What is Silver Trading and How to Trade Silver

Direct Answer: Silver trading is the act of buying and selling on the price movements of silver (XAG) without necessarily taking physical delivery of the metal. Traders utilize derivatives like CFDs to profit from volatility, capitalizing on both rising (long) and falling (short) markets through leverage. Key Takeaways - What is Silver Trading: You trade silver by speculating on XAG price movements without owning physical metal. Derivatives like CFDs let you go long or short, often with leverage. - Long Term Investing vs Trading Silver: Physical bullion is a buy and hold store of value with premiums and storage costs and no leverage. Trading focuses on short term volatility using liquid products, but adds financing and leverage risk. - Products You Can Use to Trade Silver: Main routes are spot silver CFDs, silver ETFs, silver mining stocks and stock ETFs, and silver futures. Each differs by liquidity, leverage access, complexity, and whether it has expiry and rollover costs. - What Moves Silver Price: Silver is driven by industrial demand and precious metal sentiment. Manufacturing data and growth cycles matter, and the gold silver ratio is a key relative value signal; silver is less liquid than gold so slippage can spike around major news. - Silver Trading Strategies: Common approaches are range trading at support and resistance, breakout trading with volume and confirmed candle close to avoid fakeouts, and trend following using moving averages aligned with macro demand cycles. - Analyzing the Market: Fundamentals & Technicals: Combine fundamentals like visible stockpiles and industrial output with technical context like the gold silver ratio for relative valuation. Ratio extremes can signal mean reversion setups even if the chart pattern is unclear.

What is Silver Trading?

Silver trading (XAGUSD) is the act of speculating on the price movements of silver to generate profits, rather than buying physical metal for ownership. It involves buying or selling derivatives—such as CFDs, futures, or ETFs—to take advantage of rising or falling prices. Traders often analyze industrial demand, inflation, and the gold-silver ratio to inform their decisions.

Silver Trading vs Silver Investing

Silver Investing:

Physical Bullion

Before executing a trade, you must distinguish between investment and speculation. Physical Silver involves buying bars or coins; it is a long-term store of value with high premiums and storage costs, offering no leverage.

Silver ETFs

Exchange-Traded Funds (ETFs) like iShares Silver Trust (SLV) for high liquidity, and investing in silver mining stocks or ETFs. The main strength of investing using Silver ETFs is that ETFs provide exposure without storage costs or security concerns.

Silver Trading:

Silver trading involves using many instruments including silver stocks, silver ETFs and of course, Silver CFDs (Contracts for Difference). Silver CFDs are more suited for beginners, because it allows you to trade price movements without ownership.

An added benefit of trading Silver CFDs is that besides buy low sell high, CFDs also enable short selling (profiting when prices drop) and the use of leverage, where a small deposit controls a larger position size. For active traders seeking to capture short-term volatility, CFDs or Spot Silver offer superior liquidity and lower entry costs compared to physical dealers.

Pro Tip: When trading Spot Silver (XAG/USD), always check the Swap Rates (overnight financing); unlike physical holdings, holding leveraged positions long-term can erode profits due to negative carry.

Products You Can Use to Trade Silver

Institutional and retail traders access the silver market through distinct vehicles, each with specific liquidity profiles and expiry rules.

Spot Silver CFDs (XAG/USD): This is one of the most common forms of retail trading, trading the current market price for immediate settlement without having to pay for storage of physical Silver Bullion. It offers tight spreads and continuous trading hours, making it ideal for day traders and scalpers.

Silver ETFs: Silver Exchange Traded Funds track the underlying price of silver bullion. They are suitable for swing traders who want exposure without the complexity of derivatives, though they often lack the leverage available in FX or CFD accounts. Stickers like SLV, ZSL, PSLV and so on, are the most traded Silver ETFs on the market.

Silver Stocks: One of the most popular Silver Stocks traded are the silver mining stocks. Mining stocks often act as a "leveraged play" on the spot price; once silver rises above a miner's break-even cost, their profit margins—and share prices—can expand disproportionately.

