on one currency's relative strength or weakness versus another. Unlike futures, FX options trading doesn’t obligate traders to fulfill the contract terms at expiration, which gives them more flexibility. Here’s a quick dive into how FX options are traded and why platforms like TMGM are ideal for executing your strategy.

What Are FX Options?

An FX option, sometimes called a forex option, is a financial contract that gives the trader the right, but not the obligation, to buy or sell a currency pair at a pre-agreed price known as the strike price. This right is valid until a specified expiry date. Since the trader is not required to execute the trade, FX options provide flexibility that traditional contracts like futures or forwards do not.

The key idea is that the trader gains the choice of exercising the option if the market moves in their favor. If the market moves against them, they can simply let the option expire. This characteristic is one of the main reasons beginner traders search for phrases like “what is forex options” or “how to trade forex options”, especially when they want more control over their risk and are comparing different forex trading options. For a broader foundation on currency markets, it can be helpful to review a structured forex trading for beginners guide before focusing on FX options.

Key FX Options Terms to Understand Early

Currency pair: The two currencies involved in the contract.

Strike price: The price at which the trader can buy or sell if they choose to exercise the option.

Expiry date: The last date on which the option can be exercised.

Premium: The cost of purchasing the option. This is the trader’s maximum risk.

Because the maximum risk for the buyer of an option is limited to the premium, FX options trading is often considered a flexible method of engaging with the forex market without committing large amounts of capital upfront.

How Does FX Options Trading Work?

To understand how to trade forex options, it is vital to examine how the contract works in practice. When a trader purchases an FX option, they gain confidence in their choices that depend on how the market behaves.

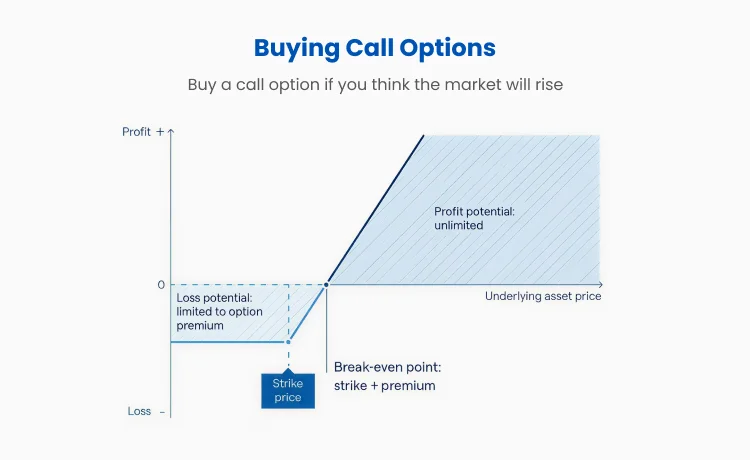

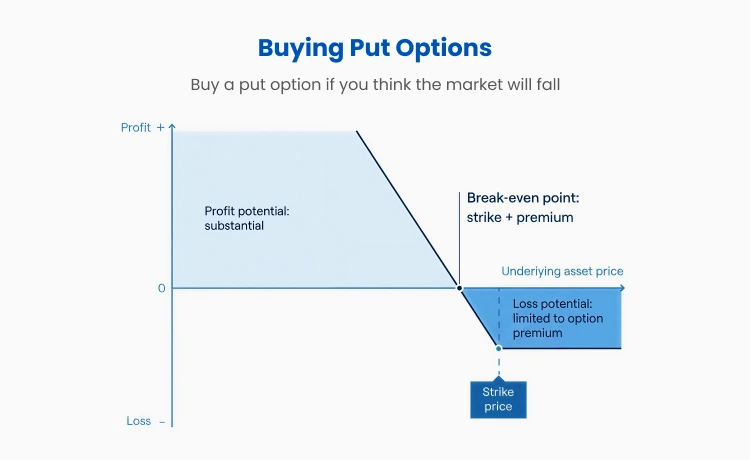

Call and Put Option

There are two core types of FX options:

Call Option: Right to buy a currency pair. This is used by traders typically when expecting the base currency to strengthen.

Put Option: Right to sell a currency pair. This is used by traders typically when expecting the base currency to weaken.

If a trader believes that one currency will rise in value relative to another, they may buy a call option. The profit potential increases if the market moves in the predicted direction. If it does not, the trader simply does not exercise the option and only loses the premium paid.

This structure enables traders to limit potential losses while keeping open the possibility of benefiting from favorable price movements.

Risk and Reward Structure

The premium is the cost of purchasing the option. It is paid at the beginning of the trade. Many traders use a trading calculator to estimate potential profit and loss before opening an options position. If the market moves in your favor, your potential profit can exceed the cost. If the market moves against you and you choose not to exercise the option, the premium represents your total loss. This makes FX options appealing to beginners who value controlled downside risk.

In contrast, traders who choose to sell FX options receive a premium upfront but face much higher risk. The seller can incur significant losses if the market moves sharply against the position. For this reason, beginners usually start on the buying side of options rather than on the selling side.