Pro tip: If you want to trade Silver without analyzing individual company’s balance sheets, you can use Silver Mining Stocks ETFs. The ETFMG Prime Junior Silver Miners ETF (SILJ) is a popular ticker for this, it tracks a basket of volatile small-cap explorers/miners (Juniors) that offer high-beta exposure to aggressive silver rallies.

Silver Futures: These are standardized contracts to buy or sell silver at a predetermined price on a future date. Futures trade on centralized exchanges (like COMEX) and provide transparency on volume and Open Interest, but they come with expiration dates and potential rollover costs (contango or backwardation).

Market Drivers: What Moves Silver Price?

Understanding silver requires analyzing its unique dual identity as both a precious metal and an industrial commodity.

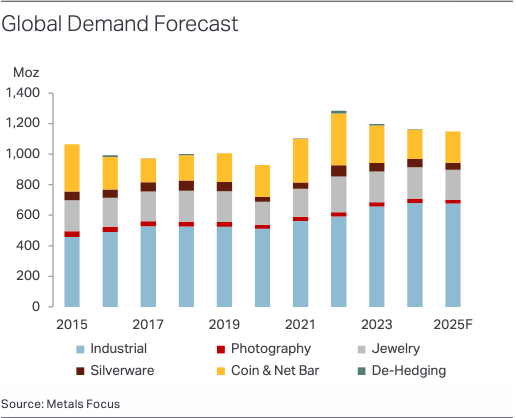

Figure: A bar chart with distribution of use cases of Global Silver Demand from The Silver Institute’s: World Silver Survey 2025.

Industrial Demand: Unlike gold, over 50% of silver demand stems from industrial applications, specifically photovoltaics (solar panels) and electronics. Consequently, silver prices are highly sensitive to global manufacturing data (PMI) and economic growth cycles in major hubs like China and the US.

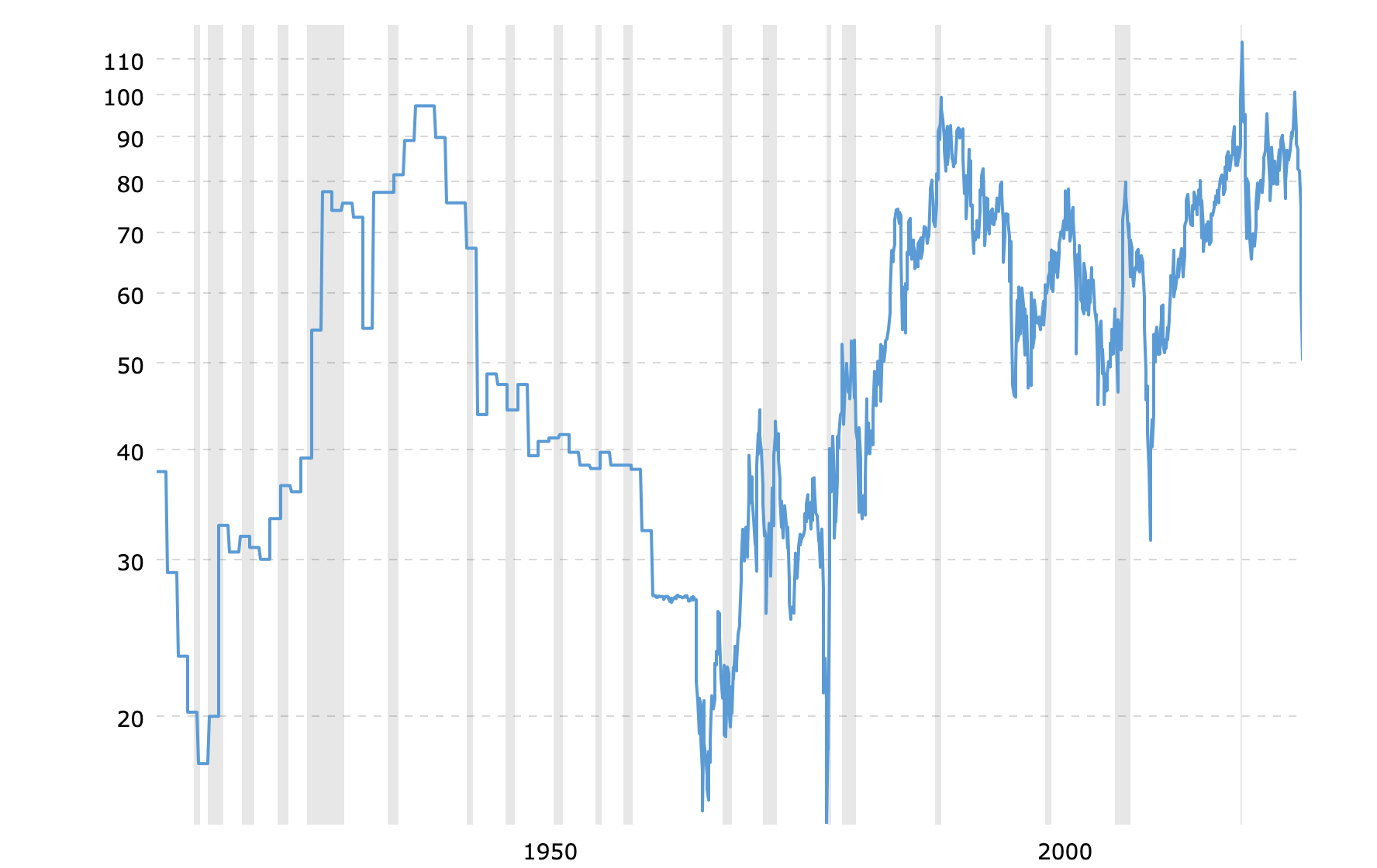

Figure: This chart tracks the current and historical ratio of gold prices to silver prices. Historical data goes back to 1915. Sources: The MacroTrends.net

The Most Important Precious Metal Tool – Gold-Silver Ratio: This metric measures how many ounces of silver it takes to buy one ounce of gold. A high ratio often signals that silver is undervalued relative to gold, potentially triggering a reversion-to-mean trade where institutional algorithms buy silver and sell gold.

Important: Silver is notoriously less liquid than Gold (XAU/USD), meaning it is more prone to Slippage during high-impact news events like NFP or CPI releases.

Silver Trading Strategies

Silver trading strategies focus on capitalizing on price movements using approaches like Range Trading, Breakout Trading, Trend Following. After picking an approach, you will need to analyze the current market before deciding on the timing and price of entry.

Range Trading (The Accumulation Play)

Silver frequently spends weeks trapped between clear Support and Resistance levels. Range traders exploit this by buying at the bottom (Support) and selling at the top (Resistance). This strategy works best during Asian and early European sessions when volume is lower. The key is to place tight stops just outside the range to minimize loss if the floor collapses.

Breakout Trading (Volatility Capture)

When Silver finally leaves a range, the move is often rapid and substantial. Breakout traders wait for the price to breach a key psychological level (e.g., $25.00 or $30.00) with Volume Confirmation. Unlike Range trading, you are entering with momentum.

Pro Tip: Silver is infamous for "Fakeouts" (false breakouts). Always wait for a candle close above the breakout level on the H4 or Daily chart before committing capital, rather than chasing the initial wick.

Trend Following (Riding the Industrial Cycle)

This approach aligns with longer-term macro drivers. Since industrial demand (solar, electronics) drives prolonged trends, traders use Moving Averages (like the 50-day and 200-day SMA) to identify the dominant direction. In this strategy, you are not looking for tops or bottoms; you are entering on pullbacks to the average during an established uptrend.