The Role of the ‘Greeks’

Traders often use a group of analytical tools called the Greeks to understand how different factors affect the price of an option:

Delta: Measures how the option price changes as the currency pair's price moves

Gamma: Measures how Delta changes as price changes continue

Theta: Measures how time affects the option’s value

Vega: Measures how volatility affects pricing

Rho: Measures the impact of interest rate changes

While beginners do not need to memorize every detail of the Greeks, knowing they exist is helpful when learning more advanced FX options trading strategies later on.

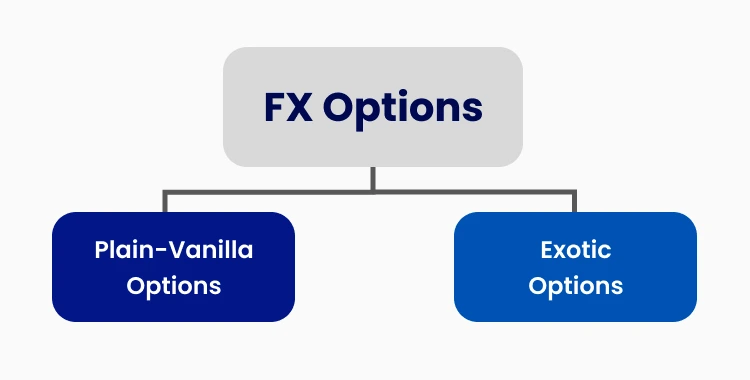

Types of FX Options

There are different types of FX options, each offering varying levels of flexibility and complexity. The main categories that beginners encounter are plain vanilla options and exotic options.

Plain-Vanilla Options

These are the simplest and most commonly used types of FX options. They follow the standard call and put structure, with a clear strike price and expiry date. Plain-vanilla options are suitable for beginners because they are easier to price and understand, and are widely available on forex platforms.

Exotic Options

Exotic options include contracts with more complex pricing or payout conditions. Some examples include barrier options, which are activated or cancelled when the price reaches certain levels; binary options, which pay a fixed amount if the market condition is met; and Asian options, whose pricing is based on the average price during the contract period.

How to Trade Forex Options?

Trading FX options involves a structured approach that helps traders analyze markets, choose the correct contract, and manage risk effectively. Here is a step-by-step guide that explains the process clearly and logically. Risk management tools such as position sizing calculators help align each FX options trade with your overall risk tolerance.

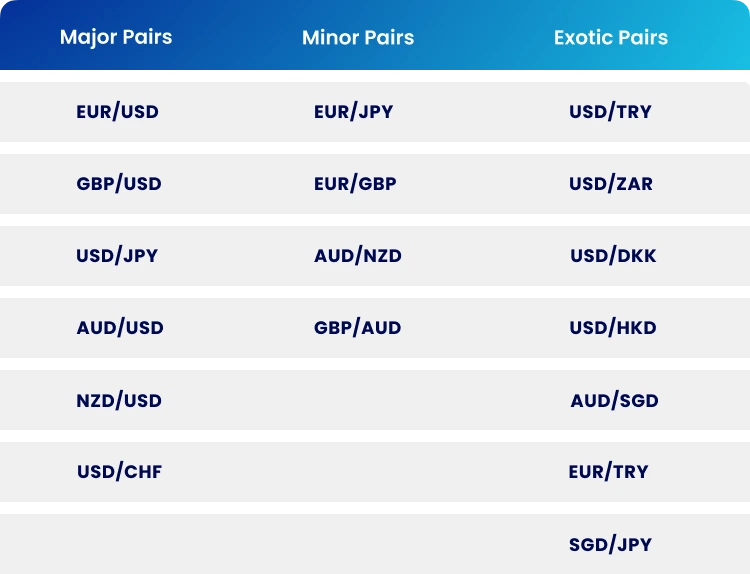

Select A Currency Pair

Start with a currency pair you understand. Popular pairings include EUR/USD, USD/JPY, and GBP/AUD.

Beginners often choose major pairs because they are more liquid and exhibit more predictable behavior.

Open a Trading Account

FX options are traded through a CFD account. Before you start trading, review the available trading account types to ensure the features and costs match your strategy. A key advantage of using CFDs is that they only require a small margin deposit to control a leveraged position.

Decide Whether to Buy or Sell

Before entering a trade, determine whether you expect the base currency to strengthen or weaken. If you expect it to rise, consider buying a call. If you expect it to fall, consider buying a put.

This expectation should be supported by simple analysis, such as reviewing charts, reading economic updates, or observing interest rate trends.

Select Your Strike Price

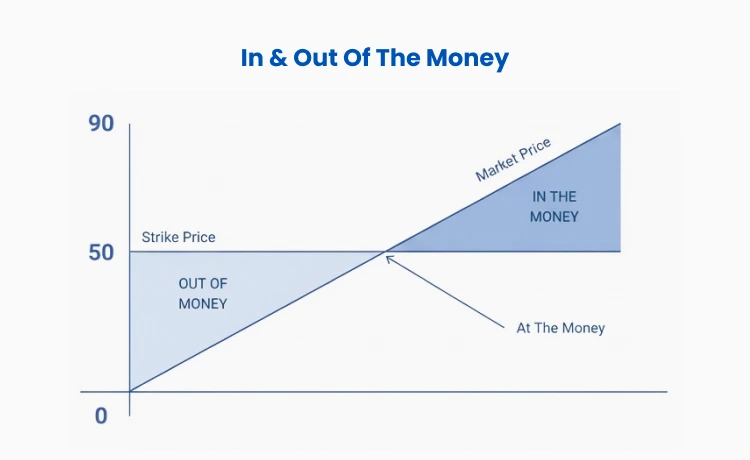

The strike price determines whether the option expires in the money or out of the money. Expiry times can range from very short durations to several weeks or months.

Short expiries are sensitive to short-term price movements.

Longer expiries give your market view more time to develop.

Monitor Your Position

Traders need to stay up to date with economic events, interest rate announcements, and geopolitical developments that could affect the value of their currency pair, often by following an economic calendar.

Why Trade FX Options?

Controlled Risk and Hedging

FX options offer an effective way to hedge existing forex positions, protecting traders against adverse price movements. Options can act as a buffer for spot FX trades or even foreign stock market positions.

Multiple Trading Strategies

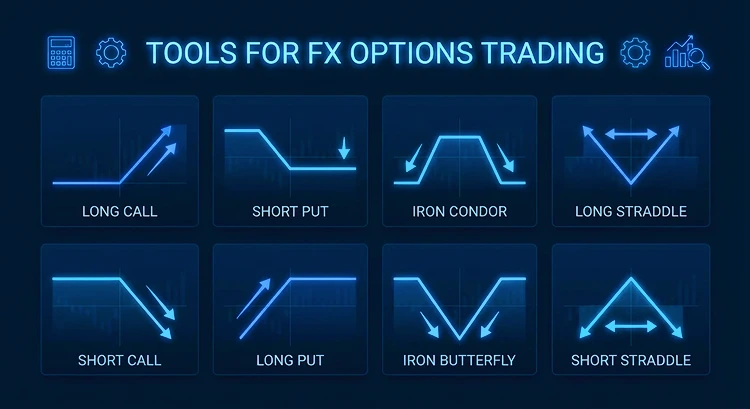

FX options are highly versatile, allowing traders to implement FX options trading strategies such as straddles, condors, butterflies, and vertical spreads. These strategies cater to different market scenarios, whether volatile or stable.

Speculation on Market Trends

FX options allow traders to speculate on both short-term and long-term market movements. Whether a trader has a strong view of future interest rate changes or economic data, options provide the opportunity to act on those predictions.

Flexibility of Entry with Lower Capital

One of the most significant advantages of FX options trading is the ability to enter trades with smaller upfront capital than other financial instruments. This lower barrier to entry makes FX options an appealing choice for many traders.

Tools for FX Options Trading

Successful FX options trading requires the right tools to analyze the market, manage risk, and execute trades efficiently. Here are some essential tools every options trader should consider:

Options Pricing Calculator

Helps traders calculate the premium and potential profits based on volatility, strike price, and time to expiration.

Volatility Indicators

Tools such as the Implied Volatility (IV) Index and Bollinger Bands help traders assess market uncertainty and identify optimal strike prices. Trend indicators such as moving averages also help confirm direction before placing forex options trades.

Economic Calendar

Tracking an economic calendar and major economic events helps traders anticipate market-moving news that could affect their FX options positions.

Options Chain Viewer

Provides an overview of available strike prices, premiums, and expirations for chosen currency pairs.

Risk Management Tools

Use stop-loss orders, position sizing rules, and profit-taking strategies to mitigate risk while trading options.

Trading FX Options with TMGM

Wide Range of Currency Pairs

TMGM offers traders access to over 50 currency pairs, from major pairs like EUR/USD to more exotic combinations, including many of the best forex pairs to trade for active market participants. This wide selection allows traders to explore diverse markets and capitalize on various opportunities.

Competitive Spreads and Liquidity

TMGM offers spreads as low as 0.0 pips, ensuring the best possible trading conditions. With over 10 tier-1 liquidity providers, traders benefit from fast execution and minimal slippage, even during volatile market conditions.

Leverage and Speed

The high leverage of up to 1:1000 and lightning-fast NY4 servers make TMGM an ideal platform for FX options traders looking to speed up and efficiently execute their trades.

No Requotes

TMGM ensures that there are no requotes, allowing traders to execute their strategies without delay or frustration. This makes it a reliable choice for FX option traders.

Support for All Trading Strategies

Whether you’re a beginner or an experienced trader, TMGM provides a platform that accommodates a variety of trading strategies. With readily available tools and educational resources, traders can optimize their approach.

FX options trading offers traders the flexibility to manage risk, speculate on currency movements, and employ complex strategies without the obligation to fulfill the contract at expiration.

With the right tools and resources, such as those offered by TMGM, traders can maximize their potential and take advantage of opportunities in the global currency market.

Whether hedging existing positions or speculating on future price movements, FX options trading is a powerful way to engage with the forex market.

Trade Smarter Today

Frequently Asked Questions

What is FX option?

What is a call option?

What is a put option?

Option trading VS Forex trading, which is better?

Account

Account

Instantly