Analyzing the Market: Fundamentals & Technicals

Before executing any strategy, you must gauge the market environment. This involves a dual-layer analysis:

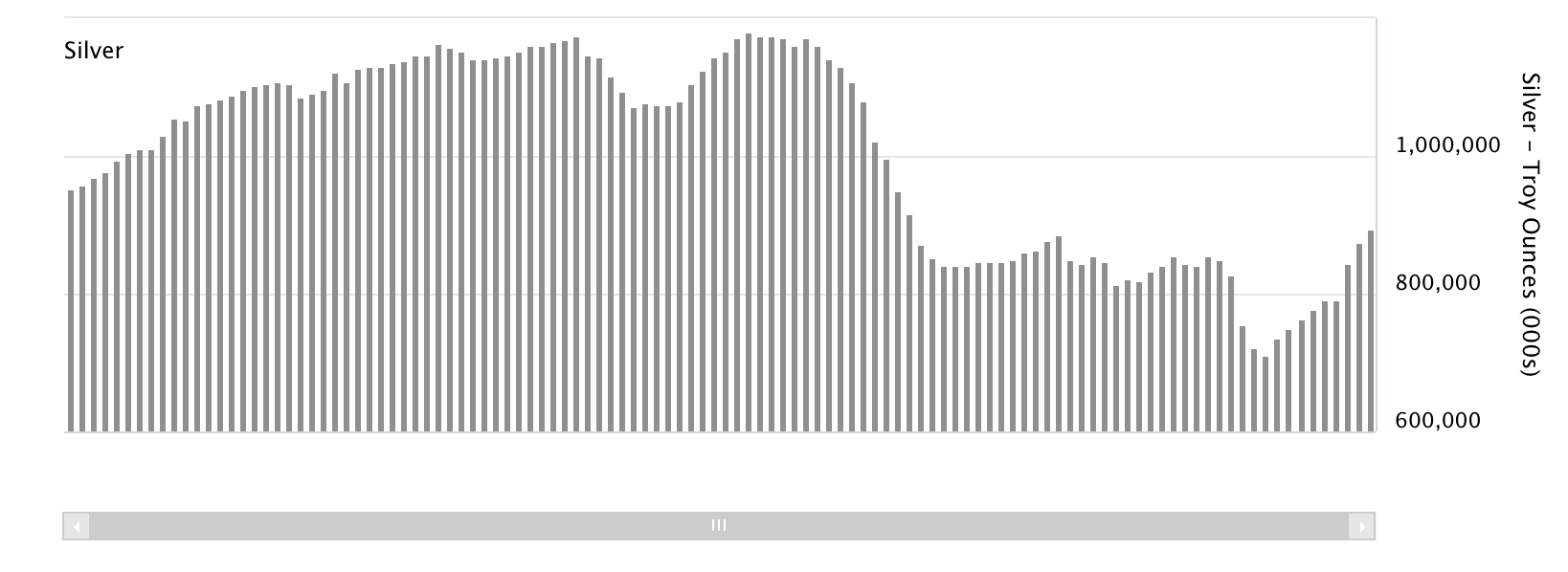

Fundamental Analysis: Monitor LBMA (London Bullion Market Association) stock levels and global industrial output reports. A drop in visible stockpiles often precedes a supply crunch squeeze.

You can learn how fundamental analysis on silver trading is done in our 2026 forecast article on Silver Prices which also explains silver trading approaches.

Figure: The data represents the volume of Loco London gold and silver held in the London vaults offering custodian services. Source: LBMA London Vault Data

Technical Analysis: Use the Gold-Silver Ratio to determine relative value. If the ratio hits historical highs (e.g., 80:1), Silver is statistically undervalued, signaling a potential mean-reversion, giving you a potential buy opportunity regardless of the specific chart pattern.

Risk Management & Volatility

Silver's volatility is famously higher than gold's ("Gold on steroids"), necessitating stricter risk controls.

Leverage Management: While leverage amplifies gains, it also accelerates losses. Traders should utilize Guaranteed Stop Loss Orders (GSLO) where available to protect against market gaps, especially over weekends when geopolitical news can cause prices to jump past standard stops.

Position Sizing: Due to silver's wide daily ranges, standard lot sizes used in Forex may expose you to excessive risk. It is critical to calculate position size based on dollar risk per trade rather than a fixed lot count, ensuring that a typical 2-3% daily move does not trigger a margin call.

Trade Smarter Today

FAQ About Silver Trading And How To Trade Silver

What is silver trading, and how is it different from investing in physical silver?

How do I start silver trading?

What moves the silver price the most?

Is silver trading good for beginners?

Is silver more volatile than gold, and how should I adjust risk?

Account

Account

Instantly